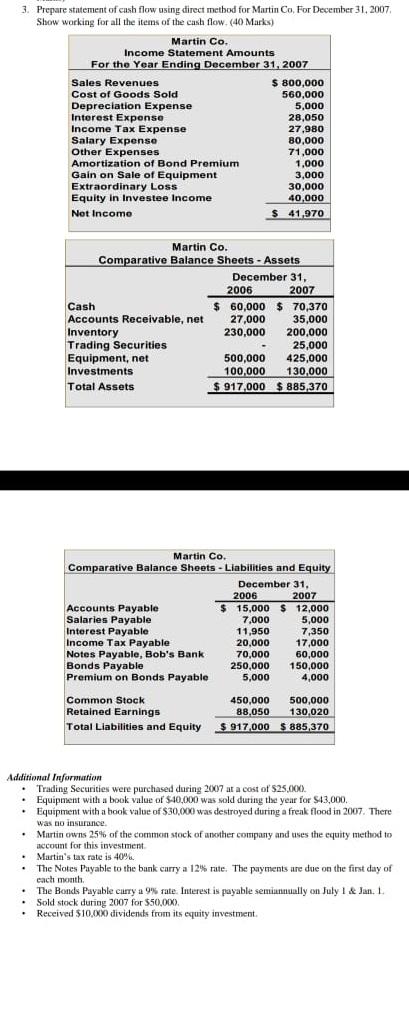

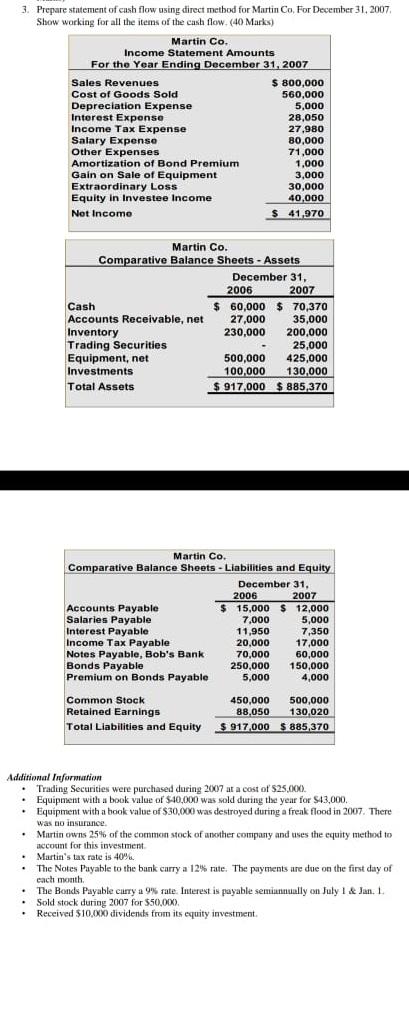

3. Prepare statement of cash flow using direct method for Martin Co, For December 31, 2007, Show working for all the items of the cash flow. (40 Marks) Martin Co. Income Statement Amounts For the Year Ending December 31, 2007 Sales Revenues $ 800,000 Cost of Goods Sold 560.000 Depreciation Expense 5,000 Interest Expense 28,050 Income Tax Expense 27,980 Salary Expenso 80,000 Other Expenses 71,000 Amortization of Bond Premium 1,000 Gain on Sale of Equipment 3,000 Extraordinary Loss 30,000 Equity in Investee Income 40,000 Not Incomo $ 41,970 Martin Co. Comparative Balance Sheets - Assets December 31, 2006 2007 Cash $ 60,000 $ 70,370 Accounts Receivable, net 27,000 35,000 Inventory 230,000 200,000 Trading Securities 25,000 Equipment, net 500,000 425,000 Investments 100,000 130,000 Total Assets $ 917,000 $885,370 Martin Co. Comparative Balance Sheets - Liabilities and Equity December 31. 2006 2007 Accounts Payable $ $ 15,000 $ 12,000 Salaries Payable 7,000 5,000 Interest Payable 11,950 7,350 Income Tax Payable 20,000 17,000 Notes Payable, Bob's Bank 70,000 60,000 Bonds Payable 250,000 150,000 Premium on Bonds Payable 5,000 4,000 Common Stock 450,000 500,000 Retained Earnings 88,050 130,020 Total Liabilities and Equity S 917,000 $ 885,370 Additional Information Trading Securities were purchased during 2007 at a cost of $25.00) Equipment with a book value of $40,000 was sold during the year for $43,000. Equipment with a book value of $30,000 was destroyed during a freak flood in 2007. There was to insurance Martin owns 25% of the common stock of another company and uses the equity method to account for this investment Martin's tax rate is 40%. The Notes Payable to the bank carry a 12% rate. The payments are due on the first day of each month The Bonds Payable curry a 9% rate. Interest is payable semiannually on July 1. Jan. 1 Sold stock during 2007 for $50,00%). Received $10,0XXO dividends from its equity investment . 3. Prepare statement of cash flow using direct method for Martin Co, For December 31, 2007, Show working for all the items of the cash flow. (40 Marks) Martin Co. Income Statement Amounts For the Year Ending December 31, 2007 Sales Revenues $ 800,000 Cost of Goods Sold 560.000 Depreciation Expense 5,000 Interest Expense 28,050 Income Tax Expense 27,980 Salary Expenso 80,000 Other Expenses 71,000 Amortization of Bond Premium 1,000 Gain on Sale of Equipment 3,000 Extraordinary Loss 30,000 Equity in Investee Income 40,000 Not Incomo $ 41,970 Martin Co. Comparative Balance Sheets - Assets December 31, 2006 2007 Cash $ 60,000 $ 70,370 Accounts Receivable, net 27,000 35,000 Inventory 230,000 200,000 Trading Securities 25,000 Equipment, net 500,000 425,000 Investments 100,000 130,000 Total Assets $ 917,000 $885,370 Martin Co. Comparative Balance Sheets - Liabilities and Equity December 31. 2006 2007 Accounts Payable $ $ 15,000 $ 12,000 Salaries Payable 7,000 5,000 Interest Payable 11,950 7,350 Income Tax Payable 20,000 17,000 Notes Payable, Bob's Bank 70,000 60,000 Bonds Payable 250,000 150,000 Premium on Bonds Payable 5,000 4,000 Common Stock 450,000 500,000 Retained Earnings 88,050 130,020 Total Liabilities and Equity S 917,000 $ 885,370 Additional Information Trading Securities were purchased during 2007 at a cost of $25.00) Equipment with a book value of $40,000 was sold during the year for $43,000. Equipment with a book value of $30,000 was destroyed during a freak flood in 2007. There was to insurance Martin owns 25% of the common stock of another company and uses the equity method to account for this investment Martin's tax rate is 40%. The Notes Payable to the bank carry a 12% rate. The payments are due on the first day of each month The Bonds Payable curry a 9% rate. Interest is payable semiannually on July 1. Jan. 1 Sold stock during 2007 for $50,00%). Received $10,0XXO dividends from its equity investment