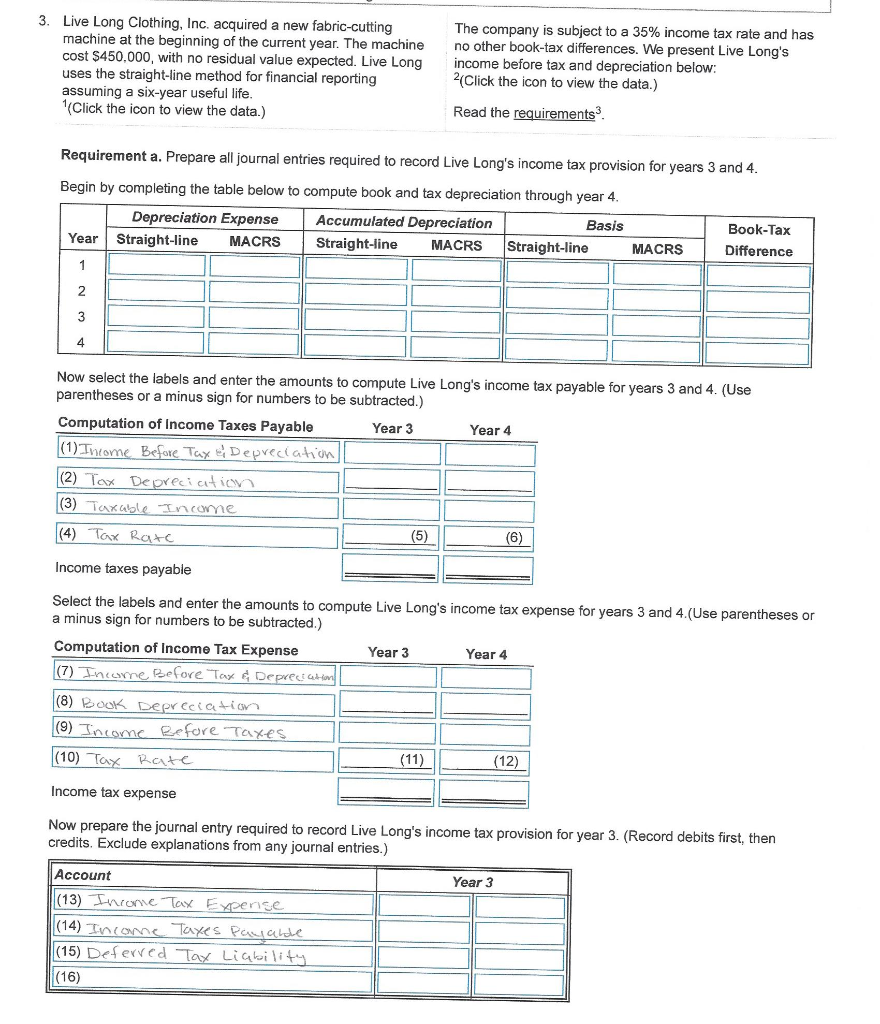

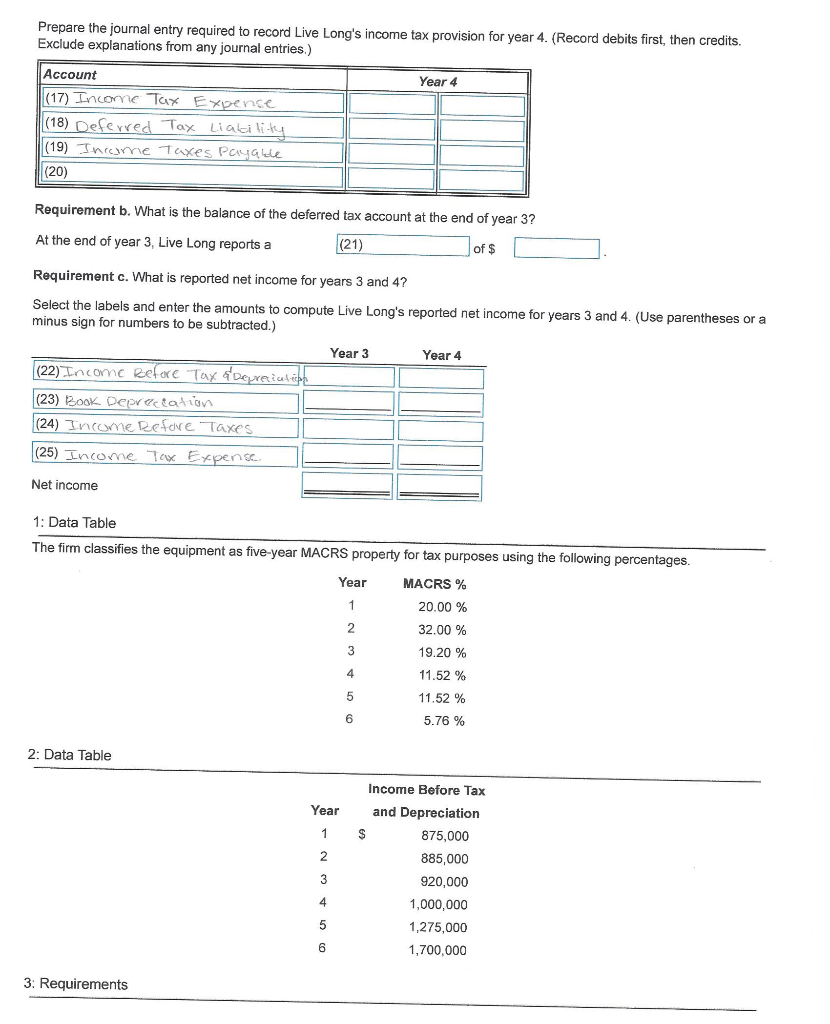

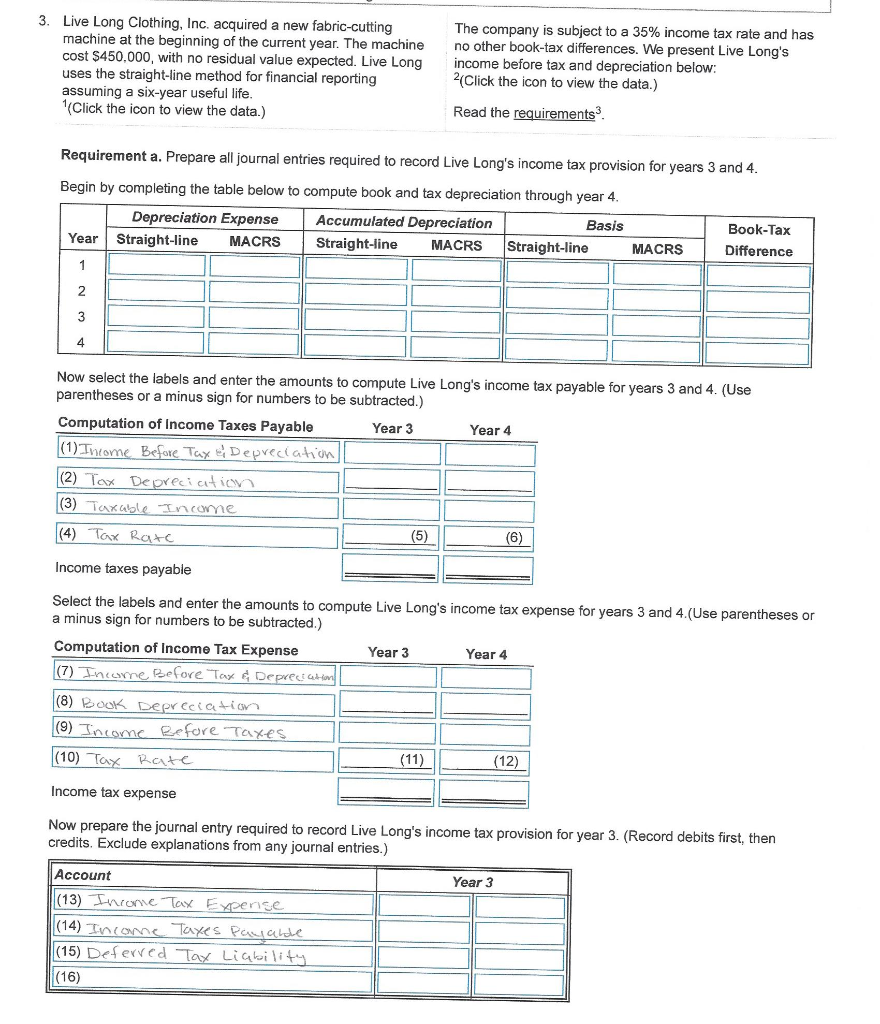

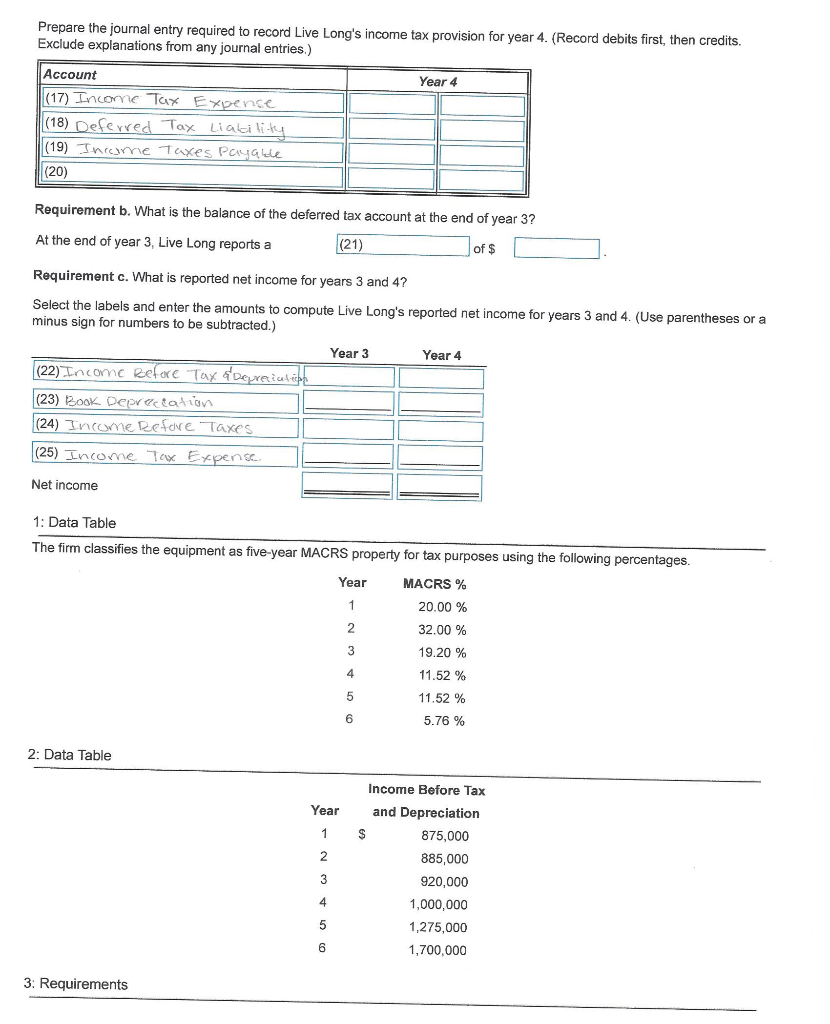

3. Live Long Clothing, Inc. acquired a new fabric-cutting machine at the beginning of the current year. The machine cost $450,000, with no residual value expected. Live Long uses the straight-line method for financial reporting assuming a six-year useful life. (Click the icon to view the data.) The company is subject to a 35% income tax rate and has no other book-tax differences. We present Live Long's income before tax and depreciation below: 2(Click the icon to view the data.) Read the requirements Requirement a. Prepare all journal entries required to record Live Long's income tax provision for years 3 and 4. Begin by completing the table below to compute book and tax depreciation through year 4. Depreciation Expense Accumulated Depreciation Basis Year Straight-line MACRS Straight-line MACRS Straight-line MACRS Book-Tax Difference Now select the labels and enter the amounts to compute Live Long's income tax payable for years 3 and 4. (Use parentheses or a minus sign for numbers to be subtracted.) Computation of Income Taxes Payable |(1) Income Before Tax E Depreciation | |(2) Tax Depreciation |(3) Taxable Income |(4) Tax Rate Income taxes payable Select the labels and enter the amounts to compute Live Long's income tax expense for years 3 and 4.(Use parentheses or a minus sign for numbers to be subtracted.) Computation of Income Tax Expense Year 3 Year 4 (7) Income Before Tax Depreciatim |(8) Book Depreciation |(9) Income Before Taxes (10) Tax Rate Income tax expense Now prepare the journal entry required to record Live Long's income tax provision for year 3. (Record debits first, then credits. Exclude explanations from any journal entries.) Year 3 Account (13) Income Tax Expense |(14) Income Taxes Payalde (15) Deferred Tax Liability (16) Prepare the journal entry required to record Live Long's income tax provision for year 4. (Record debits first, then credits. Exclude explanations from any journal entries) Year 4 Account (17) Income Tax Expence (18) Deferred Tax Liability (19) Income Taxes Payable (20) Requirement b. What is the balance of the deferred tax account at the end of year 3? At the end of year 3, Live Long reports a (21) of $ Requirement c. What is reported net income for years 3 and 4? Select the labels and enter the amounts to compute Live Long's reported net income for years 3 and 4. (Use parentheses or a minus sign for numbers to be subtracted.) Year 3 Year 4 (22) Income Refore Tax Depreciatik (23) Book Depreciation (24) Income Refore Taxes (25) Income Tax Expense Net income 1: Data Table The firm classifies the equipment as five-year MACRS property for tax purposes using the following percentages. Year MACRS % 20.00% 32.00% 19.20 % 11.52 % 11.52 % 5.76 % 2: Data Table Year 1 Income Before Tax and Depreciation $ 875,000 885,000 920,000 1,000,000 1,275,000 1,700,000 3: Requirements a. Prepare all journal entries required to record Live Long's income tax provision for years 3 and 4. b. What is the balance of the deferred tax account at the end of year 3? c. What is reported net income for years 3 and 4