Question

3 Prepare journal entries to record these transactions: (If no entry is required for a transaction/event, select No journal entry required in the first

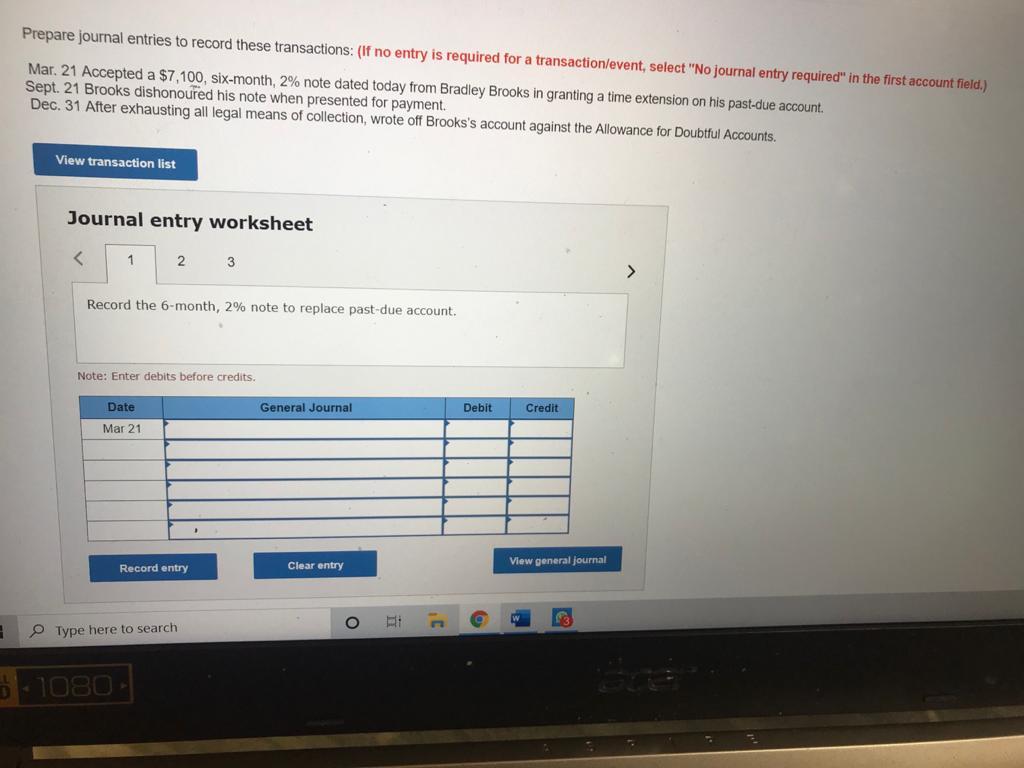

3 Prepare journal entries to record these transactions: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Mar. 21 Accepted a $7,100, six-month, 2% note dated today from Bradley Brooks in granting a time extension on his past-due account. Sept. 21 Brooks dishonoured his note when presented for payment. Dec. 31 After exhausting all legal means of collection, wrote off Brooks's account against the Allowance for Doubtful Accounts. View transaction list Journal entry worksheet < 1 Record the 6-month, 2% note to replace past-due account. 2 3 Note: Enter debits before credits. Date Mar 21 5-1080 Record entry Type here to search General Journal Clear entry Ei Debit Credit View general journal 13 >

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Account Debit Credit Mar 21 Note receivable 7100 Accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App