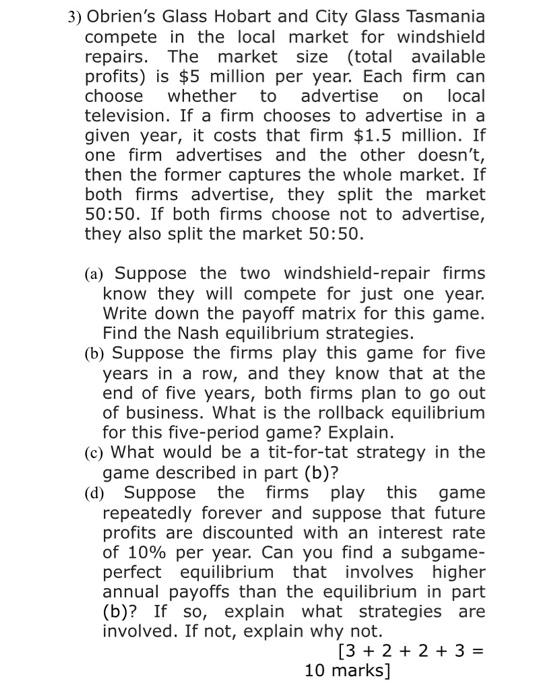

3) Obrien's Glass Hobart and City Glass Tasmania compete in the local market for windshield repairs. The market size (total available profits) is $5 million per year. Each firm can choose whether to advertise on local television. If a firm chooses to advertise in a given year, it costs that firm $1.5 million. If one firm advertises and the other doesn't, then the former captures the whole market. If both firms advertise, they split the market 50:50. If both firms choose not to advertise, they also split the market 50:50. (a) Suppose the two windshield-repair firms know they will compete for just one year. Write down the payoff matrix for this game. Find the Nash equilibrium strategies. (b) Suppose the firms play this game for five years in a row, and they know that at the end of five years, both firms plan to go out of business. What is the rollback equilibrium for this five-period game? Explain. (c) What would be a tit-for-tat strategy in the game described in part (b)? (d) Suppose the firms play this game repeatedly forever and suppose that future profits are discounted with an interest rate of 10% per year. Can you find a subgameperfect equilibrium that involves higher annual payoffs than the equilibrium in part (b)? If so, explain what strategies are involved. If not, explain why not. [3+2+2+3= 10 marks] 3) Obrien's Glass Hobart and City Glass Tasmania compete in the local market for windshield repairs. The market size (total available profits) is $5 million per year. Each firm can choose whether to advertise on local television. If a firm chooses to advertise in a given year, it costs that firm $1.5 million. If one firm advertises and the other doesn't, then the former captures the whole market. If both firms advertise, they split the market 50:50. If both firms choose not to advertise, they also split the market 50:50. (a) Suppose the two windshield-repair firms know they will compete for just one year. Write down the payoff matrix for this game. Find the Nash equilibrium strategies. (b) Suppose the firms play this game for five years in a row, and they know that at the end of five years, both firms plan to go out of business. What is the rollback equilibrium for this five-period game? Explain. (c) What would be a tit-for-tat strategy in the game described in part (b)? (d) Suppose the firms play this game repeatedly forever and suppose that future profits are discounted with an interest rate of 10% per year. Can you find a subgameperfect equilibrium that involves higher annual payoffs than the equilibrium in part (b)? If so, explain what strategies are involved. If not, explain why not. [3+2+2+3= 10 marks]