Answered step by step

Verified Expert Solution

Question

1 Approved Answer

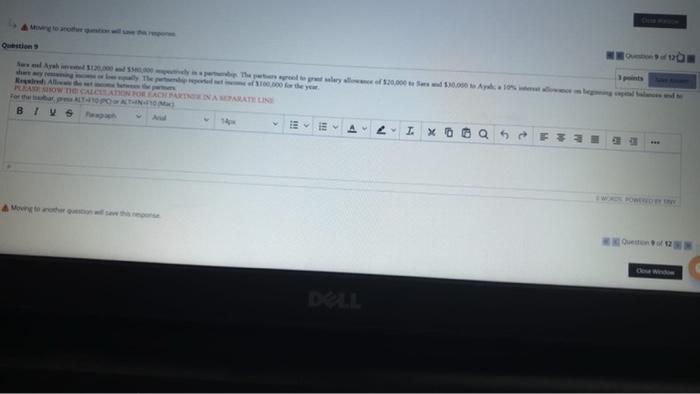

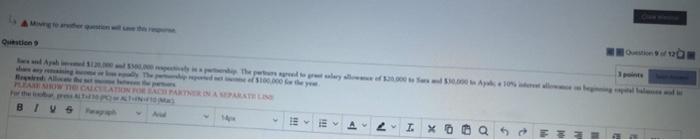

3 points Saving Armen Sara and Aya invested $ 120,000 and $ 360,000, respectively, in a partnership. The partners agreed to award a salary allowance

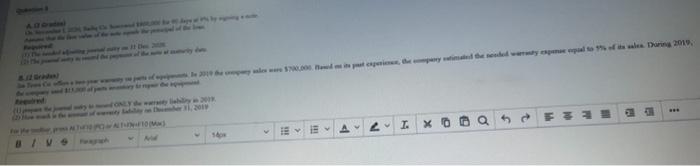

3 points Saving Armen Sara and Aya invested $ 120,000 and $ 360,000, respectively, in a partnership. The partners agreed to award a salary allowance of $ 20,000 to Sarah and $ 30,000 to share any residual income or loss equally. The partnership recorded a net income of $ 100,000 for the year. Required: Allocation of net income between partners Please show the account for each partner in a separate line on the toolbar, press ALT + F10 (PC) or ALT + FN + F10 (Mac). Aya Allocated Interest at 10% on Initial Capital Balances and to BIY S Para Arial 14px I.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started