3 photos

4 new photos

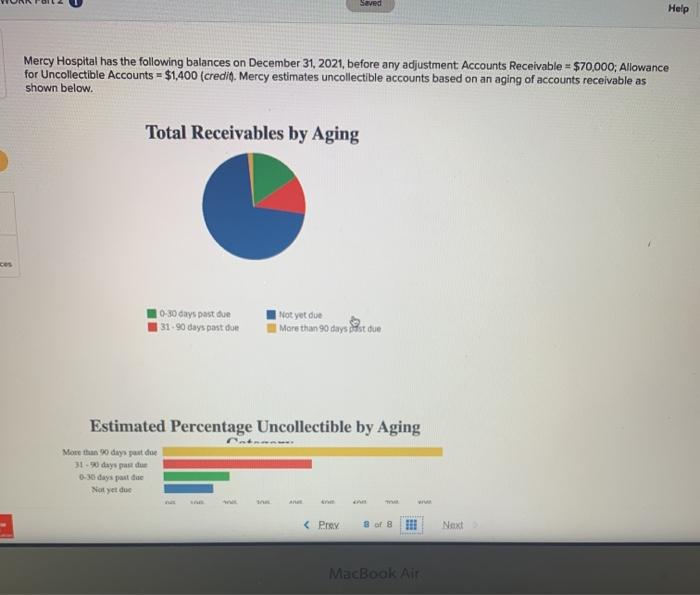

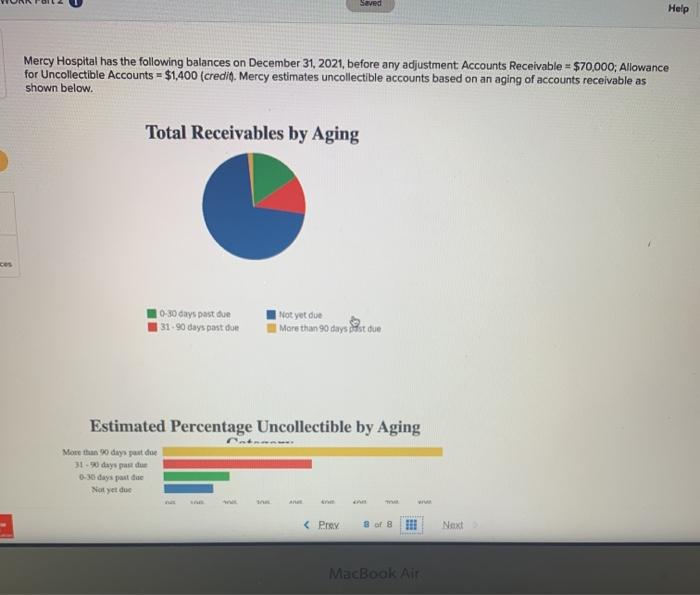

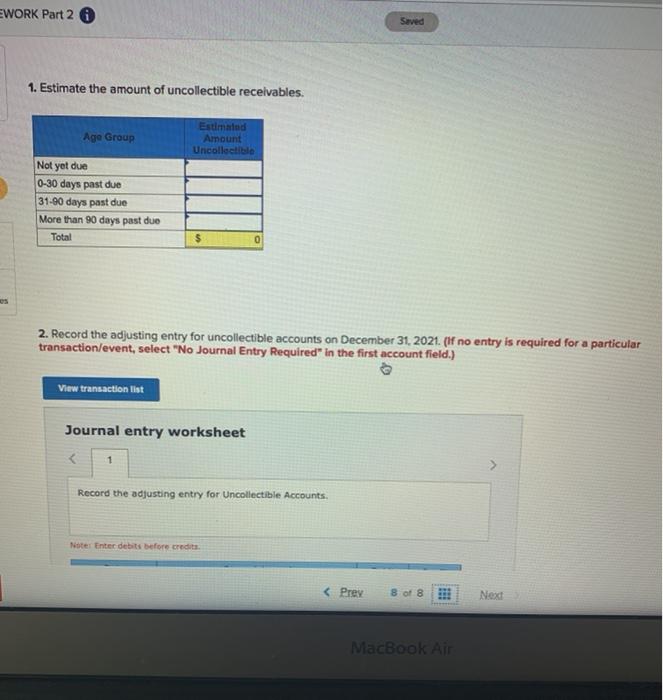

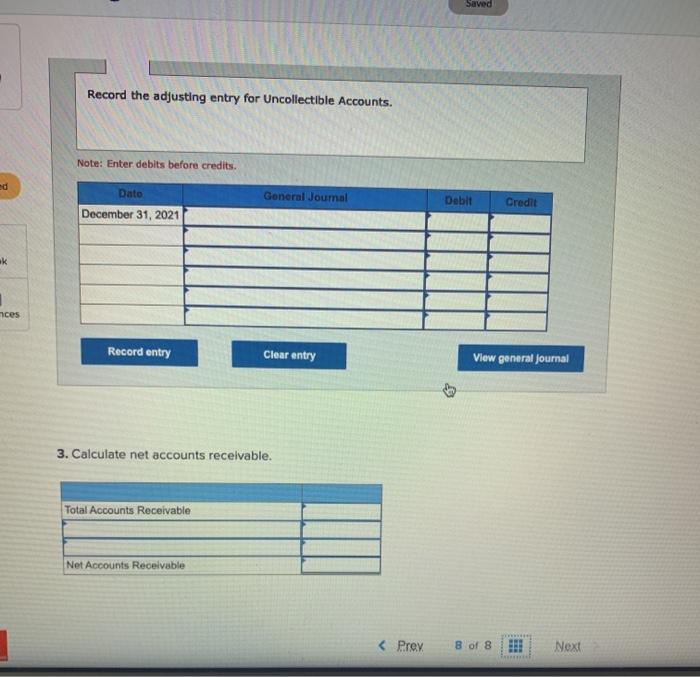

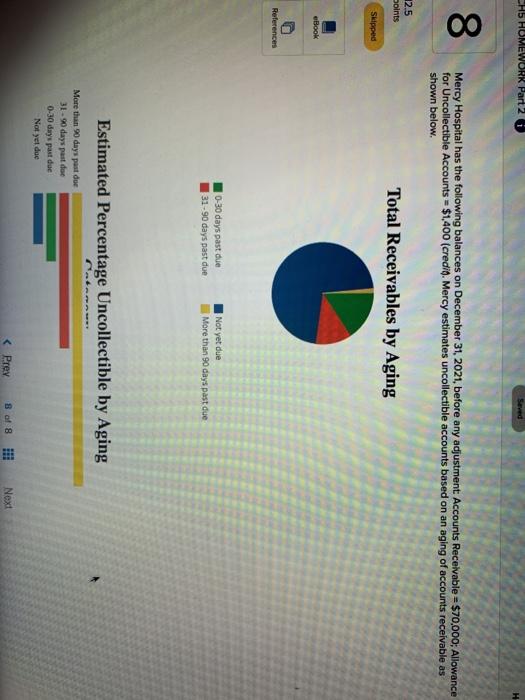

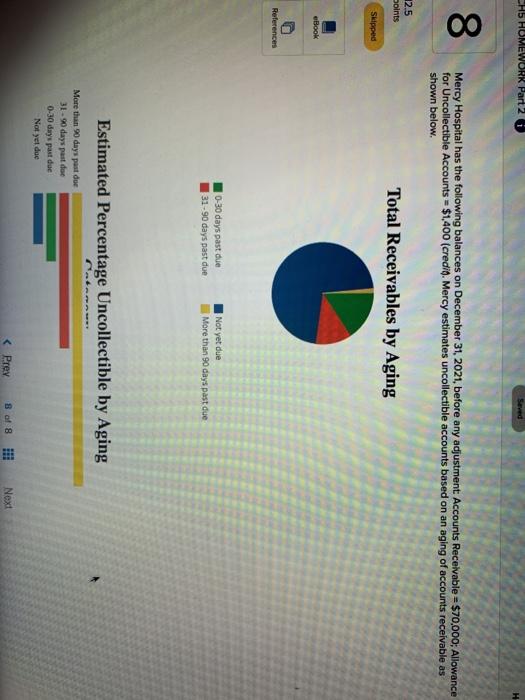

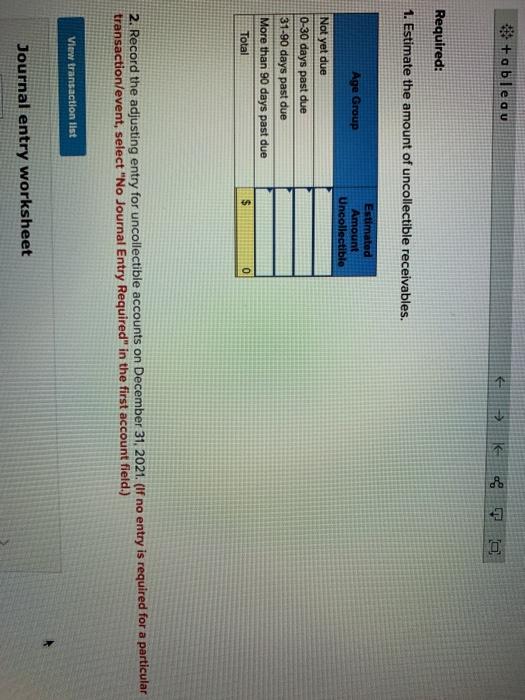

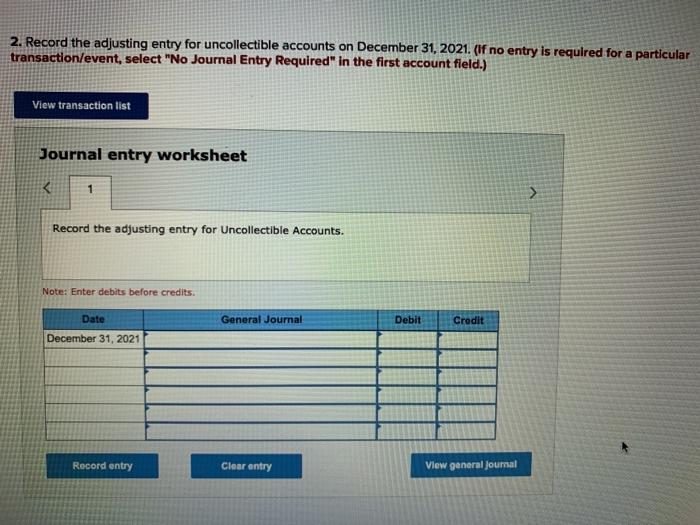

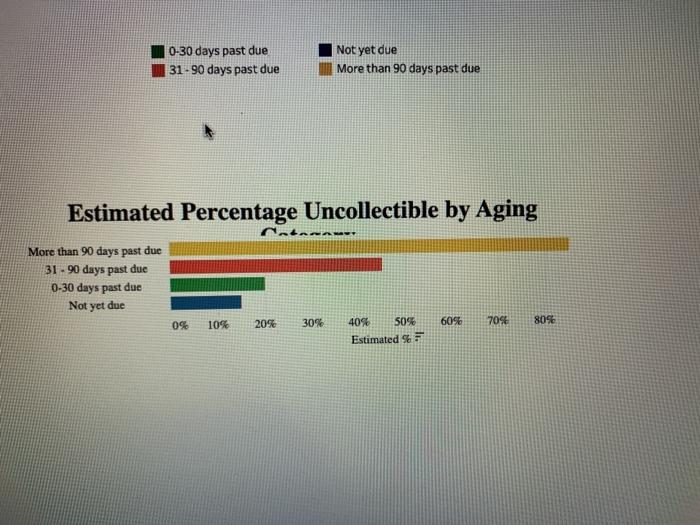

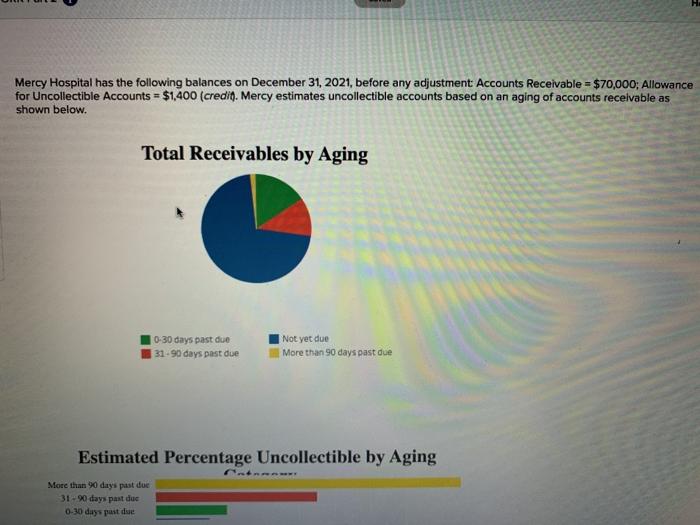

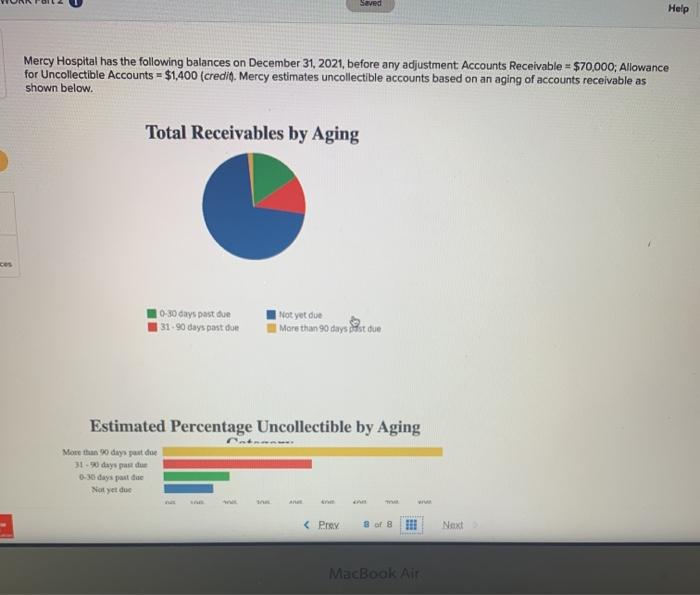

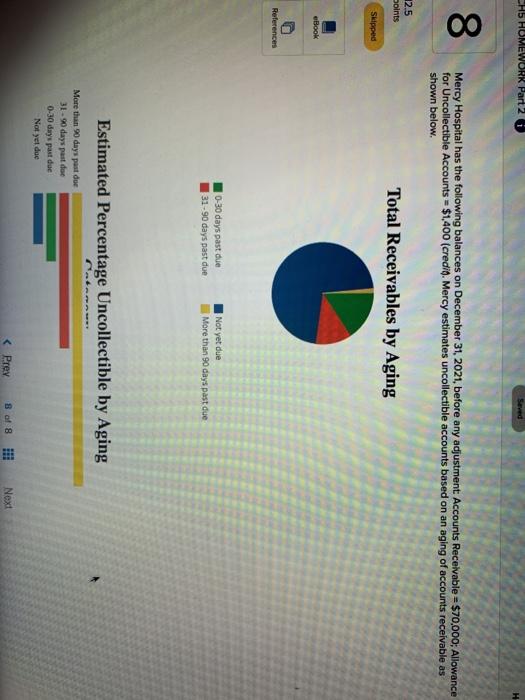

Seved Help Mercy Hospital has the following balances on December 31, 2021, before any adjustment Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit. Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Total Receivables by Aging ces 10-30 days past due 1 31.90 days past due Not yet due More than 90 days is due Estimated Percentage Uncollectible by Aging More than 90 days put doe 31-93 days past de 0-30 days pas de Not yet due Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general Journal 3. Calculate net accounts receivable. Total Accounts Receivable Net Accounts Receivable 0-30 days past due 31-90 days past due Not yet due More than 90 days past due Estimated Percentage Uncollectible by Aging nd LA More than 90 days past due 31 - 90 days past due 0-30 days past due Not yet due 0% 10% 20% 30% 60% 70% 8096 40% 50% Estimated Se Mercy Hospital has the following balances on December 31, 2021, before any adjustment Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit. Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Total Receivables by Aging 0-30 days past due 31-90 days past due | Not yet due More than 90 days past due Estimated Percentage Uncollectible by Aging More than 90 days past due 31-90 days past due 0-30 day past due Seved Help Mercy Hospital has the following balances on December 31, 2021, before any adjustment Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit. Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Total Receivables by Aging ces 10-30 days past due 1 31.90 days past due Not yet due More than 90 days is due Estimated Percentage Uncollectible by Aging More than 90 days put doe 31-93 days past de 0-30 days pas de Not yet due Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general Journal 3. Calculate net accounts receivable. Total Accounts Receivable Net Accounts Receivable 0-30 days past due 31-90 days past due Not yet due More than 90 days past due Estimated Percentage Uncollectible by Aging nd LA More than 90 days past due 31 - 90 days past due 0-30 days past due Not yet due 0% 10% 20% 30% 60% 70% 8096 40% 50% Estimated Se Mercy Hospital has the following balances on December 31, 2021, before any adjustment Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit. Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Total Receivables by Aging 0-30 days past due 31-90 days past due | Not yet due More than 90 days past due Estimated Percentage Uncollectible by Aging More than 90 days past due 31-90 days past due 0-30 day past due