Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 3 ) Question 6 : A CEO who led a famous turnaround at a large corporation has just retired. A publishing company has offered

Question :

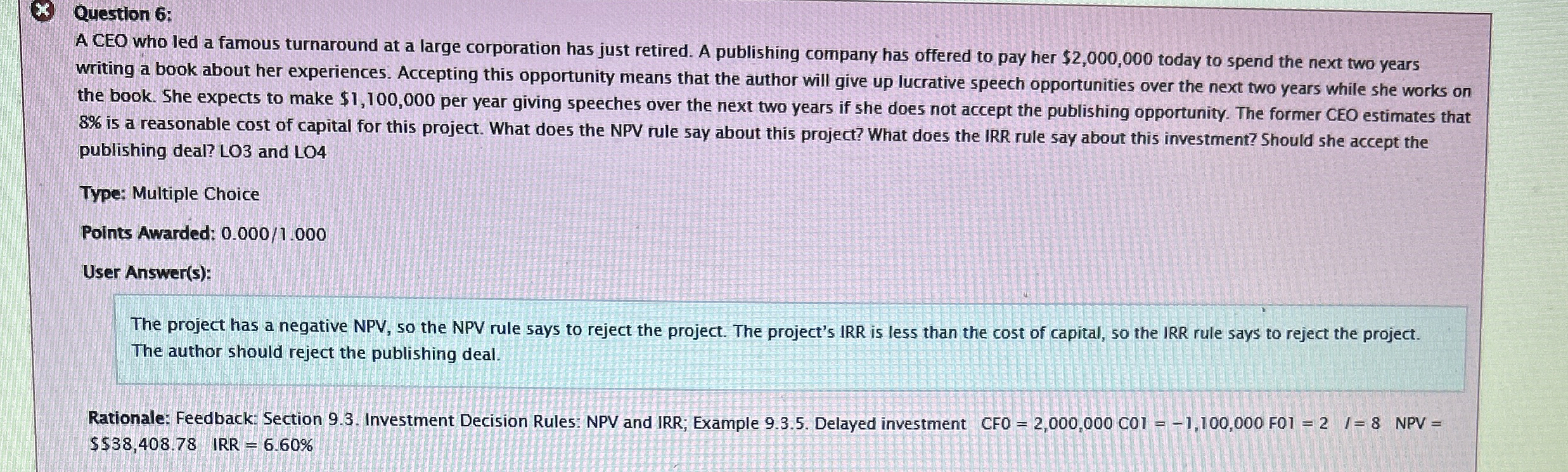

A CEO who led a famous turnaround at a large corporation has just retired. A publishing company has offered to pay her $ today to spend the next two years writing a book about her experiences. Accepting this opportunity means that the author will give up lucrative speech opportunities over the next two years while she works on the book. She expects to make $ per year giving speeches over the next two years if she does not accept the publishing opportunity. The former CEO estimates that is a reasonable cost of capital for this project. What does the NPV rule say about this project? What does the IRR rule say about this investment? Should she accept the publishing deal? LO and LO

Type: Multiple Choice

Points Awarded:

User Answers:

The project has a negative NPV so the NPV rule says to reject the project. The project's IRR is less than the cost of capital, so the IRR rule says to reject the project.

The author should reject the publishing deal.

Rationale: Feedback: Section Investment Decision Rules: NPV and IRR; Example Delayed investment CF C F NPV $$ IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started