3- PLEASE answer parts A B C thank you

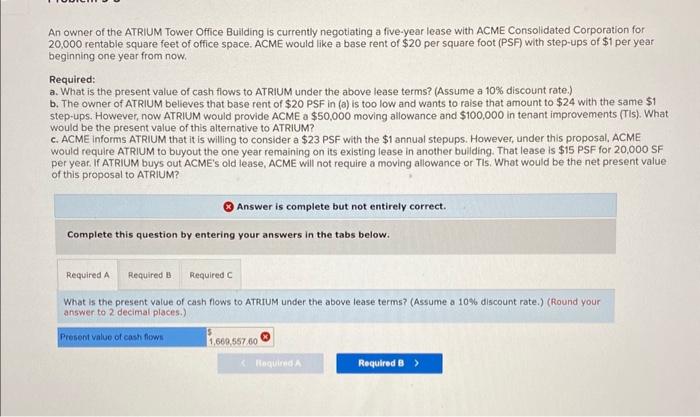

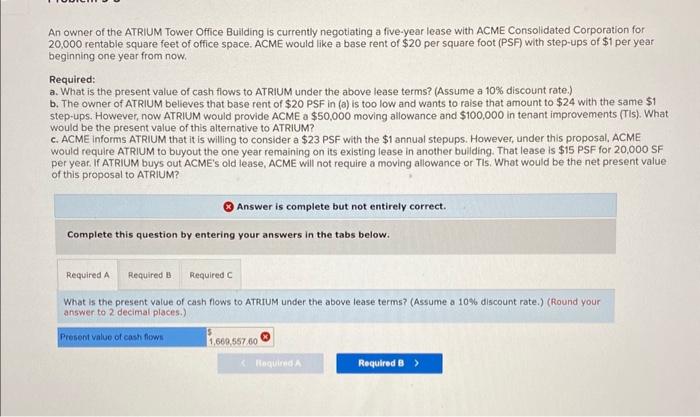

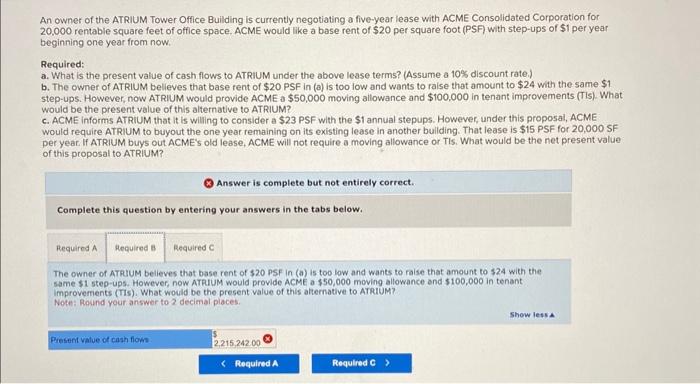

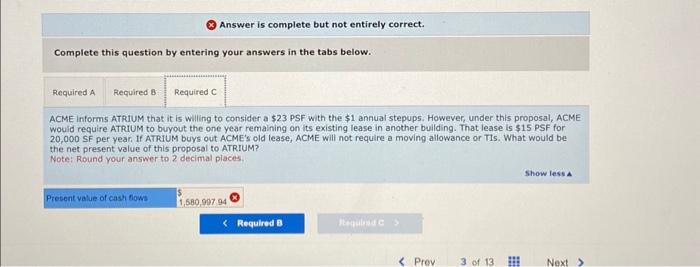

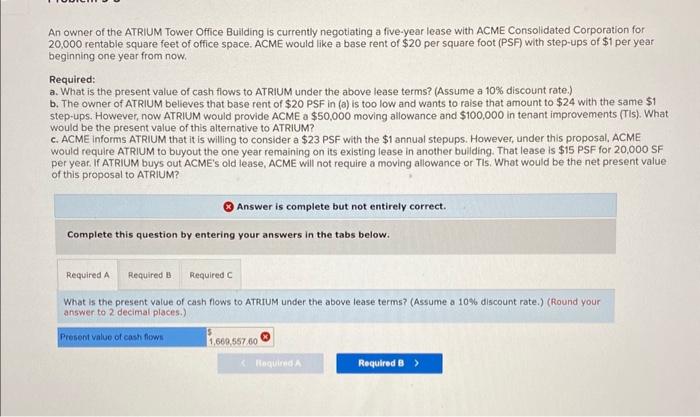

An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $20 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10\% discount rate.) b. The owner of ATRIUM believes that base rent of $20 PSF in (a) is too low and wants to raise that amount to $24 with the same $1 step-ups. However, now ATRIUM would provide ACME a $50,000 moving allowance and $100,000 in tenant improvements (TIs). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a \$23 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $15 PSF for 20,000 SF per year. If ATRIUM buys out ACME's old lease, ACME will not require a moving allowance or TIs. What would be the net present value of this proposal to ATRIUM? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) (Round your answer to 2 decimal places.) An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20.000 rentable square feet of office space. ACME would like a base rent of $20 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $20 PSF in (a) is too low and wants to raise that amount to $24 with the same $1 step-ups. However, now ATRIUM would provide ACME a $50,000 moving allowance and $100,000 in tenant improvements (Tis). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a \$23 PSF with the \$1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another buliding. That lease is $15 PSF for 20,000 SF per year. If ATRIUM buys out ACME's old lease, ACME will not require a moving allowance or TIs. What would be the net present value of this proposal to ATRIUM? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. The owner of ATRIUM believes that base rent of 320 PSF in (a) is too low and wants to raise that amount to $24 with the same \$1 step-ups. However, now ATRIUM would provide ACME a $50,000 moving allowance and 5100,000 in tenant improvements (Tis). What would be the present value of this aliernative to ATRiUM? Note: Round your answer to 2 decimal places. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. ACME informs ATRIUM that it is willing to consider a $23 PSF with the $1 annual stepup5. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another buliding. That lease is $15 PSF for 20,000 SF per year. If ATRIUM buys out ACME's old lease, ACME will not require a moving allowance or TIs. What would be the net present value of thils proposal to ATRIUM? Note: Round your answer to 2 decimal places