Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Skip to question [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the

Required information

Skip to question

[The following information applies to the questions displayed below.]

In preparation for developing its statement of cash flows for the year ended December 31, 2024, D-Krug Solutions, Incorporated collected the following information:

($ in millions)Payment for the early extinguishments of long-term notes (book value: $96.0 million)$ 100.0Sale of common shares252.0Retirement of common shares141.0Loss on sale of equipment3.9Proceeds from sale of equipment15.6Issuance of short-term note payable for cash29.0Acquisition of building for cash16.5Purchase of marketable securities (not a cash equivalent)24.0Purchase of marketable securities (considered a cash equivalent)20.0Cash payment for 3-year insurance policy22.0Collection of note receivable with interest (principal amount, $30)32.0Declaration of cash dividends70.0Distribution of cash dividends declared in 202367.0

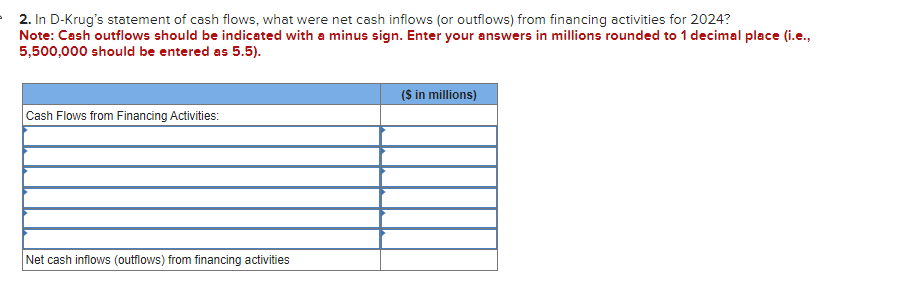

2. In D-Krugs statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024?

Note: Cash outflows should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).

2. In D-Krug's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024 ? Note: Cash outflows should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5 )

2. In D-Krug's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024 ? Note: Cash outflows should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started