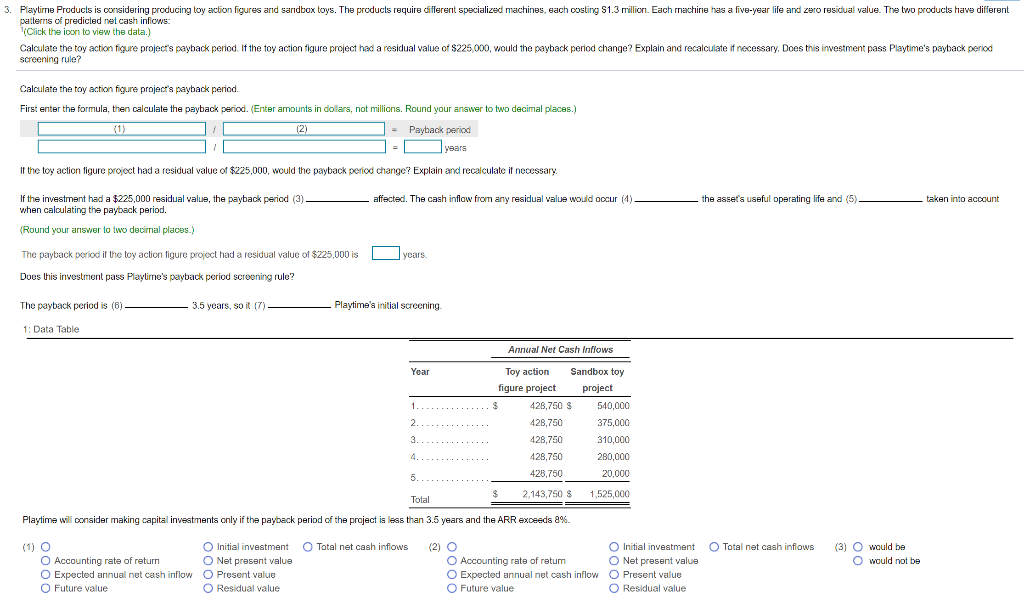

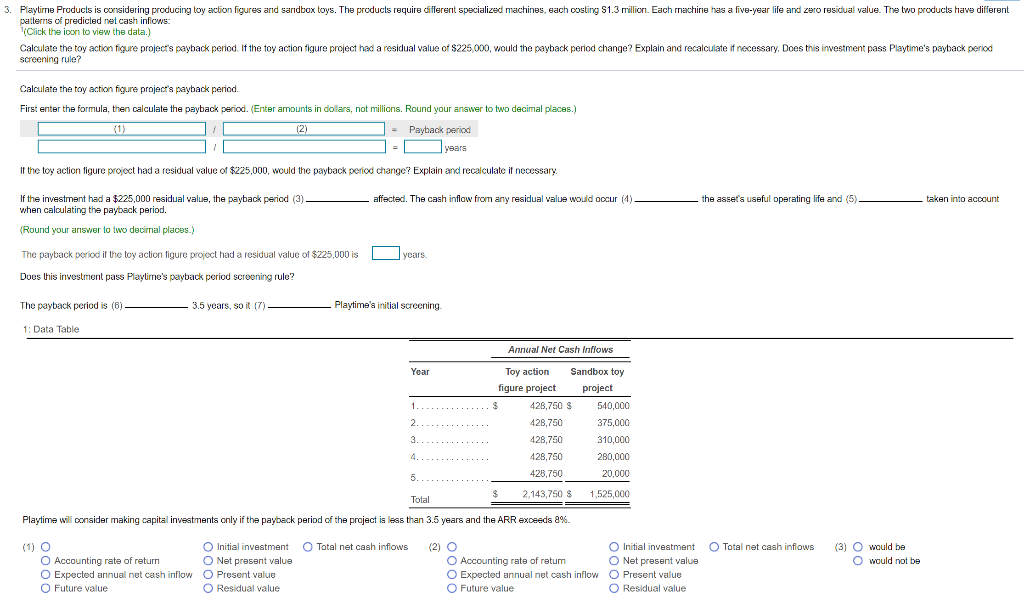

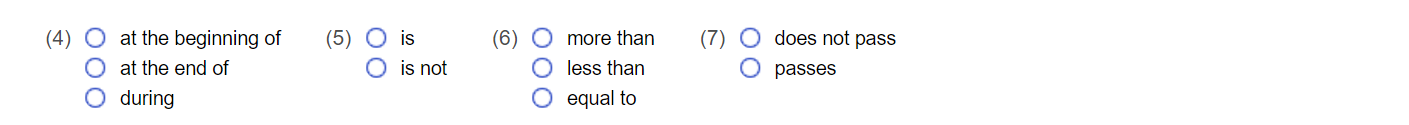

3. Playtime Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing S1.3 million. Each machine has a five-year life and zero residual value. The two products have different patterns of predicted nel cash inflows: (Click the icon to view the data.) Calculate the toy action figure project's payback period. If the toy action figure project had a residual value of $225,000, would the payback period change? Explain and recalculate if necessary. Does this investment pass Playtime's payback period screening rule? Calculate the toy action figure project's payback period. First enter the formula, then calculate the payback period. (Enter amounts in dollars, not millions. Round your answer to two decimal places.) = = Payback period years if the toy action figure project had a residual value of $225,000, would the payback period change? Explain and recalculate if necessary. - affected. The cash inflow from any residual value would occur (4) - the asset's useful operating life and (5) taken into account If the investment had a $225,000 residual value, the payback period (3) - when calculating the payback period. (Round your answer to two decimal places.) The payback period if the toy action figure project had a residual value of $225,000 is years. Does this investment pass Playlime's payback period screening rule? The payback period is (6) 3.5 years, so it (7) - Playtime's initial screening 1: Data Table Annual Net Cash Inflows Year Toy action Sandbox toy figure project project 1................$ 428,750 $ 540,000 2............... 428,750 375,000 3............... 428,750 310,000 4............... 428,750 280,000 428,750 20,000 Total 2,143,750 $ 1,525,000 Playtime will consider making capital investments only if the payback period of the project is less than 3.5 years and the ARR exceeds 8%. Total net cash inflows Total net cash inflows (3) would be O would not be (1) O Accounting rate of return Expected annual net cash inflow O Future value Initial investment O Net present value O Present value Residual value (2) O O Accounting rate of retum O Expected annual net cash inflow O Future value Initial investment Net present value O Present value O Residual value (4) O at the beginning of at the end of O during (5) Ois O is not (6) O more than less than O equal to (7) O does not pass O passes O