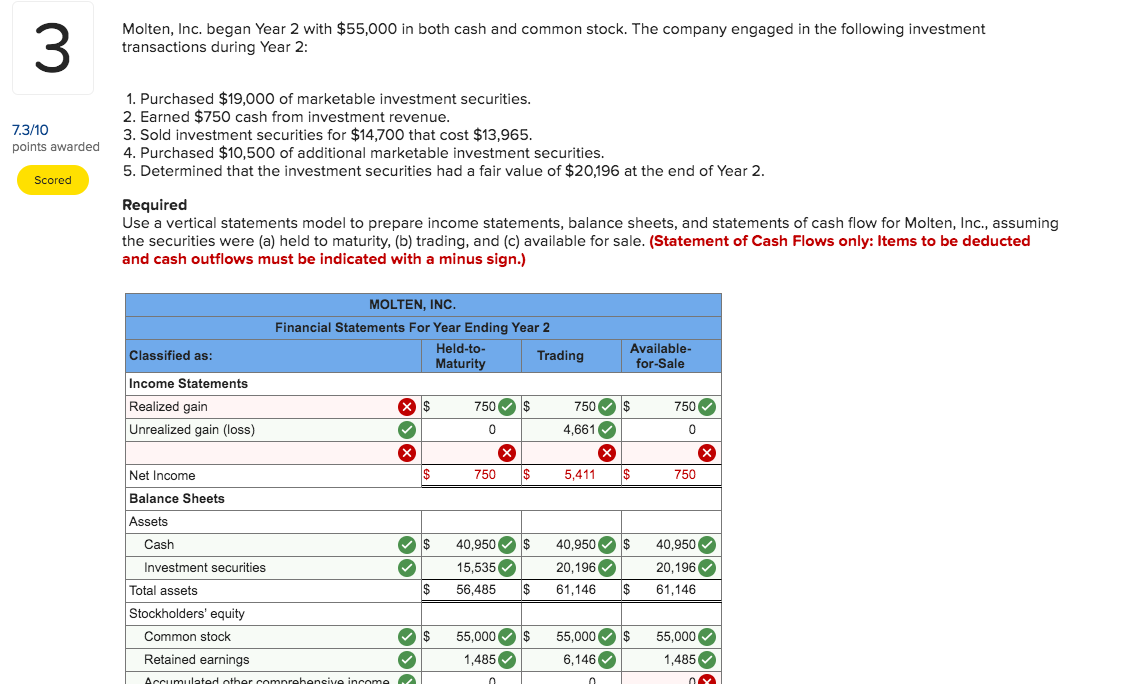

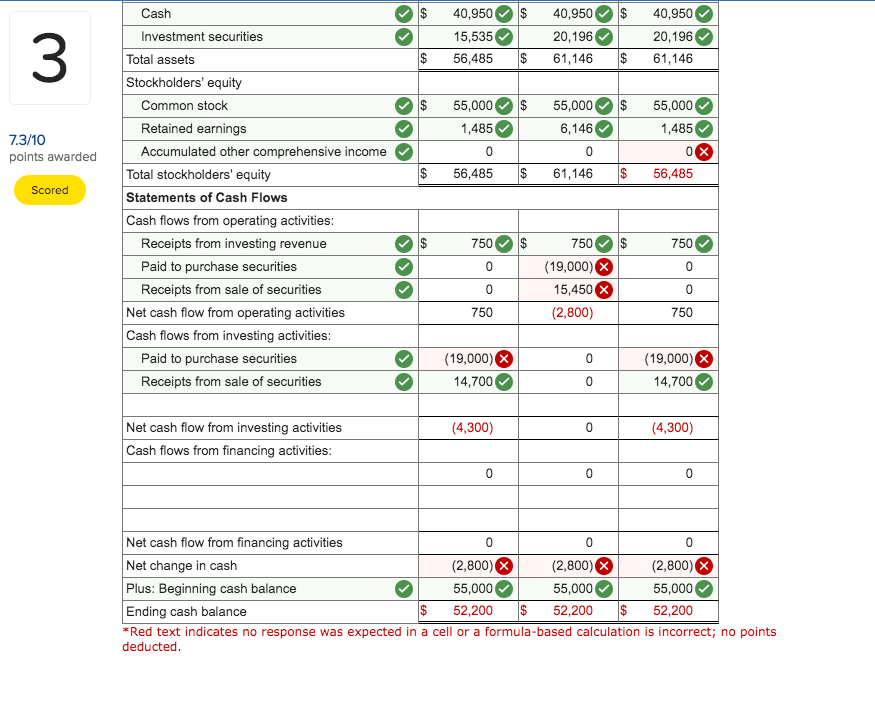

3 Molten, Inc. began Year 2 with $55,000 in both cash and common stock. The company engaged in the following investment transactions during Year 2: 7.3/10 points awarded 1. Purchased $19,000 of marketable investment securities. 2. Earned $750 cash from investment revenue. 3. Sold investment securities for $14,700 that cost $13,965. 4. Purchased $10,500 of additional marketable investment securities. 5. Determined that the investment securities had a fair value of $20,196 at the end of Year 2. Scored Required Use a vertical statements model to prepare income statements, balance sheets, and statements of cash flow for Molten, Inc., assuming the securities were (a) held to maturity, (b) trading, and (c) available for sale. (Statement of Cash Flows only: Items to be deducted and cash outflows must be indicated with a minus sign.) MOLTEN, INC. Financial Statements For Year Ending Year 2 Held-to- Trading Maturity Classified as: Available for-Sale Income Statements x $ 750 $ $ 750 Realized gain Unrealized gain (loss) 750 4,661 0 0 X x X X $ 750 $ 5,411 $ 750 Net Income Balance Sheets $ 40,950 $ 15,535 56,485 40,950 $ 20,196 61,146 $ 40,950 20,196 61,146 $ Assets Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income $ $ 55,000 $ 1,485 55,000 6,146 55,000 1,485 Oy >> 3 40,950 15,535 56,485 40,950 20,196 61,146 40,950 20,196 61,146 $ $ $ $ $ 55,000 1,485 55,000 6,146 7.3/10 points awarded 55,000 1,485 0x 56,485 0 0 $ 56,485 $ 61,146 $ Scored Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Statements of Cash Flows Cash flows from operating activities: Receipts from investing revenue Paid to purchase securities Receipts from sale of securities Net cash flow from operating activities Cash flows from investing activities: Paid to purchase securities Receipts from sale of securities $ 750 750 $ 750 0 0 0 (19,000) 15,450 X (2,800) 0 750 750 0 (19,000) 14,700 (19,000) 14,700 0 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 0 Net cash flow from financing activities 0 Net change in cash (2,800) X (2,800) (2,800) X Plus: Beginning cash balance 55,000 55,000 55,000 Ending cash balance $ 52,200 $ 52,200 $ 52,200 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted 3 Molten, Inc. began Year 2 with $55,000 in both cash and common stock. The company engaged in the following investment transactions during Year 2: 7.3/10 points awarded 1. Purchased $19,000 of marketable investment securities. 2. Earned $750 cash from investment revenue. 3. Sold investment securities for $14,700 that cost $13,965. 4. Purchased $10,500 of additional marketable investment securities. 5. Determined that the investment securities had a fair value of $20,196 at the end of Year 2. Scored Required Use a vertical statements model to prepare income statements, balance sheets, and statements of cash flow for Molten, Inc., assuming the securities were (a) held to maturity, (b) trading, and (c) available for sale. (Statement of Cash Flows only: Items to be deducted and cash outflows must be indicated with a minus sign.) MOLTEN, INC. Financial Statements For Year Ending Year 2 Held-to- Trading Maturity Classified as: Available for-Sale Income Statements x $ 750 $ $ 750 Realized gain Unrealized gain (loss) 750 4,661 0 0 X x X X $ 750 $ 5,411 $ 750 Net Income Balance Sheets $ 40,950 $ 15,535 56,485 40,950 $ 20,196 61,146 $ 40,950 20,196 61,146 $ Assets Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income $ $ 55,000 $ 1,485 55,000 6,146 55,000 1,485 Oy >> 3 40,950 15,535 56,485 40,950 20,196 61,146 40,950 20,196 61,146 $ $ $ $ $ 55,000 1,485 55,000 6,146 7.3/10 points awarded 55,000 1,485 0x 56,485 0 0 $ 56,485 $ 61,146 $ Scored Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Statements of Cash Flows Cash flows from operating activities: Receipts from investing revenue Paid to purchase securities Receipts from sale of securities Net cash flow from operating activities Cash flows from investing activities: Paid to purchase securities Receipts from sale of securities $ 750 750 $ 750 0 0 0 (19,000) 15,450 X (2,800) 0 750 750 0 (19,000) 14,700 (19,000) 14,700 0 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 0 Net cash flow from financing activities 0 Net change in cash (2,800) X (2,800) (2,800) X Plus: Beginning cash balance 55,000 55,000 55,000 Ending cash balance $ 52,200 $ 52,200 $ 52,200 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted