Answered step by step

Verified Expert Solution

Question

1 Approved Answer

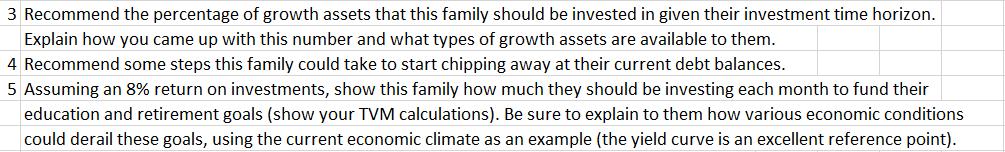

3 Recommend the percentage of growth assets that this family should be invested in given their investment time horizon. Explain how you came up

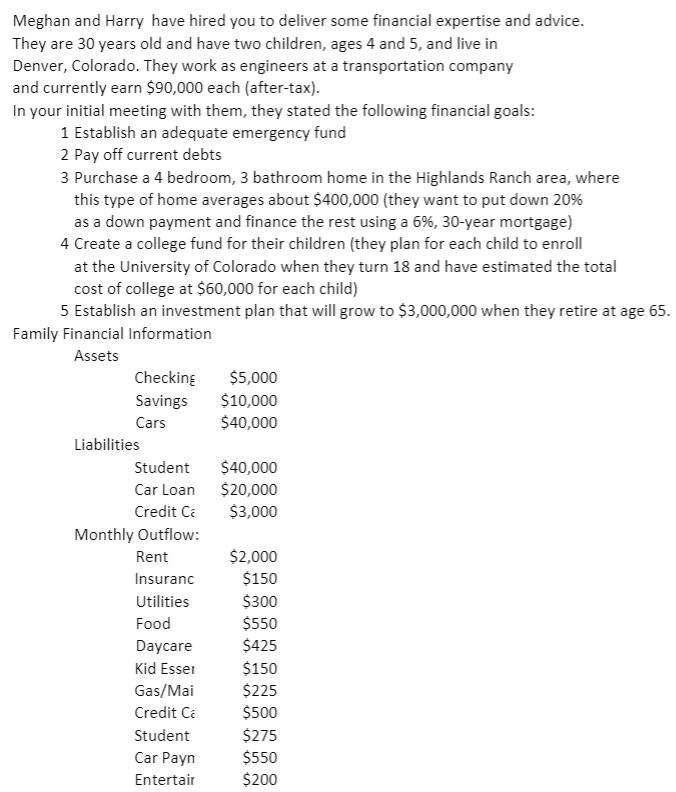

3 Recommend the percentage of growth assets that this family should be invested in given their investment time horizon. Explain how you came up with this number and what types of growth assets are available to them. 4 Recommend some steps this family could take to start chipping away at their current debt balances. 5 Assuming an 8% return on investments, show this family how much they should be investing each month to fund their education and retirement goals (show your TVM calculations). Be sure to explain to them how various economic conditions could derail these goals, using the current economic climate as an example (the yield curve is an excellent reference point). Meghan and Harry have hired you to deliver some financial expertise and advice. They are 30 years old and have two children, ages 4 and 5, and live in Denver, Colorado. They work as engineers at a transportation company and currently earn $90,000 each (after-tax). In your initial meeting with them, they stated the following financial goals: 1 Establish an adequate emergency fund 2 Pay off current debts 3 Purchase a 4 bedroom, 3 bathroom home in the Highlands Ranch area, where this type of home averages about $400,000 (they want to put down 20% as a down payment and finance the rest using a 6%, 30-year mortgage) 4 Create a college fund for their children (they plan for each child to enroll at the University of Colorado when they turn 18 and have estimated the total cost of college at $60,000 for each child) 5 Establish an investment plan that will grow to $3,000,000 when they retire at age 65. Family Financial Information Assets Checking Savings Cars Liabilities Student Car Loan Credit Ca Monthly Outflow: Rent Insuranc Utilities Food Daycare Kid Esser Gas/Mai Credit Ca Student Car Payn Entertair $5,000 $10,000 $40,000 $40,000 $20,000 $3,000 $2,000 $150 $300 $550 $425 $150 $225 $500 $275 $550 $200

Step by Step Solution

★★★★★

3.61 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

answer 1 Establish an Adequate Emergency Fund The first step in financial planning is to establish an emergency fund An emergency fund is money set aside to cover unexpected expenses that can arise in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started