Answered step by step

Verified Expert Solution

Question

1 Approved Answer

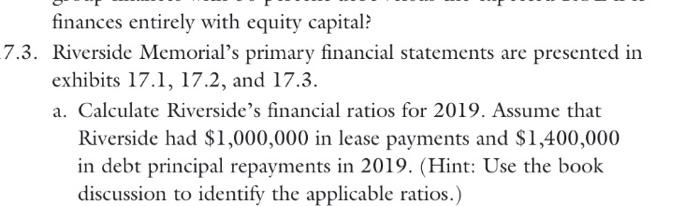

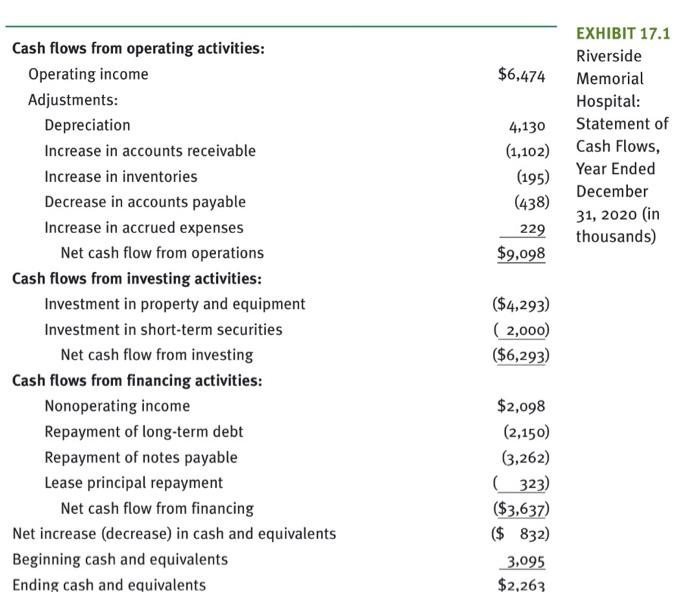

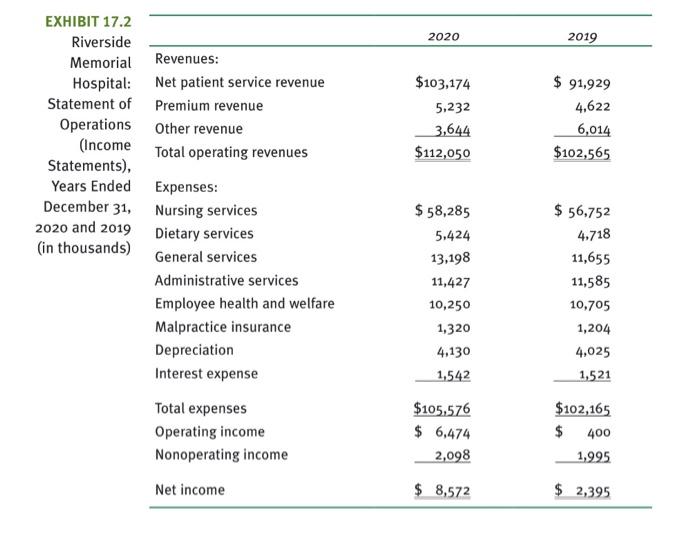

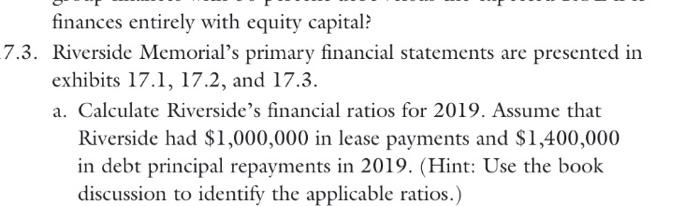

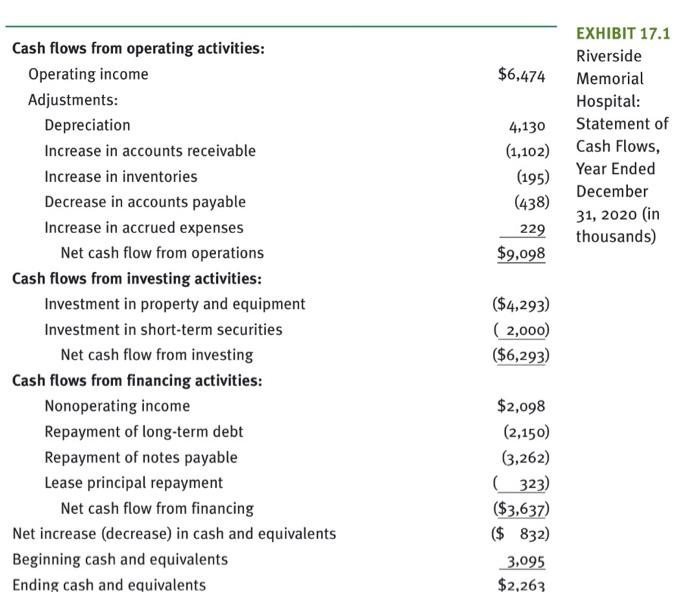

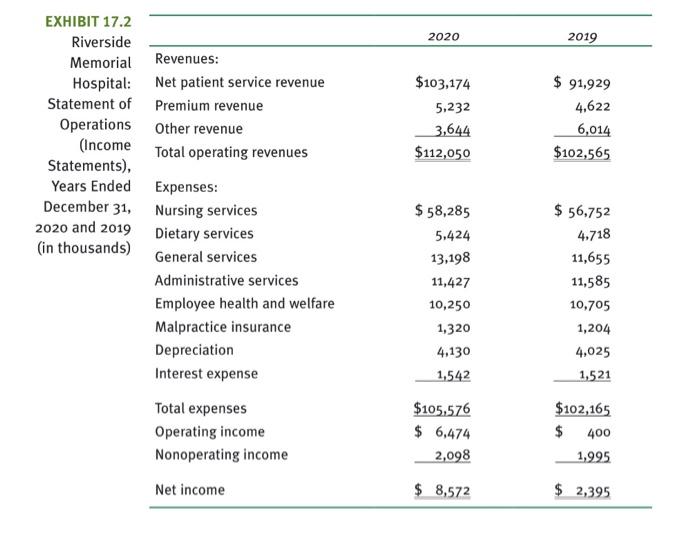

.3. Riverside Memorial's primary financial statements are presented in exhibits 17.1,17.2, and 17.3. a. Calculate Riverside's financial ratios for 2019 . Assume that Riverside had

.3. Riverside Memorial's primary financial statements are presented in exhibits 17.1,17.2, and 17.3. a. Calculate Riverside's financial ratios for 2019 . Assume that Riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2019. (Hint: Use the book discussion to identify the applicable ratios.) Cash flows from operating activities: EXHIBIT 17.1 Cash flows from investing activities: Investment in property and equipment ($4,293) Investment in short-term securities (2,000) Net cash flow from investing ($6,293) Cash flows from financing activities: \begin{tabular}{lr} Nonoperating income & $2,098 \\ Repayment of long-term debt & (2,150) \\ Repayment of notes payable & (3,262) \\ Lease principal repayment & (323) \\ Net cash flow from financing & ($3,637) \\ increase (decrease) in cash and equivalents & ($832) \\ inning cash and equivalents & 3,095 \\ \hline ing cash and equivalents & $2,263 \end{tabular} EXHIBIT 17.2 EXHIBIT 17.3

.3. Riverside Memorial's primary financial statements are presented in exhibits 17.1,17.2, and 17.3. a. Calculate Riverside's financial ratios for 2019 . Assume that Riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2019. (Hint: Use the book discussion to identify the applicable ratios.) Cash flows from operating activities: EXHIBIT 17.1 Cash flows from investing activities: Investment in property and equipment ($4,293) Investment in short-term securities (2,000) Net cash flow from investing ($6,293) Cash flows from financing activities: \begin{tabular}{lr} Nonoperating income & $2,098 \\ Repayment of long-term debt & (2,150) \\ Repayment of notes payable & (3,262) \\ Lease principal repayment & (323) \\ Net cash flow from financing & ($3,637) \\ increase (decrease) in cash and equivalents & ($832) \\ inning cash and equivalents & 3,095 \\ \hline ing cash and equivalents & $2,263 \end{tabular} EXHIBIT 17.2 EXHIBIT 17.3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started