Answered step by step

Verified Expert Solution

Question

1 Approved Answer

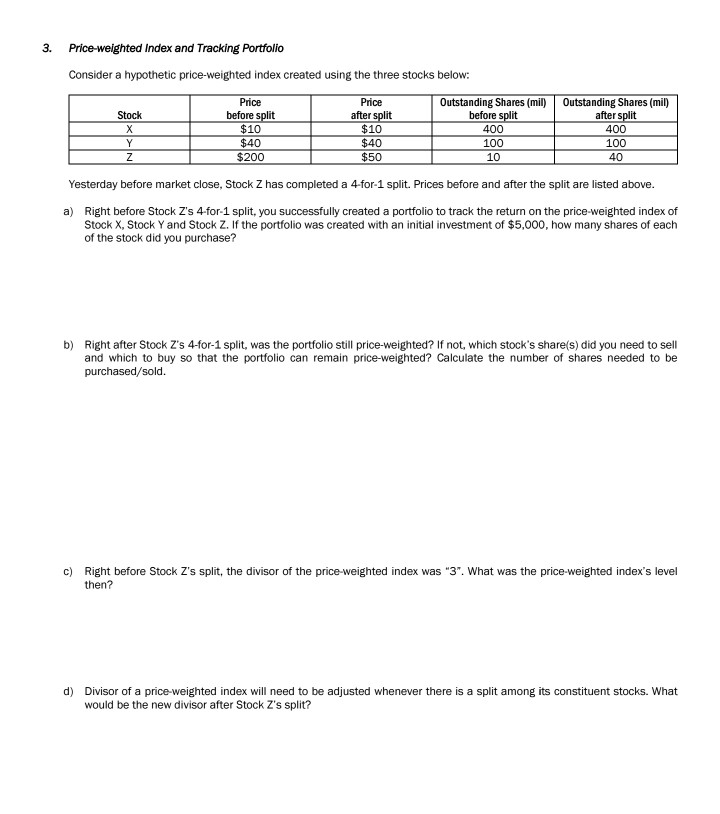

3. Price-weighted Index and Tracking Portfolio Consider a hypothetic price-weighted index created using the three stocks below: Price Price Outstanding Shares (mi before split 400

3. Price-weighted Index and Tracking Portfolio Consider a hypothetic price-weighted index created using the three stocks below: Price Price Outstanding Shares (mi before split 400 100 10 Outstanding Shares (mil) Stock after $10 $40 $200 $10 $40 $50 after split 400 100 40 Yesterday before market close, Stock Z has completed a 4-for-1 split. Prices before and after the split are listed above a) Right before Stock Z's 4-for-1 split, you successfully created a portfolio to track the return on the price-weighted index of Stock X, Stock Yand Stock Z. If the portfolio was created with an initial investment of $5,000, how many shares of each of the stock did you purchase? Right after Stock Z's 4-for-1 split, was the portfolio still price-weighted? If not, which stock's shares) did you need to sell and which to buy so that the portfolio can remain price-weighted? Calculate the number of shares needed to be purchased/sold. b) c) Right before Stock Z's split, the divisor of the price-weighted index was "3". What was the price-weighted index's level then? d) Divisor of a price-weighted index will need to be adjusted whenever there is a split among its constituent stocks. What would be the new divisor after Stock Z's split

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started