Answered step by step

Verified Expert Solution

Question

1 Approved Answer

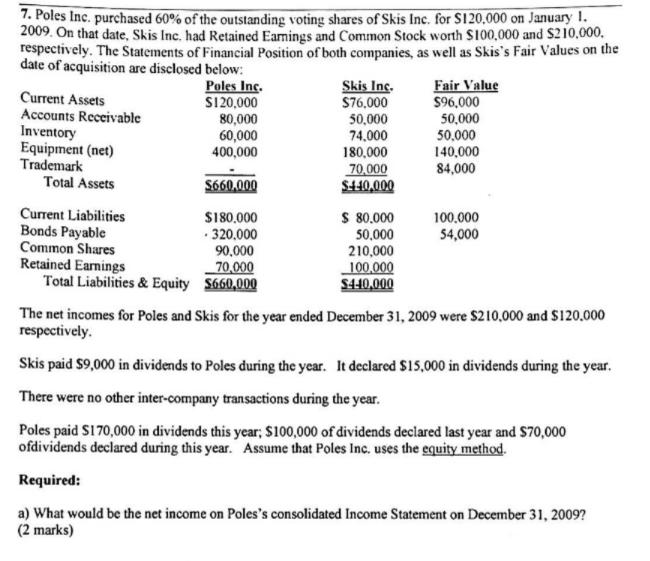

7. Poles Inc. purchased 60% of the outstanding voting shares of Skis Inc. for $120,000 on January 1. 2009. On that date, Skis Inc.

7. Poles Inc. purchased 60% of the outstanding voting shares of Skis Inc. for $120,000 on January 1. 2009. On that date, Skis Inc. had Retained Earnings and Common Stock worth $100,000 and $210,000, respectively. The Statements of Financial Position of both companies, as well as Skis's Fair Values on the date of acquisition are disclosed below: Poles Inc. $120,000 80,000 60,000 400,000 $660.000 $180,000 - 320,000 90,000 70,000 $660,000 Current Assets Accounts Receivable Inventory Equipment (net) Trademark Total Assets Current Liabilities Bonds Payable Common Shares Retained Earnings Total Liabilities & Equity Skis Inc. $76,000 50,000 74,000 180,000 70,000 $440,000 $ 80,000 50,000 210,000 100,000 $440,000 Fair Value $96,000 50,000 50,000 140,000 84,000 100,000 54,000 The net incomes for Poles and Skis for the year ended December 31, 2009 were $210,000 and $120.000 respectively. Skis paid $9,000 in dividends to Poles during the year. It declared $15,000 in dividends during the year. There were no other inter-company transactions during the year. Poles paid $170,000 in dividends this year; $100,000 of dividends declared last year and $70,000 ofdividends declared during this year. Assume that Poles Inc. uses the equity method. Required: a) What would be the net income on Poles's consolidated Income Statement on December 31, 2009? (2 marks) b) What would be the amount of Retained Earnings appearing on Poles's consolidated Balance Sheet as at December 31, 2009 would be: (2 marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Net income on Poless consolidated Income Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started