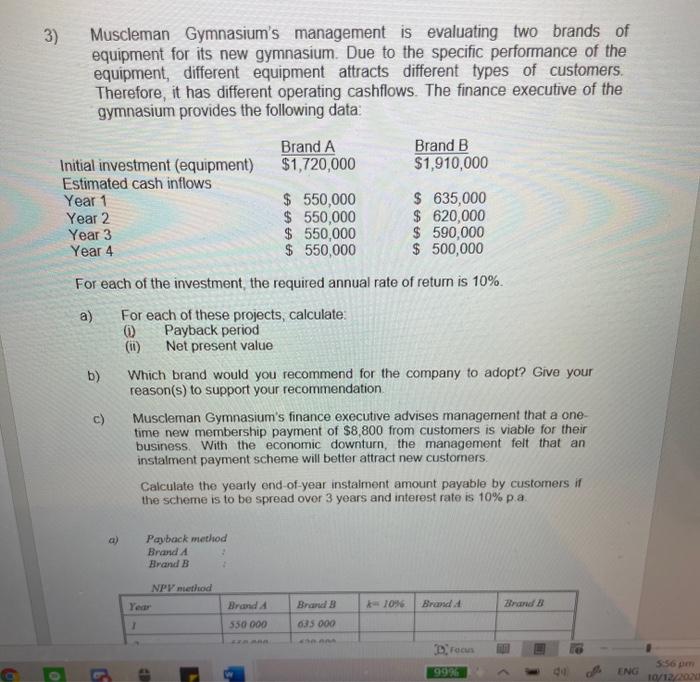

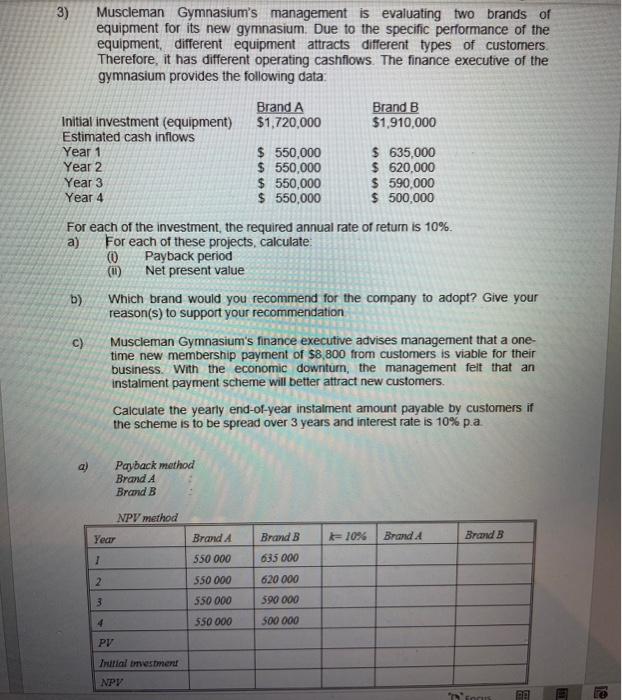

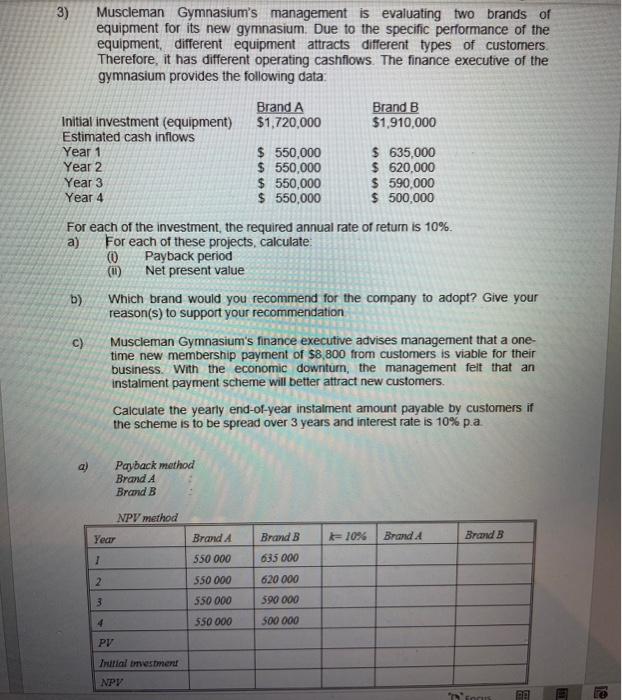

3) Muscleman Gymnasium's management is evaluating two brands of equipment for its new gymnasium. Due to the specific performance of the equipment, different equipment attracts different types of customers. Therefore, it has different operating cashflows. The finance executive of the gymnasium provides the following data: Brand A $1,720,000 Brand B $1,910,000 Initial investment (equipment) Estimated cash inflows Year 1 Year 2 Year 3 Year 4 $ 550,000 $ 550,000 $ 550,000 $ 550,000 $ 635,000 $ 620,000 $ 590,000 $ 500,000 For each of the investment, the required annual rate of return is 10%. a) b) For each of these projects, calculate: 0 Payback period Net present value Which brand would you recommend for the company to adopt? Give your reason(s) to support your recommendation Muscleman Gymnasium's finance executive advises management that a one- time new membership payment of $8,800 from customers is viable for their business. With the economic downturn, the management felt that an instalment payment scheme will better attract new customers Calculate the yearly end-of-year instalment amount payable by customers if the scheme is to be spread over 3 years and interest rate is 10% pa. c) a) Payback method Brand A Brand B NPV niethod Brand Brand 10 Brand Brand & 1 550 000 035 000 Dros el 999 ENG 1012/ 3) Muscleman Gymnasium's management is evaluating two brands of equipment for its new gymnasium. Due to the specific performance of the equipment, different equipment attracts different types of customers Therefore, it has different operating cashflows. The finance executive of the gymnasium provides the following data. Brand A $1,720,000 Brand B $1,910,000 Initial investment (equipment) Estimated cash inflows Year 1 Year 2 Year 3 Year 4 $ 550,000 $ 550,000 $ 550,000 $ 550,000 $ 635,000 $ 620,000 $ 590,000 $ 500,000 For each of the investment, the required annual rate of return is 10%. a) For each of these projects, calculate (0 Payback period (II) Net present value b) Which brand would you recommend for the company to adopt? Give your reason(s) to support your recommendation Muscleman Gymnasium's finance executive advises management that a one- time new membership payment of $8,800 from customers is viable for their business. With the economic downturn, the management felt that an instalment payment scheme will better attract new customers. Calculate the yearly end-of-year instalment amount payable by customers if the scheme is to be spread over 3 years and interest rate is 10% pa C) Payback method Brand A Brand B NPV method Year Brand B 10% Brand. Brand B 1 635 000 2 Brand A 550 000 550 000 550 000 550 000 3 620 000 590 000 500 000 4 PV Intial tmesmer NPV us Del