Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Prepare the consolidation entries for the year ended 31 December 20x2. (20 marks) 4. Prepare the consolidated statement of profit or loss for the

3. Prepare the consolidation entries for the year ended 31 December 20x2. (20 marks)

4. Prepare the consolidated statement of profit or loss for the year ended 31 December 20x2 and the consolidated statement of financial position as at 31 December 20x2 for P Group. (30 marks)

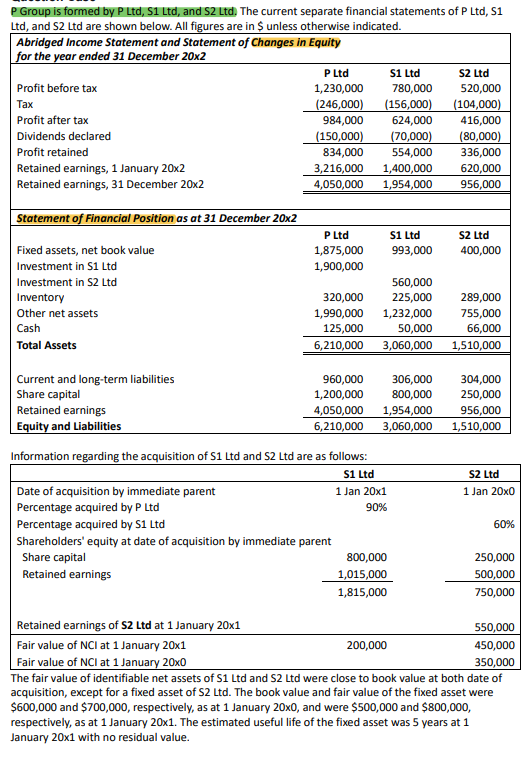

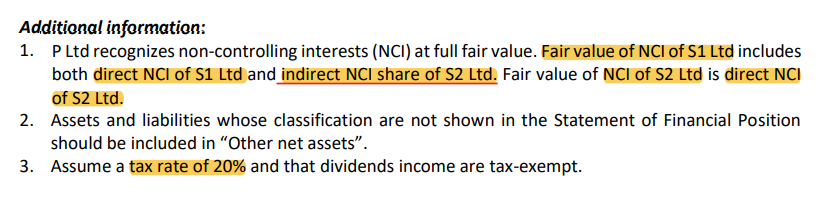

P Group is formed by P Ltd, S1 Ltd, and S2 Ltd. The current separate financial statements of P Ltd, S1 The fair value of identifiable net assets of S1 Ltd and S2 Ltd were close to book value at both date of acquisition, except for a fixed asset of $2 Ltd. The book value and fair value of the fixed asset were $600,000 and $700,000, respectively, as at 1 January 200, and were $500,000 and $800,000, respectively, as at 1 January 20x1. The estimated useful life of the fixed asset was 5 years at 1 January 201 with no residual value. Additional information: 1. P Ltd recognizes non-controlling interests (NCl) at full fair value. Fair value of NCl of S1Ltd includes both direct NCl of S1Ltd and indirect NCl share of S2Ltd. Fair value of NCl of S2 Ltd is direct NCI of S2 Ltd. 2. Assets and liabilities whose classification are not shown in the Statement of Financial Position should be included in "Other net assets". 3. Assume a tax rate of 20% and that dividends income are tax-exempt. P Group is formed by P Ltd, S1 Ltd, and S2 Ltd. The current separate financial statements of P Ltd, S1 The fair value of identifiable net assets of S1 Ltd and S2 Ltd were close to book value at both date of acquisition, except for a fixed asset of $2 Ltd. The book value and fair value of the fixed asset were $600,000 and $700,000, respectively, as at 1 January 200, and were $500,000 and $800,000, respectively, as at 1 January 20x1. The estimated useful life of the fixed asset was 5 years at 1 January 201 with no residual value. Additional information: 1. P Ltd recognizes non-controlling interests (NCl) at full fair value. Fair value of NCl of S1Ltd includes both direct NCl of S1Ltd and indirect NCl share of S2Ltd. Fair value of NCl of S2 Ltd is direct NCI of S2 Ltd. 2. Assets and liabilities whose classification are not shown in the Statement of Financial Position should be included in "Other net assets". 3. Assume a tax rate of 20% and that dividends income are tax-exemptStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started