Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 Shao Khan has expressed interest in investing his resources in corporate bonds which are taxable and yield 5%. His most trusted advisor Shang Tsung

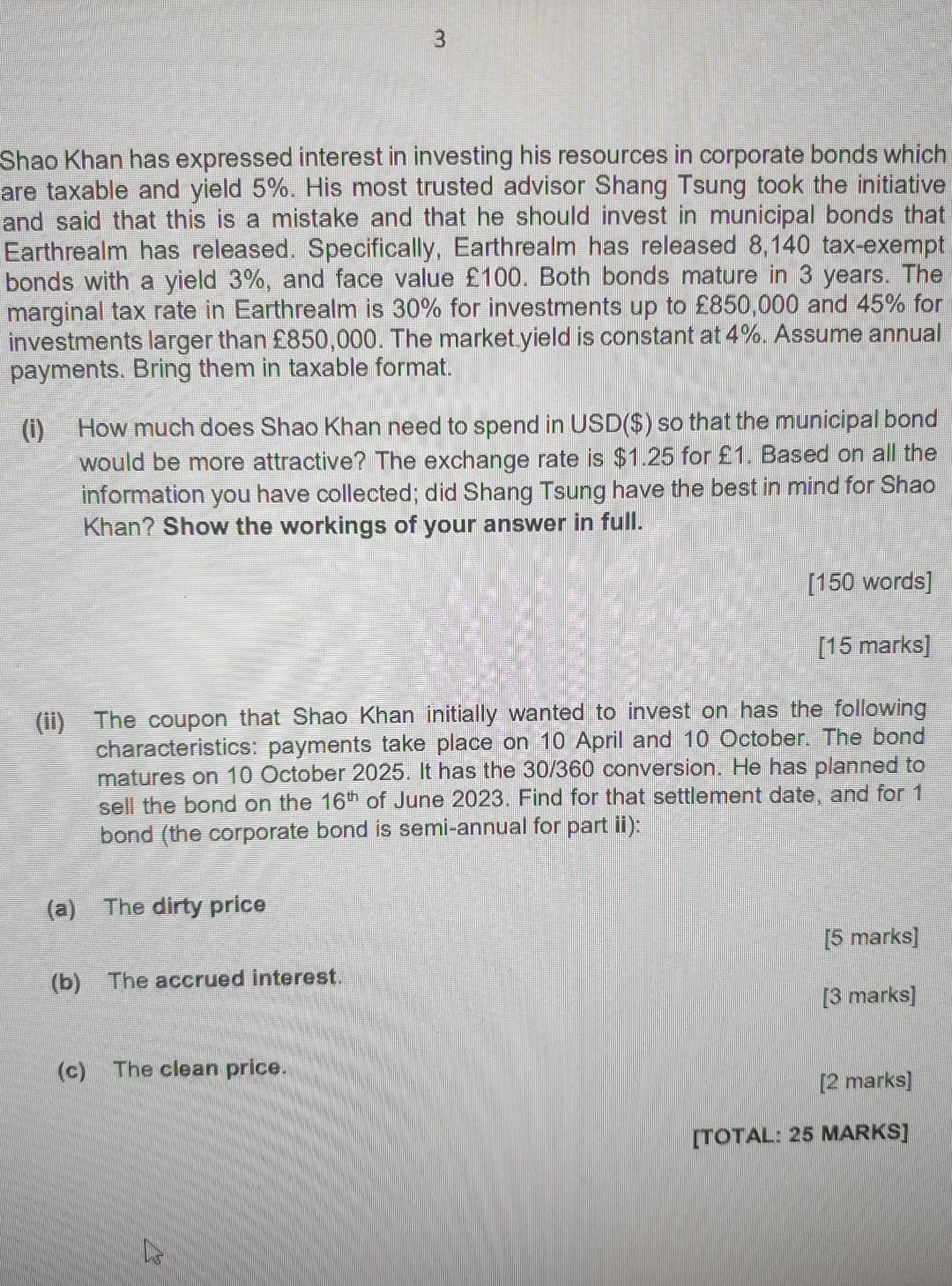

3 Shao Khan has expressed interest in investing his resources in corporate bonds which are taxable and yield 5%. His most trusted advisor Shang Tsung took the initiative and said that this is a mistake and that he should invest in municipal bonds that Earthrealm has released. Specifically, Earthrealm has released 8,140 tax-exempt bonds with a yield 3%, and face value 100. Both bonds mature in 3 years. The marginal tax rate in Earthrealm is 30% for investments up to 850,000 and 45% for investments larger than 850,000. The market.yield is constant at 4%. Assume annual payments. Bring them in taxable format. (i) How much does Shao Khan need to spend in USD($) so that the municipal bond would be more attractive? The exchange rate is $1.25 for 1. Based on all the information you have collected; did Shang Tsung have the best in mind for Shao Khan? Show the workings of your answer in full. [150 words] [15 marks] (ii) The coupon that Shao Khan initially wanted to invest on has the following characteristics: payments take place on 10 April and 10 October. The bond matures on 10 October 2025. It has the 30/360 conversion. He has planned to sell the bond on the 16th of June 2023. Find for that settlement date, and for 1 bond (the corporate bond is semi-annual for part ii): (a) The dirty price [5 marks] (b) The accrued interest. [3 marks] (c) The clean price. [2 marks] [TOTAL: 25 MARKS] 3 Shao Khan has expressed interest in investing his resources in corporate bonds which are taxable and yield 5%. His most trusted advisor Shang Tsung took the initiative and said that this is a mistake and that he should invest in municipal bonds that Earthrealm has released. Specifically, Earthrealm has released 8,140 tax-exempt bonds with a yield 3%, and face value 100. Both bonds mature in 3 years. The marginal tax rate in Earthrealm is 30% for investments up to 850,000 and 45% for investments larger than 850,000. The market.yield is constant at 4%. Assume annual payments. Bring them in taxable format. (i) How much does Shao Khan need to spend in USD($) so that the municipal bond would be more attractive? The exchange rate is $1.25 for 1. Based on all the information you have collected; did Shang Tsung have the best in mind for Shao Khan? Show the workings of your answer in full. [150 words] [15 marks] (ii) The coupon that Shao Khan initially wanted to invest on has the following characteristics: payments take place on 10 April and 10 October. The bond matures on 10 October 2025. It has the 30/360 conversion. He has planned to sell the bond on the 16th of June 2023. Find for that settlement date, and for 1 bond (the corporate bond is semi-annual for part ii): (a) The dirty price [5 marks] (b) The accrued interest. [3 marks] (c) The clean price. [2 marks] [TOTAL: 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started