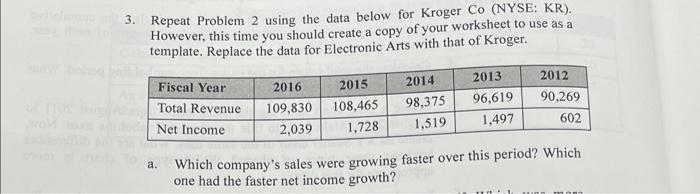

Question: 3. Repeat Problem 2 using the data below for Kroger Co (NYSE: KR), However, this time you should create a copy of your worksheet to

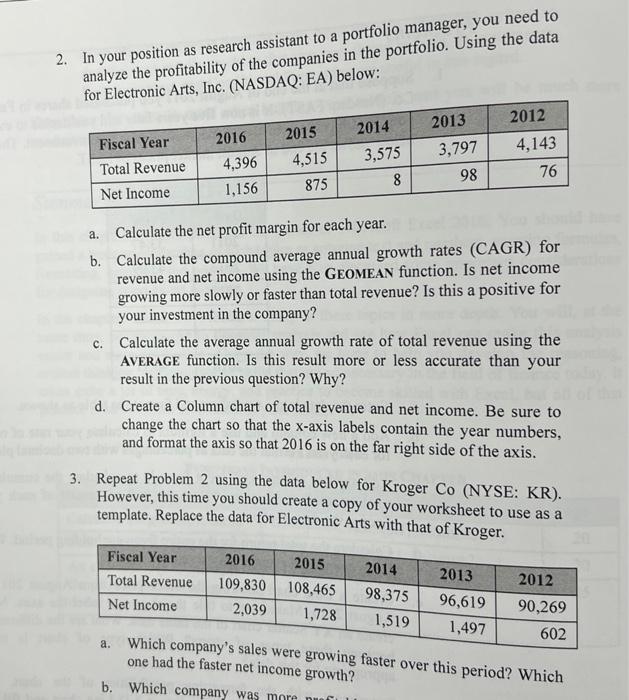

3. Repeat Problem 2 using the data below for Kroger Co (NYSE: KR), However, this time you should create a copy of your worksheet to use as a template. Replace the data for Electronic Arts with that of Kroger. a. Which company's sales were growing faster over this period? Which one had the faster net income growth? 2. In your position as research assistant to a portfolio manager, you need to analyze the profitability of the companies in the portfolio. Using the data for Electronic Arts, Inc. (NASDAQ: EA) below: a. Calculate the net profit margin for each year. b. Calculate the compound average annual growth rates (CAGR) for revenue and net income using the GEOMEAN function. Is net income growing more slowly or faster than total revenue? Is this a positive for your investment in the company? c. Calculate the average annual growth rate of total revenue using the AVERAGE function. Is this result more or less accurate than your result in the previous question? Why? d. Create a Column chart of total revenue and net income. Be sure to change the chart so that the x-axis labels contain the year numbers, and format the axis so that 2016 is on the far right side of the axis. 3. Repeat Problem 2 using the data below for Kroger Co (NYSE: KR). However, this time you should create a copy of your worksheet to use as a template. Replace the data for Electronic Arts with that of Kroger. whe company's sales were growing faster over this period? Which b. Which company wet income growth? 3. Repeat Problem 2 using the data below for Kroger Co (NYSE: KR), However, this time you should create a copy of your worksheet to use as a template. Replace the data for Electronic Arts with that of Kroger. a. Which company's sales were growing faster over this period? Which one had the faster net income growth? 2. In your position as research assistant to a portfolio manager, you need to analyze the profitability of the companies in the portfolio. Using the data for Electronic Arts, Inc. (NASDAQ: EA) below: a. Calculate the net profit margin for each year. b. Calculate the compound average annual growth rates (CAGR) for revenue and net income using the GEOMEAN function. Is net income growing more slowly or faster than total revenue? Is this a positive for your investment in the company? c. Calculate the average annual growth rate of total revenue using the AVERAGE function. Is this result more or less accurate than your result in the previous question? Why? d. Create a Column chart of total revenue and net income. Be sure to change the chart so that the x-axis labels contain the year numbers, and format the axis so that 2016 is on the far right side of the axis. 3. Repeat Problem 2 using the data below for Kroger Co (NYSE: KR). However, this time you should create a copy of your worksheet to use as a template. Replace the data for Electronic Arts with that of Kroger. whe company's sales were growing faster over this period? Which b. Which company wet income growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts