Answered step by step

Verified Expert Solution

Question

1 Approved Answer

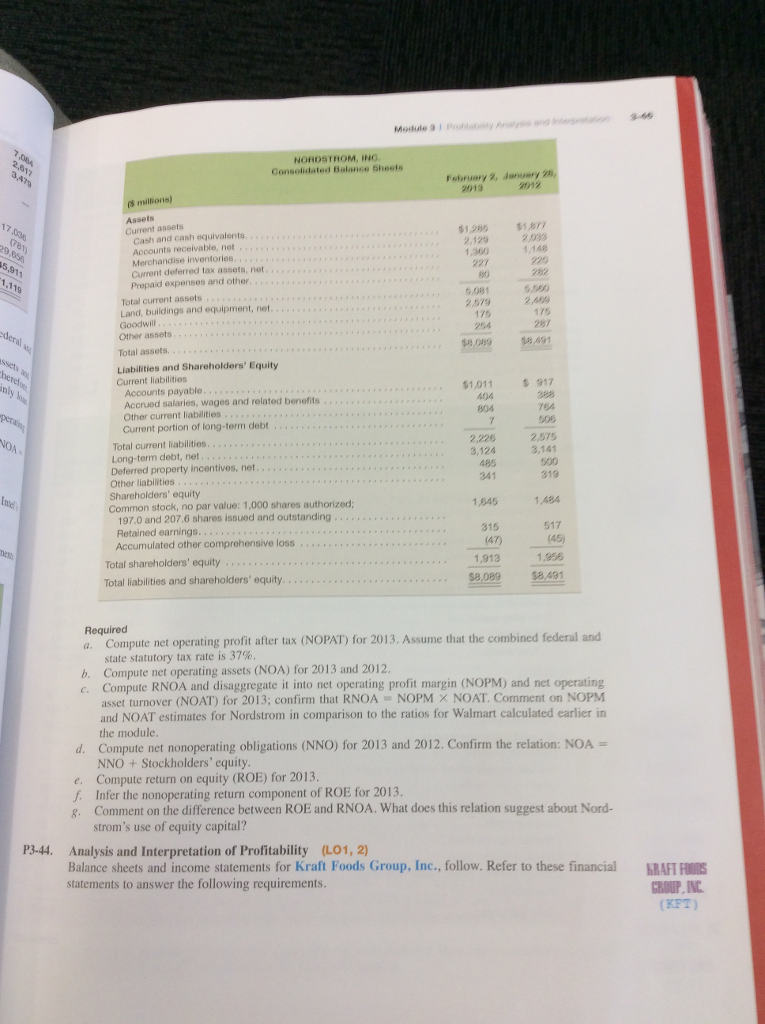

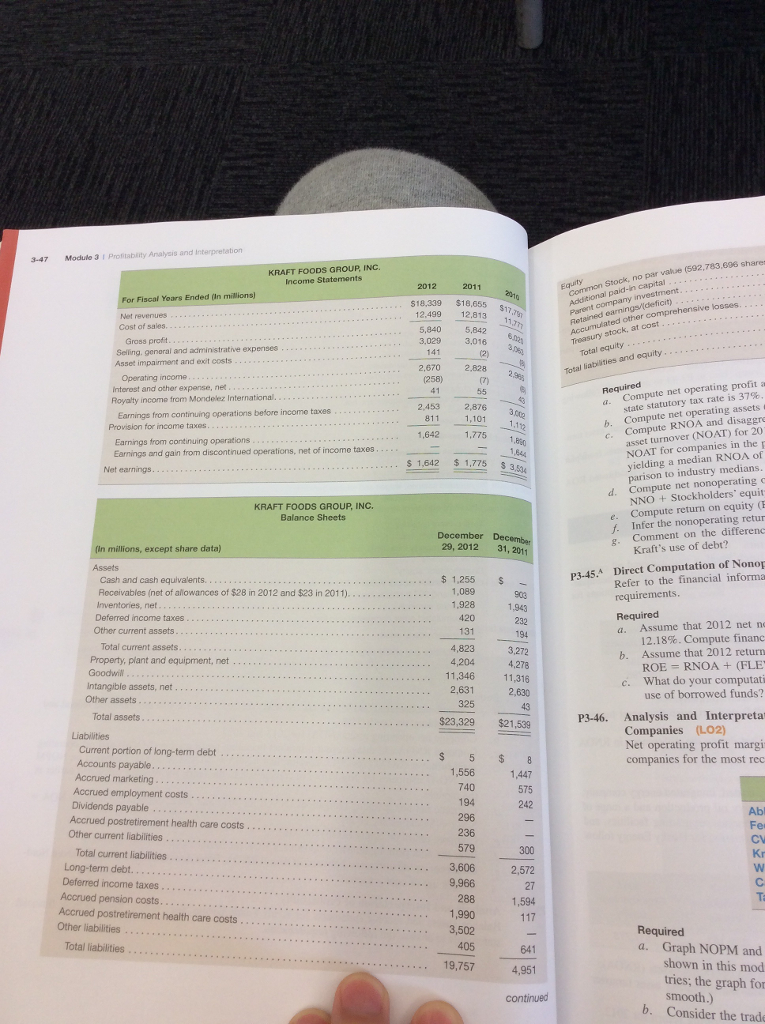

(3) P3-44 on page 3-46 of EMSZ (2015) 20 marks in total Part (a) is worth 2 marks Part (b) is worth 4 marks. Please

(3) P3-44 on page 3-46 of EMSZ (2015) 20 marks in total

Part (a) is worth 2 marks

Part (b) is worth 4 marks. Please treat Other current assets, Other assets, Other current

liabilities and Other liabilities as operating items.

Part (c) is worth 6 marks

Part (d) is worth 4 marks. Please treat Dividends Payable as a non-operating item.

Part (e) is worth 1 mark

Part (f) is worth 1 mark

Part (g) is worth 2 mark

NORDSTROM, ING. Consolidated Balance Sheets 2013 212 (s millions) Current assets Cash and cash equivalents $1,286 $1817 2,1292 1,340 221 80 1448 220 Current deferred lax assets, net Prepaid expenses and other Total current assets Land, buildings and equipment, net 5,580 6 081 2.079 175 254 175 281 Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable $1,011 917 Accrued salaries, wages and related benefits 288 754 50% 2,575 3,141 500 313 Other current liabilities Current portion of long-term debt Total current liabilities Long-term debt, net Deferred property incentives, net. Other liabilities Shareholders' equity 2,226 3,124 485 341 9 Common stock, no par value: 1,000 shares authorized 1,645 1,484 197.0 and 207.6 shares issued and outstanding Retained earnings. Accumulated other comprehensive loss 517 315 (47) Total shareholders' equity Total liabilities and shareholders' equity. . . . . . . . . . . . . 1.913 1. 1,958 $8,491 $8,089 , , , , , , , Compute net operating profit after tax (NOPAT) for 2013 . Assume that the combined federal and a state statutory tax rate is 37% b. Compute net operating assets (NOA) for 2013 and 2012 c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2013; confirm that RNOA = NOPM NOAT. Comment on NORM and NOAT estimates for Nordstrom in comparison to the ratios for Walmart calculated earlier in the module Compute net non operating obligations (NNO) for 2013 and 2012. Confirm the relation: NOA NNO +Stockholders' equity Compute return on equity (ROE) for 2013 d e. Infer the nonoperating return component of ROE for 2013 g. Comment on the difference between ROE and RNOA. What does this relation suggest about Nord- strom's use of equity capital? P3-44. Analysis and Interpretation of Profitability (LO1, 2) Balance sheets and income statements for Kraft Foods Group, Inc., follow. Refer to these financial RAFT F statements to answer the following requirements ROUP INC. KET)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started