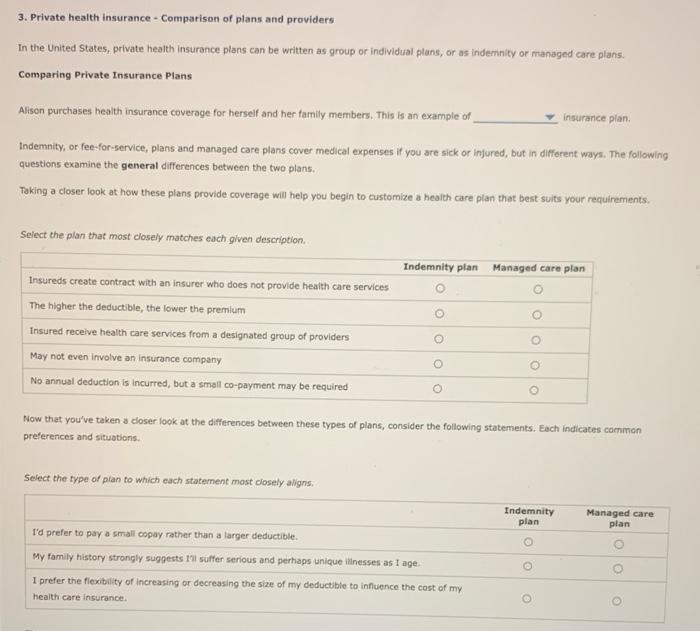

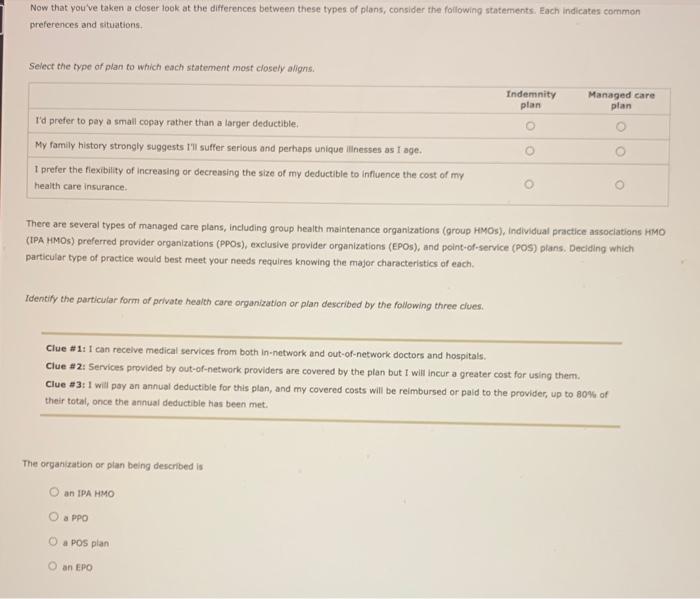

3. Private health insurance - Comparison of plans and providers In the United States, private health insurance plans can be written as group or individual plans, or as indemity or managed care plans. Comparing Private Insurance Plans Alison purchases health insurance coverage for herself and her family members. This is an example of insurance plan. Indemnity, or fee-for-service, plans and managed care plans cover medical expenses if you are sick or injured, but in different ways. The following questions examine the general differences between the two plans. Taking a closer look at how these plans provide coverage will help you begin to customize a health care plan that best suits your requiremients. Select the plan that most closely matches each given description. Now that you've taken a closer look at the differences between these types of plans, consider the following statements. Each indicates comman preferences and situotions. Now that youve taken a closer look at the differences between these types of plans, consider the foilowing statements. Each indicates common preferences and situations. Select the trpe of plan to which each statement most closely aligns. There are several types of managed care plans, including group health maintenance organizations (group HMOs), individual practice associations HMO (IPA HMOS) preferred provider organizations (PPOS), exclusive provider organizations (EPOS), and point-of-service (POS) plans, Deciding which particular type of practice would best meet your needs requires knowing the major characteristics of each. Identify the particular form of private health care organization or plan described by the following three clues. Clue # 1: 1 can recelve medical services from both in-network and out-of-network doctors and hospitals. Clue # 2: Services provided by out-of-network providers are covered by the plan but I will incur a greater cost for using them. Clue 33:1 will pay an annual deductible for this plan, and my covered costs will be reimbursed or paid to the provider, up to 80% of their total, once the annual deductible has been met. The organization or plan being described is an IPA HMO a PPO a Pos plan an EPO