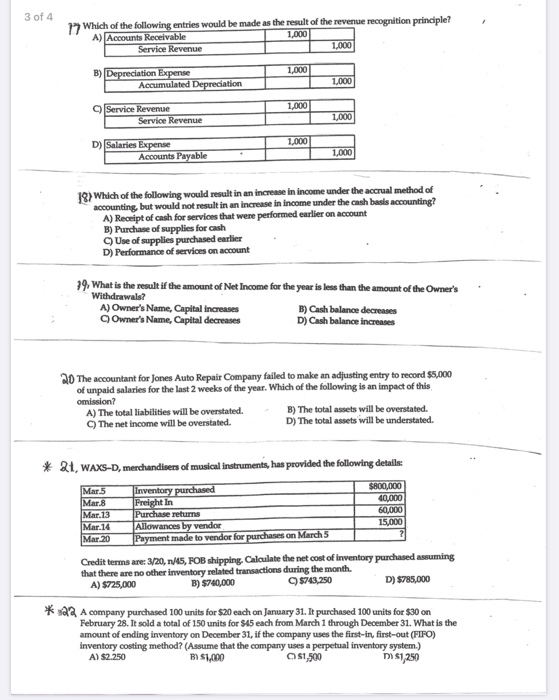

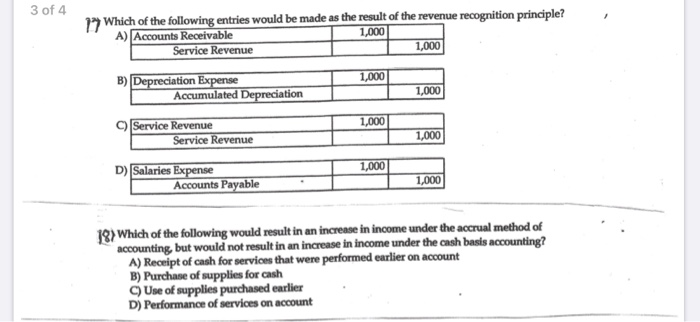

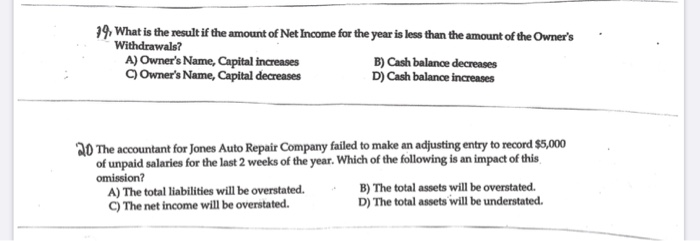

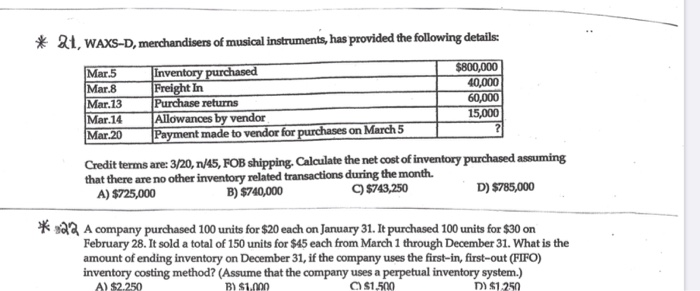

3 of 4 12 Which of the following entries would be made as the result of the revenue recognition principle? A) Accounts Receivable Service Revenue 1,000 B) Depreciation Expense Accumulated Depreciation 1.000 Service Revenue Service Revenue 1,000 D) Salaries Expense Accounts Payable 1,000 18) Which of the following would result in an increase in income under the accrual method of accounting, but would not result in an increase in income under the cash basis accounting? A) Receipt of cash for services that were performed earlier on account B) Purchase of supplies for cash Use of supplies purchased earlier D) Performance of services on account 19. What is the result if the amount of Net Income for the year is less than the amount of the Owner's Withdrawals? A) Owner's Name, Capital increases B) Cash balance decreases Owner's Name, Capital decreases D) Cash balance increases 20 The accountant for Jones Auto Repair Company failed to make an adjusting entry to record $5,000 of unpaid salaries for the last 2 weeks of the year. Which of the following is an impact of this omission? A) The total liabilities will be overstated. B) The total assets will be overstated C) The net income will be overstated. D) The total assets will be understated. * 21, WAXS-D, merchandisers of musical instruments, has provided the following details: Mar 5 Mar.8 Mar. 13 Mar.14 Mar.20 Inventory purchased Freight in Purchase returns Allowances by vendor Payment made to vendor for purchases on March 5 $800,000 coton 60.000 15.000 Credit terms are: 3/20, 1/45, FOB shipping. Calculate the net cost of Inventory purchased assuming that there are no other inventory related transactions during the month A) $725,000 B) $740,000 8743,250 D) $785,000 * A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold a total of 150 units for $45 each from March 1 through December 31. What is the amount of ending inventory on December 31, if the company uses the first-in, first-out (FIFO) inventory costing method? (Assume that the company uses a perpetual inventory system.) A) $2.250 B$1.000 $1,500 151,250 3 of 4 12 Which of the following entries would be made as the result of the revenue recognition principle? A) Accounts Receivable 1.000 Service Revenue 1.000 B) Depreciation Expense Accumulated Depreciation Service Revenue Service Revenue 1,000 1000 1,000 D) Salaries Expense Accounts Payable 1,000 18) Which of the following would result in an increase in income under the accrual method of & but would not result in an increase in income under the cash basis accounting? A) Receipt of cash for services that were performed earlier on account B) Purchase of supplies for cash Use of supplies purchased earlier D) Performance of services on account 19. What is the result if the amount of Net Income for the year is less than the amount of the Owner's Withdrawals? A) Owner's Name, Capital increases B) Cash balance decreases Owner's Name, Capital decreases D) Cash balance increases The accountant for Jones Auto Repair Company failed to make an adjusting entry to record $5,000 of unpaid salaries for the last 2 weeks of the year. Which of the following is an impact of this omission? A) The total liabilities will be overstated. B) The total assets will be overstated. C) The net income will be overstated. D) The total assets will be understated. * 21, WAXS-D, merchandisers of musical instruments, has provided the following details: Mar.5 Mar 8 Mar.13 Mar. 14 Mar.20 Inventory purchased Freight In Purchase returns Allowances by vendor Payment made to vendor for purchases on March 5 $800,000 40,000 60,000 15,000 Credit terms are: 3/20, 1/45, FOB shipping. Calculate the net cost of inventory purchased assuming that there are no other inventory related transactions during the month. A) $725,000 B) $740,000 C) $743,250 D) $785,000 * 22 A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on tal of 150 units for $45 each from March 1 through December 31. What is the amount of ending inventory on December 31, if the company uses the first-in, first-out (FIFO) inventory costing method? (Assume that the company uses a perpetual inventory system.) A) $2.250 B) $1.000 $1,500 D) $1,250