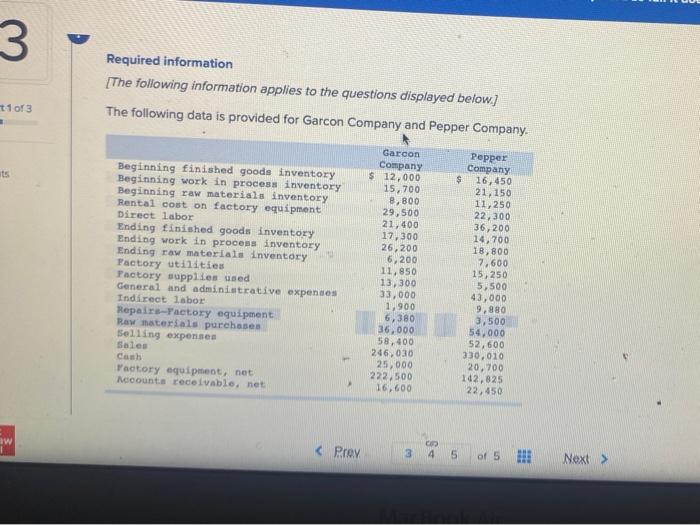

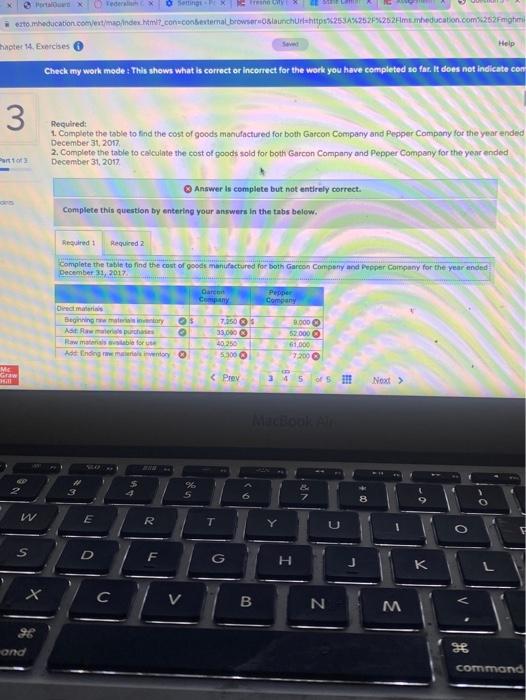

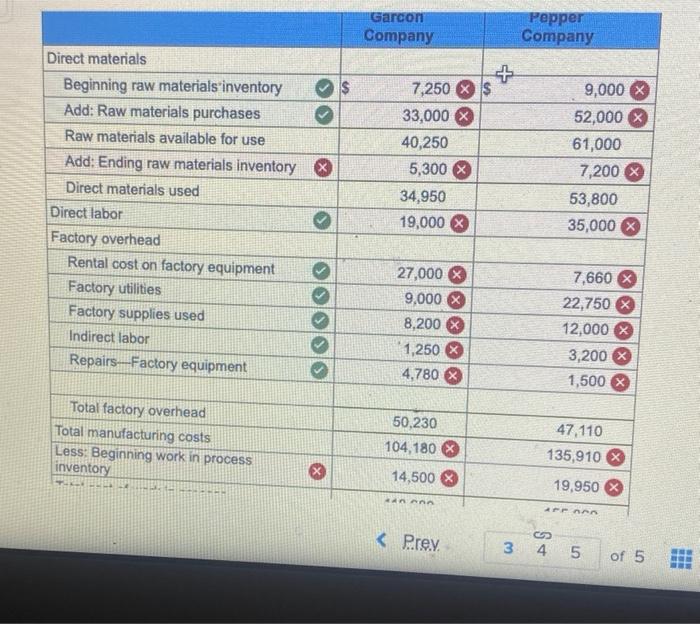

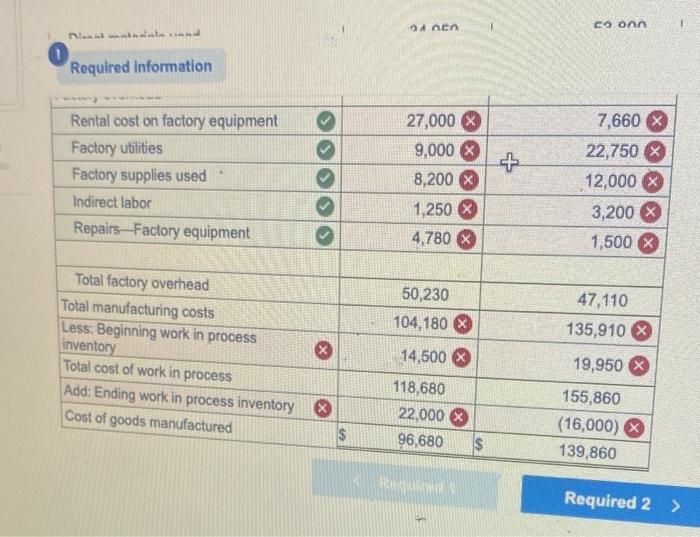

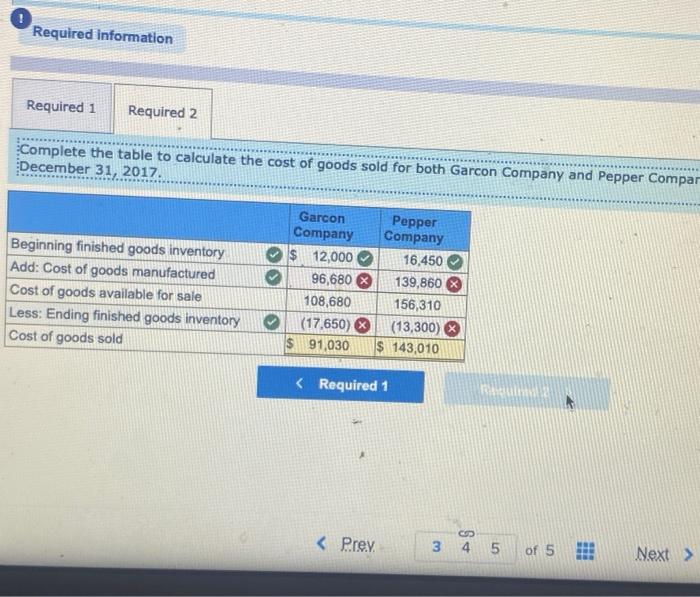

3 Required information The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company. 71 of 3 its Garcon Company Beginning finished goods inventory $ 12,000 Beginning work in process inventory 15,700 Beginning raw materials inventory 8,800 Rental cost on factory equipment S29,500 Direct labor 21,400 Ending finished goods inventory 17.300 Ending work in process inventory 26,200 Ending raw materials inventory 6,200 Factory utilities 11,950 Factory supples used 13,300 General and administrative expenses 33,000 Indirect labor 1,900 Repairs-Factory equipment 6,380 Raw materials purchases 36,000 Selling expenses 58.400 Sales 246.030 Cash 25,000 Factory equipment, net 222.500 Accounts receivable, net 16,600 Pepper Company $ 16,450 21,150 11,250 22,300 36,200 14,700 18,800 7.600 15,250 15.500 43,000 9,880 3,500 54,000 52,600 330.010 20,700 142,825 22,450 w 1 inn ezto medication.com/et/mandes Mini con contextemal browser Olunchurl=http%253A%252F%252Fmtmeducation.com%252Fmight hapter 14 Exercises Help Check my work mode : This shows what is correct or Incorrect for the work you have completed so far. It does not indicate con 3 Required: 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2017 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended Parts December 31, 2017 Answer is complete but not entirely correct Complete this question by entering your answers in the tabs below. Required Required 2 Complete the table to find the cost of goods manufactured for both Garcon Company and pepper Company for the year ended December 31, 2017 Oarent Company Peppe Company Detect mattis Beginning my Atau purchase How manis able for At Endementy 7.50 S 33.000 10.250 53000 3.000 52.000 61.000 72000 ME Graw 11 96 2 s 0> IN . 8 E R T Y U S D F G H K X C B N M and Commond Garconi Company Pepper Company Direct materials Beginning raw materials inventory Add: Raw materials purchases Raw materials available for use Add: Ending raw materials inventory & Direct materials used Direct labor Factory overhead Rental cost on factory equipment Factory utilities Factory supplies used Indirect labor Repairs-Factory equipment 7,250 X $ 33,000 40,250 5,300 34,950 19,000 9,000 X 52,000 X 61,000 7,200 X 53,800 35,000 X 27,000 X 9,000 X 8,200 X *1,250 4,780 7,660 X 22,750 X 12,000 X 3,200 X 1,500 Total factory overhead Total manufacturing costs Less: Beginning work in process inventory 50,230 104,180 14,500 47,110 135,910 X 4 19,950 ARARA 0 Required information Required 1 Required 2 Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Compar December 31, 2017. Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold Garcon Pepper Company Company S 12,000 16,450 96,680 X 139,860 108,680 156,310 (17,650) (13,300) $ 91,030 $ 143,010