Answered step by step

Verified Expert Solution

Question

1 Approved Answer

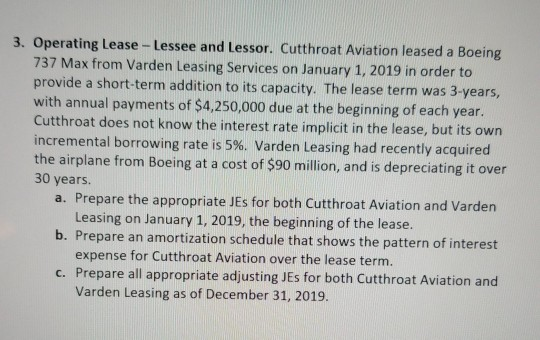

3. Operating Lease - Lessee and Lessor. Cutthroat Aviation leased a Boeing 737 Max from Varden Leasing Services on January 1, 2019 in order to

3. Operating Lease - Lessee and Lessor. Cutthroat Aviation leased a Boeing 737 Max from Varden Leasing Services on January 1, 2019 in order to provide a short-term addition to its capacity. The lease term was 3-years, with annual payments of $4,250,000 due at the beginning of each year. Cutthroat does not know the interest rate implicit in the lease, but its own incremental borrowing rate is 5%. Varden Leasing had recently acquired the airplane from Boeing at a cost of $90 million, and is depreciating it over 30 years. a. Prepare the appropriate JEs for both Cutthroat Aviation and Varden Leasing on January 1, 2019, the beginning of the lease. b. Prepare an amortization schedule that shows the pattern of interest expense for Cutthroat Aviation over the lease term. C. Prepare all appropriate adjusting JEs for both Cutthroat Aviation and Varden Leasing as of December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started