Answered step by step

Verified Expert Solution

Question

1 Approved Answer

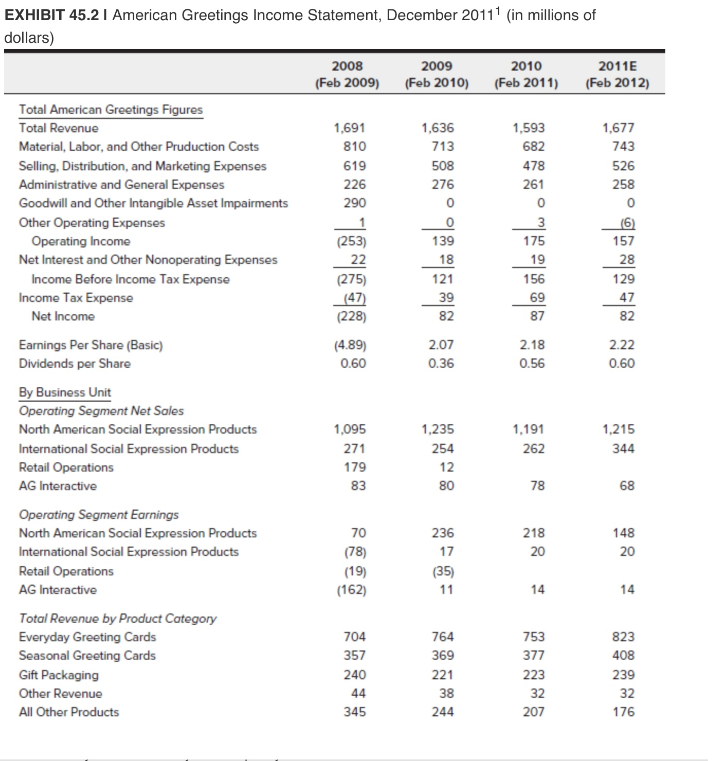

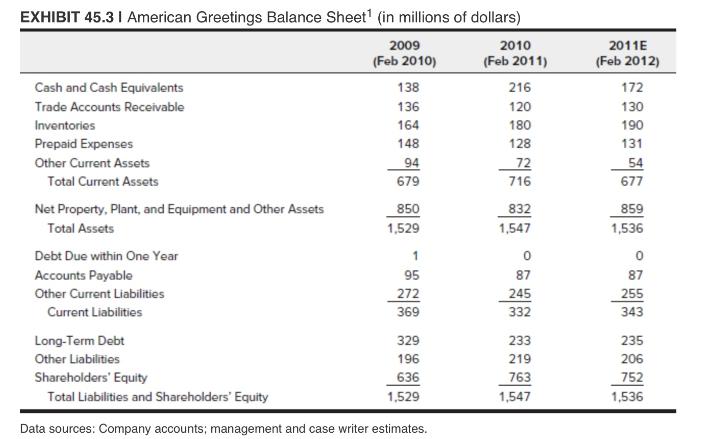

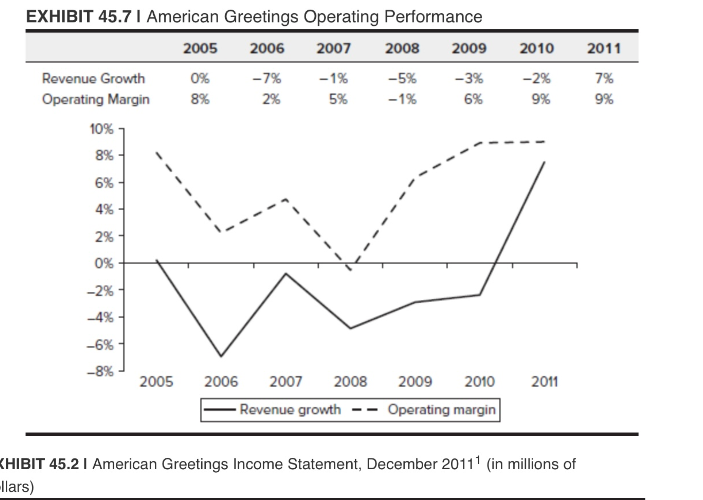

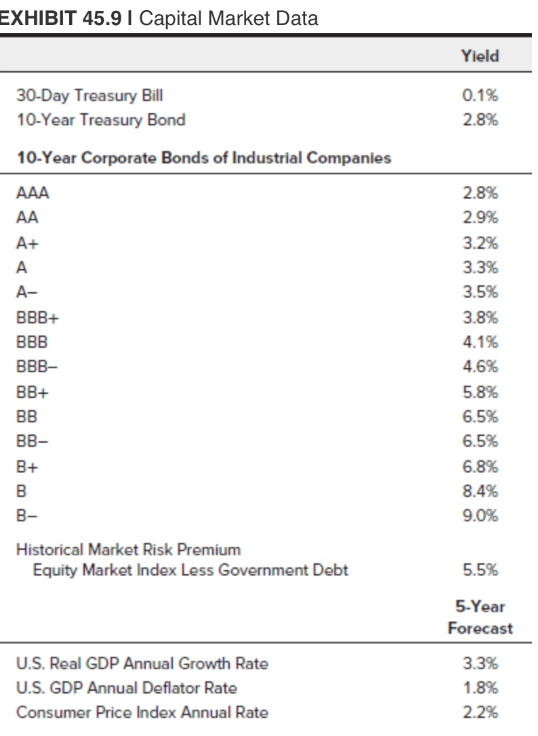

3. Please model cash flows for American Greetings for fiscal years 2012 through 2015. Using a marginal tax rate of 40% and a market risk

3. Please model cash flows for American Greetings for fiscal years 2012 through 2015. Using a marginal tax rate of 40% and a market risk premium of 5%. What is your estimate of the appropriate discount rate for the free cash flow forecast? Based on a discounted cash flow model, what is your best estimate of the implied enterprise value of American Greetings and the corresponding share price? Discuss your results and the implications for the decision facing American Greetings.

EXHIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of dollars) FXHIRIT 45.3 I American Greptinne Ralanre Shet 1 (in millinne nf dnllare) Data sources: Company accounts; management and case writer estimates. EXHIBIT 45.7 I American Greetings Operating Performance HIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of lars) EXHIBIT 45.9 I Capital Market Data EXHIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of dollars) FXHIRIT 45.3 I American Greptinne Ralanre Shet 1 (in millinne nf dnllare) Data sources: Company accounts; management and case writer estimates. EXHIBIT 45.7 I American Greetings Operating Performance HIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of lars) EXHIBIT 45.9 I Capital Market Data

EXHIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of dollars) FXHIRIT 45.3 I American Greptinne Ralanre Shet 1 (in millinne nf dnllare) Data sources: Company accounts; management and case writer estimates. EXHIBIT 45.7 I American Greetings Operating Performance HIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of lars) EXHIBIT 45.9 I Capital Market Data EXHIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of dollars) FXHIRIT 45.3 I American Greptinne Ralanre Shet 1 (in millinne nf dnllare) Data sources: Company accounts; management and case writer estimates. EXHIBIT 45.7 I American Greetings Operating Performance HIBIT 45.2 I American Greetings Income Statement, December 20111 (in millions of lars) EXHIBIT 45.9 I Capital Market Data Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started