Question

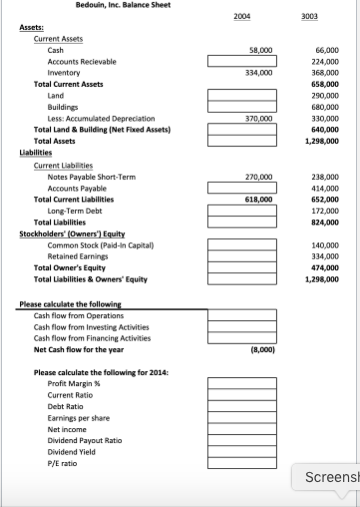

3) Please complete the excel spreadsheet using the following information: a) Net Income for the year ended December 31, 2004, was $212,000 b) Dividends paid

3) Please complete the excel spreadsheet using the following information:

a) Net Income for the year ended December 31, 2004, was $212,000

b) Dividends paid during the year ended December 31, 2004 were $84,000.

c) Accounts Receivable increased by $28,000 during the year ended December 31, 2004.

d) The cost of new buildings acquired during 2004 was $ 170,000.

e) No buildings were disposed of during 2004.

f) The land account was not affected by any transactions during the year, but the fair market value of the land at the end of 2003 was $420,000.

g)The company issued $20,000 of new common stock (paid in capital) during 2004

h)There were 200,000 shares issued and outstanding at the year-end

i)The year-end share price was $18.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started