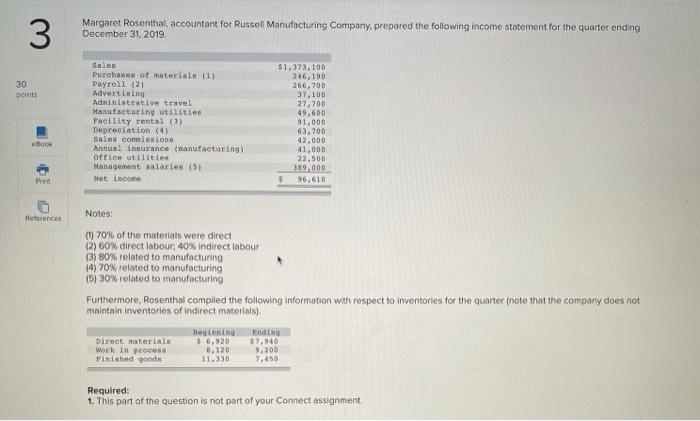

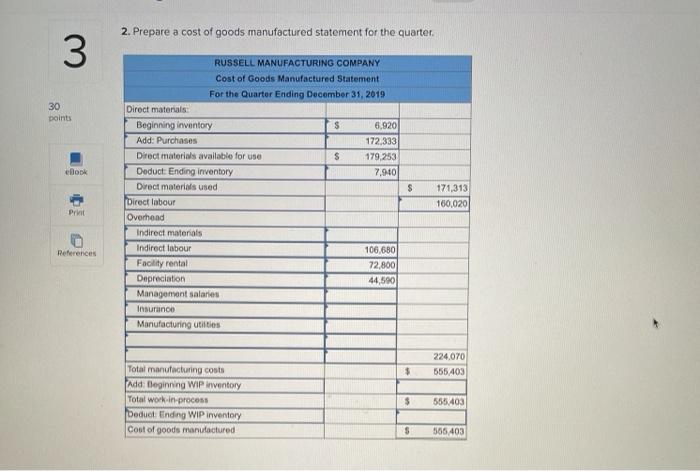

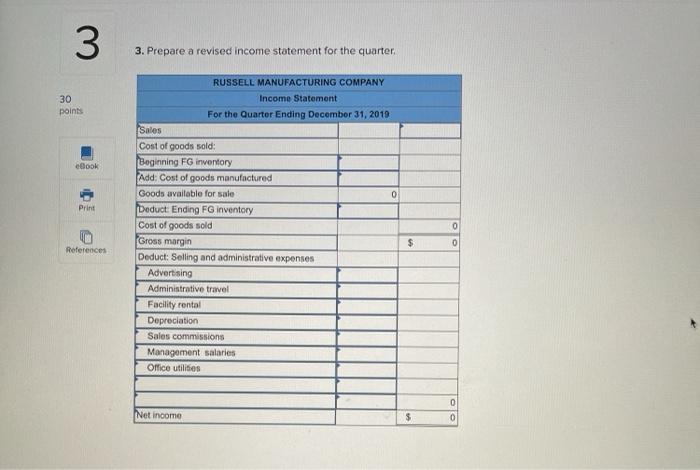

3 Margaret Rosenthal, accountant for Russell Manufacturing Company, prepared the following income statement for the quarter ending December 31, 2019 30 peints Sales Purchases of materiale 113 Payroll (2) Advertising Administrative travel Manufacturing utilities Facility rental (3) Depreciation (4) sales commissions Annual insurance (nanufacturing) orice utilities Management salaries (5) Net Income $1,373,100 246,190 266,200 37.100 27.700 49,600 91.000 63.700 42,000 41,000 22.500 259.000 $ 96.610 Book Per ... Notes: Heferences (0) 70% of the materials were direct (2) 60% direct labour, 40% indirect labour (3) 80% related to manufacturing (4) 70 related to manufacturing 15) 30% related to manufacturing Furthermore, Rosenthal compiled the following information with respect to inventories for the quarter (note that the company does not maintain Inventories of indirect materials) Direct materials Work in procesa Finished goods Beginning 56.920 3.120 11.30 Ending 57.940 9.200 7.450 Required: 1. This part of the question is not part of your Connect assignment 2. Prepare a cost of goods manufactured statement for the quarter. 3 30 points ek $ RUSSELL MANUFACTURING COMPANY Cost of Goods Manufactured Statement For the Quarter Ending December 31, 2019 Direct materials Beginning inventory S 6,9201 Add: Purchases 172,333 Direct materials available for use $ 179,253 Deduct: Ending inventory 7,940 Direct materials used Direct labour Overhead Indirect materials Indirect labour 106.680 Facility rental 72,800 Depreciation 44,500 Management salaries Insurance Manufacturing Utilties 171,313 160,020 Prvi References 224,070 555 403 $ Total manufacturing costs Add: Beginning WIP inventory Total work-in-process Deduct Ending WIP inventory Cout of goods manufactured $ 555403 $ 566,403 3 3. Prepare a revised income statement for the quarter 30 points eBook Print RUSSELL MANUFACTURING COMPANY Income Statement For the Quarter Ending December 31, 2019 Sales Cost of goods sold: Beginning FG inventory Add: Cost of goods manufactured Goods available for sale 0 Deduct: Ending FG inventory Cost of goods sold Gross margin Deduct: Selling and administrative expenses Advertising Administrative travel Facility rental Depreciation Sales commissions Management salaries Office utilities 0 $ 0 References Net income 0 0 $