Answered step by step

Verified Expert Solution

Question

1 Approved Answer

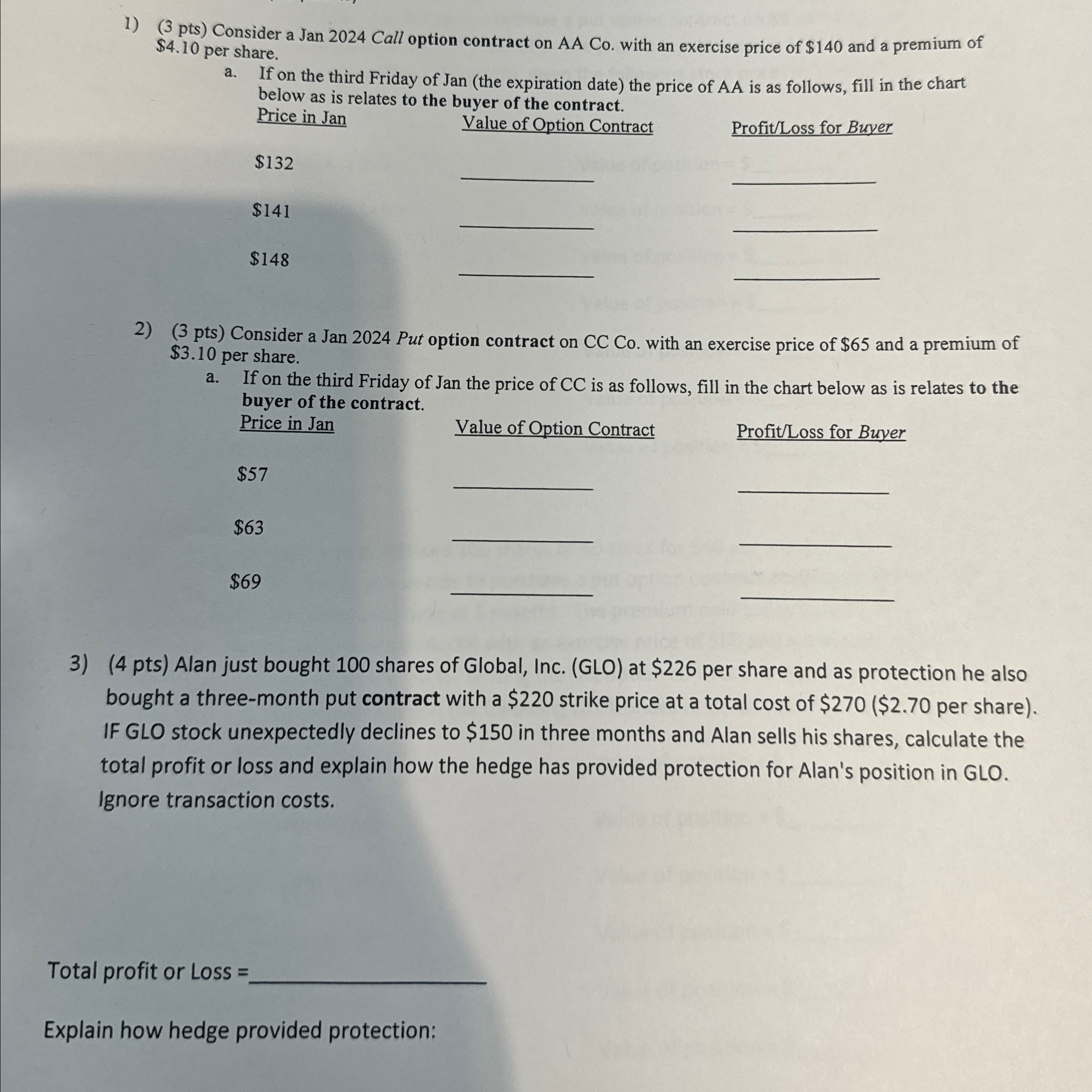

( 3 pts ) Consider a Jan 2 0 2 4 Call option contract on AA Co . with an exercise price of $ 1

pts Consider a Jan Call option contract on AA Co with an exercise price of $ and a premium of $ per share.

a If on the third Friday of Jan the expiration date the price of AA is as follows, fill in the chart below as is relates to the buyer of the contract.

Price in Jan

Value of Option Contract

ProfitLoss for Buyer

$

$

$

pts Consider a Jan Put option contract on CC Co with an exercise price of $ and a premium of $ per share.

a If on the third Friday of Jan the price of is as follows, fill in the chart below as is relates to the buyer of the contract.

Price in Jan

Value of Option Contract

ProfitLoss for Buyer

$

$

$

pts Alan just bought shares of Global, Inc. GLO at $ per share and as protection he also bought a threemonth put contract with a $ strike price at a total cost of $ $ per share IF GLO stock unexpectedly declines to $ in three months and Alan sells his shares, calculate the total profit or loss and explain how the hedge has provided protection for Alan's position in GLO. Ignore transaction costs.

Total profit or Loss

Explain how hedge provided protection:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started