Question

#3 - Required: Complete the statement of cash flows for the year ended December 31, 2022 As of January 1, 2022, the City of Summerville

#3 - Required: Complete the statement of cash flows for the year ended December 31, 2022

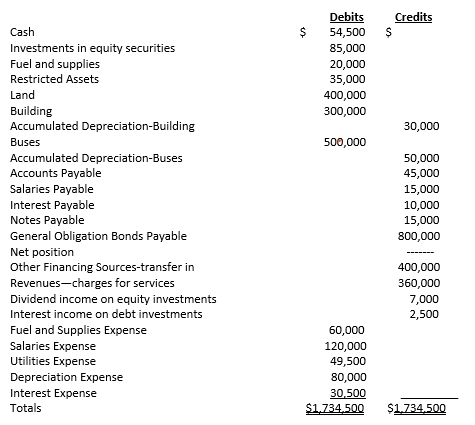

As of January 1, 2022, the City of Summerville began a municipal bus operation. The adjusted trial balance below was prepared as of December 31, 2022:

Additional information:

- A transfer of $400,000 was received from the general fund in January, 2022, and was used to acquire land.

- General obligation bonds with a face value of $800,000 were sold for $800,000 on March 31, 2022. The bonds pay interest at 5% on March 31 and September 30. The bonds were used to acquire the building and the buses.

- The bond covenant requires that Summerville set aside assets each year to repay the bond principal as it matures and is paid. During 2022, the City transferred $35,000 of cash to restricted assets. All $35,000 was used to acquire investments in 10-year treasury bonds. The general obligation bonds are serial bonds, and the first serial payment of $300,000 is scheduled for March 31, 2023.

- All the charges for services as well as the dividend and interest income from investments were received in cash during 2022.

- Salaries paid during 2022 amounted to $105,000.

- During 2022, $80,000 of fuel and supplies were purchased on account. $35,000 of the $80,000 was paid during 2022. $20,000 of the fuel and supplies were unused at December 31, 2022. The unused fuel and supplies are expected to be used in early 2023.

- There were no unpaid utility bills outstanding at December 31, 2022.

- $85,000 was spent during 2022 to acquire equity securities. These securities are expected to be sold as working capital is needed in 2023.

- During 2022, the City borrowed $15,000 from the local bank to provide additional working capital for bus operations. The note is due on March 31, 2023. Interest accrued up to December 31, 2022, of $500 was paid on December 31, 2022, and is included in the amount recorded for interest expense of $30,500.

- The remaining $30,000 of interest expense relates to the general obligation bonds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started