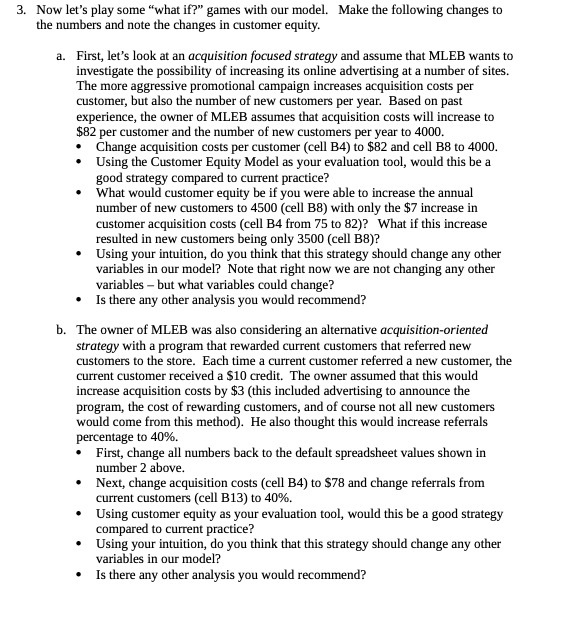

3. Now let's play some "what if?" games with our model. Make the following changes to the numbers and note the changes in customer equity. a. First, let's look at an acquisition focused strategy and assume that MLEB wants to investigate the possibility of increasing its online advertising at a number of sites. The more aggressive promotional campaign increases acquisition costs per customer, but also the number of new customers per year. Based on past experience, the owner of MLEB assumes that acquisition costs will increase to $82 per customer and the number of new customers per year to 4000. . Change acquisition costs per customer (cell B4) to $82 and cell B8 to 4000. . Using the Customer Equity Model as your evaluation tool, would this be a good strategy compared to current practice? What would customer equity be if you were able to increase the annual number of new customers to 4500 (cell B8) with only the $7 increase in customer acquisition costs (cell B4 from 75 to 82)? What if this increase resulted in new customers being only 3500 (cell BB)? Using your intuition, do you think that this strategy should change any other variables in our model? Note that right now we are not changing any other variables - but what variables could change? Is there any other analysis you would recommend? b. The owner of MLEB was also considering an alternative acquisition-oriented strategy with a program that rewarded current customers that referred new customers to the store. Each time a current customer referred a new customer, the current customer received a $10 credit. The owner assumed that this would increase acquisition costs by $3 (this included advertising to announce the program, the cost of rewarding customers, and of course not all new customers would come from this method). He also thought this would increase referrals percentage to 40%. First, change all numbers back to the default spreadsheet values shown in number 2 above. Next, change acquisition costs (cell B4) to $78 and change referrals from current customers (cell B13) to 40%. Using customer equity as your evaluation tool, would this be a good strategy compared to current practice? Using your intuition, do you think that this strategy should change any other variables in our model? Is there any other analysis you would recommend