Question

3. On January 1, 2008, Jones Company sold to Smith Company $40,000 of five-year, 8% bonds for $36,915. The effective rate of interest on

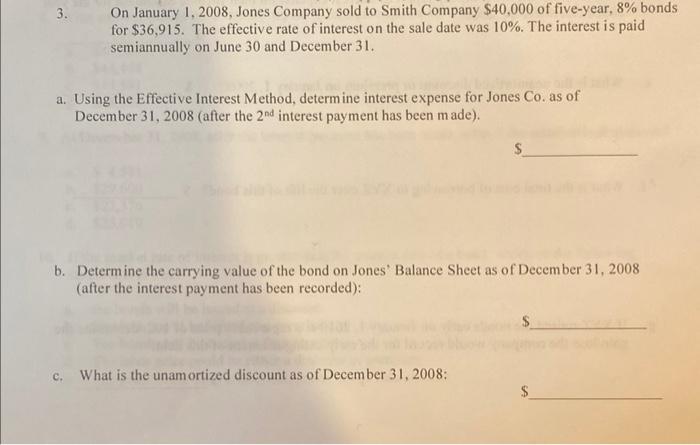

3. On January 1, 2008, Jones Company sold to Smith Company $40,000 of five-year, 8% bonds for $36,915. The effective rate of interest on the sale date was 10%. The interest is paid semiannually on June 30 and December 31. a. Using the Effective Interest Method, determine interest expense for Jones Co. as of December 31, 2008 (after the 2nd interest payment has been made). b. Determine the carrying value of the bond on Jones' Balance Sheet as of December 31, 2008 (after the interest payment has been recorded): c. What is the unamortized discount as of December 31, 2008:

Step by Step Solution

3.56 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the interest expense for Jones Company as of December 31 2008 using the Effective Interest Method we need to calculate the bond interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App