Question

3. On April 1, 20X2, Jack Company paid $800,000 for all of Ann Corporation's issued and outstanding common stock. Ann's recorded assets and liabilities

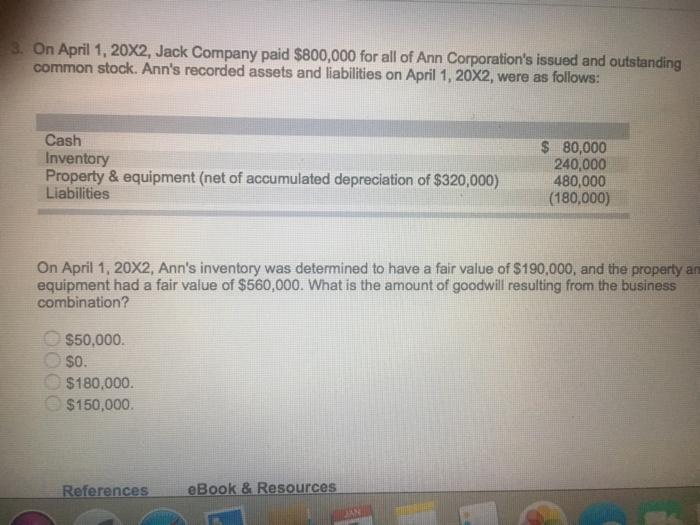

3. On April 1, 20X2, Jack Company paid $800,000 for all of Ann Corporation's issued and outstanding common stock. Ann's recorded assets and liabilities on April 1, 20X2, were as follows: Cash Inventory Property & equipment (net of accumulated depreciation of $320,000) Liabilities On April 1, 20X2, Ann's inventory was determined to have a fair value of $190,000, and the property an equipment had a fair value of $560,000. What is the amount of goodwill resulting from the business combination? $50,000. $0. $180,000. $150,000. References $ 80,000 240,000 480,000 (180,000) eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Step: 1

150000 Goodwill Amount paid towards the acquisition of Common Stock of A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App