Question

3. Prepare the relevant cost analysis based on future differential cash flows for each alternative. I am assuming I need to prepare furtuer net cash

3. Prepare the relevant cost analysis based on future differential cash flows for each alternative. I am assuming I need to prepare furtuer net cash flow and total benefits? I places my two alternatives below and think i have the accurate relevent costs needed from the 9 information given in making any decisions.

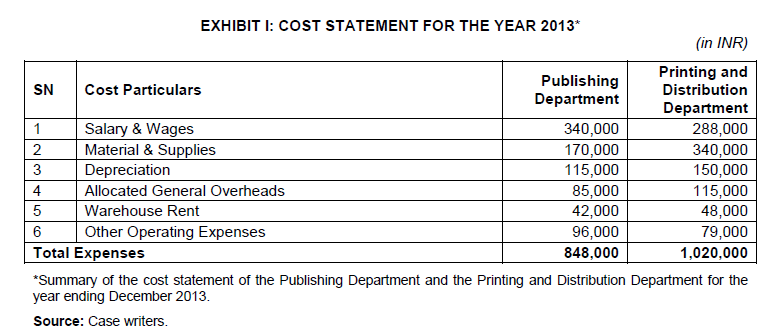

(Proposal: Fine Printing Press (FPP), offered to handle all of SPPH's printinng and distribution work for a montly paymen of INR 75,000. Contract periord for one year. [SPPH outsourced printing and distribution to FPP]. Currently, total cost of running the P&D department was INR 85,000 per a month. [see exibit 1 below] )

- Manek and Hiralal Pension plan in two years. Sameer to give pension equivalent to thier present salary of INR 2,000 per a month till eligible for pension. 2 specialist staff of P&D department will be retained present salary INR 4,000 per a month in order to coodinate work with FPP.

2. Publishing Department manager vacant and appoints Ashwin, manager P&D Department manager, to posting. Offer INR 6,500 as Publishing Department manager. Ashwin current salary of INR 6,000 per a month

3. Staff will be laid off and terms of contract, the firm will have to pay 15 months of salary as retrenchment compensation.

4. P&D Department stock of printing material work INR 90,000. FPP prepared to purchase stock for INR 88,000. SPPH entered into agreement with supplier to ensure uninterrupted delivery. Agreement included a cancelation penalty equivalent to 10% of the value of supplies canceled.

5. Depreciation expense included on machinery with original cost INR 2,000,000. Machined purchased 18 years ago and had economic life of 20 years. Straightline method calculation used. It can be sold at scrap value resulting in aloss of INR 75,000.

6. Depreciation on distribution vehicle woned by P&D Department calculated on written down value. WDV of vehicle was INR 200,000. FPP prepared to pay INR 100,000 for vehicle but Sameer denied to sell for intended company's general use.

7. General overhead cost allocated on basis of area occupied by each department. Closing the P&D Department would create a rental space it occupied for INR 5,000 per month

8. P&D Department had a 5 year lease on a warehouse with 3 years left on lease. Not possible to cancel lease and Sameer left with 2 options if decided to close department:

-Use P&D warehouse for Publishing Department and terminate its lease on the warehouse it was currently using. Since warehouse being used by Publishing department was rented on a yearly basis and the firm could save on rent of that warehouse.

-Sublease the P&D warehouse for INR 3,000 per month

9. Other operating expenses included the administration and selling cost of the department. In case of temporary closure, the expense would be worth INR 15,000 would be unavoidable, but thee firm would not incur the rest of expenses.

My alternatives for the case:

1: Accept FPP's Proposal (Outsourcing P&D Department)

Relevant Costs:

- Monthly Payment to FPP: INR 75,000 (Fixed Cost?)

- Pension to Retiring Employees (Manek and Hiralal): INR 2,000 per month each for 2 years.

- Retaining Specialist Staff: INR 4,000 per month each.

- Printing Material Sold to FPP: INR 88,000.

- Depreciation on Machinery: INR 75,000 loss (as it will be sold).

- Warehouse Rent: Potential savings if the current warehouse is terminated (INR 48,000) or income from subleasing (INR 3,000).

- Other Operating Expenses: INR 15,000 unavoidable during temporary closure.

- Retrenchment Compensation: 15 months' salary for laid-off employees

2: Reject FPP's Proposal (Continue Internal Operations)

Relevant Costs

- Continued Salary & Wages: Current expenses as per the 2013 cost statement.

- Depreciation: Current expenses as per the 2013 cost statement.

- Allocated General Overheads: Current expenses as per the 2013 cost statement.

- Warehouse Rent: Current expenses as per the 2013 cost statement.

- Other Operating Expenses: Current expenses as per the 2013 cost statement.

- Retrenchment Compensation: None if staff is not laid off.

- Potential Income: Savings if warehouse lease is terminated or income from subleasing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started