Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week.

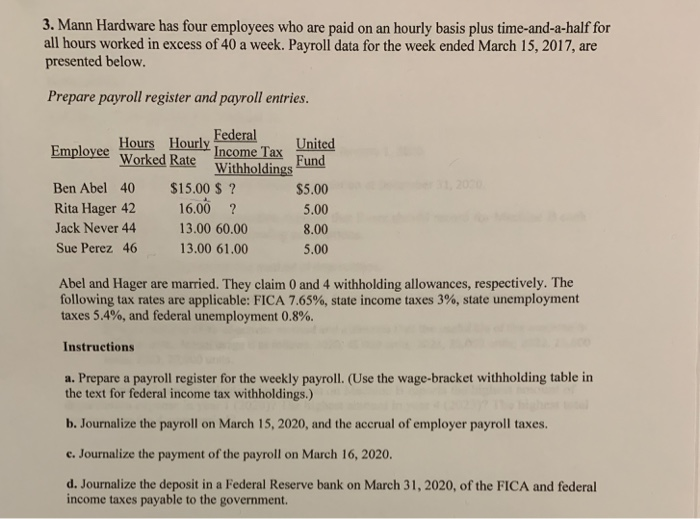

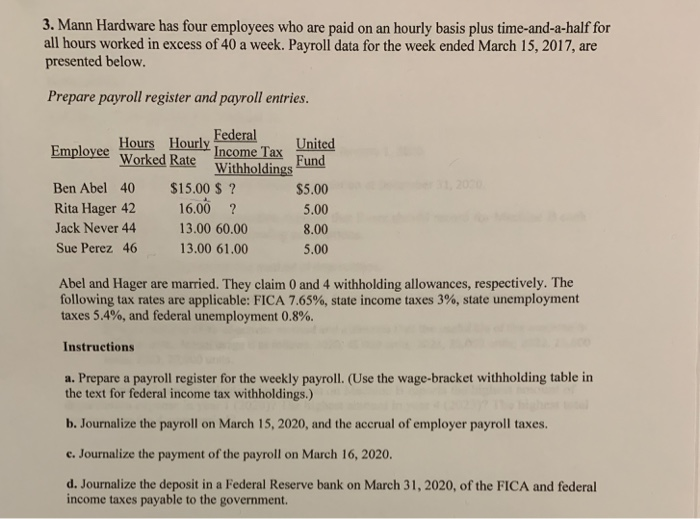

3. Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2017, are presented below. Prepare payroll register and payroll entries. FederalUnited Emplovee Worked Rate Withholdings Hours Hourly Income Tax Ben Abel 40 $15.00 $? Rita Hager 42 16.00 Jack Never 44 Sue Perez 46 Fund $5.00 5.00 8.00 5.00 13.00 60.00 13.00 61.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Instructions a. Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table in the text for federal income tax withholdings.) b. Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. e. Journalize the payment of the payroll on March 16, 2020. d. Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government 3. Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2017, are presented below. Prepare payroll register and payroll entries. FederalUnited Emplovee Worked Rate Withholdings Hours Hourly Income Tax Ben Abel 40 $15.00 $? Rita Hager 42 16.00 Jack Never 44 Sue Perez 46 Fund $5.00 5.00 8.00 5.00 13.00 60.00 13.00 61.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Instructions a. Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table in the text for federal income tax withholdings.) b. Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. e. Journalize the payment of the payroll on March 16, 2020. d. Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government

3. Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2017, are presented below. Prepare payroll register and payroll entries. FederalUnited Emplovee Worked Rate Withholdings Hours Hourly Income Tax Ben Abel 40 $15.00 $? Rita Hager 42 16.00 Jack Never 44 Sue Perez 46 Fund $5.00 5.00 8.00 5.00 13.00 60.00 13.00 61.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Instructions a. Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table in the text for federal income tax withholdings.) b. Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. e. Journalize the payment of the payroll on March 16, 2020. d. Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government 3. Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2017, are presented below. Prepare payroll register and payroll entries. FederalUnited Emplovee Worked Rate Withholdings Hours Hourly Income Tax Ben Abel 40 $15.00 $? Rita Hager 42 16.00 Jack Never 44 Sue Perez 46 Fund $5.00 5.00 8.00 5.00 13.00 60.00 13.00 61.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Instructions a. Prepare a payroll register for the weekly payroll. (Use the wage-bracket withholding table in the text for federal income tax withholdings.) b. Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. e. Journalize the payment of the payroll on March 16, 2020. d. Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started