Answered step by step

Verified Expert Solution

Question

1 Approved Answer

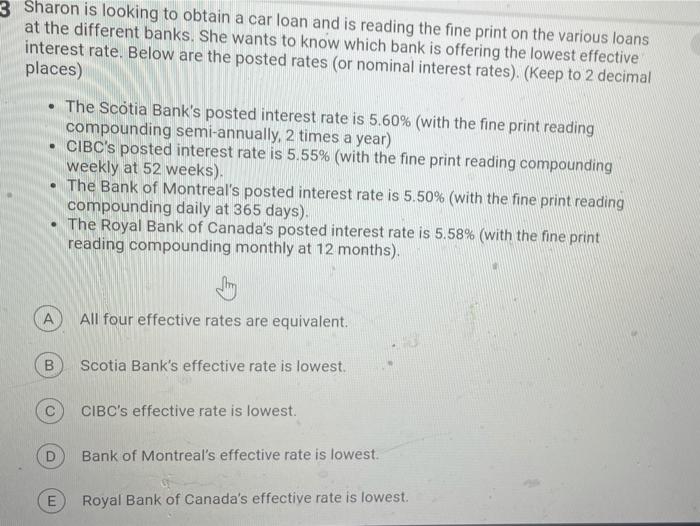

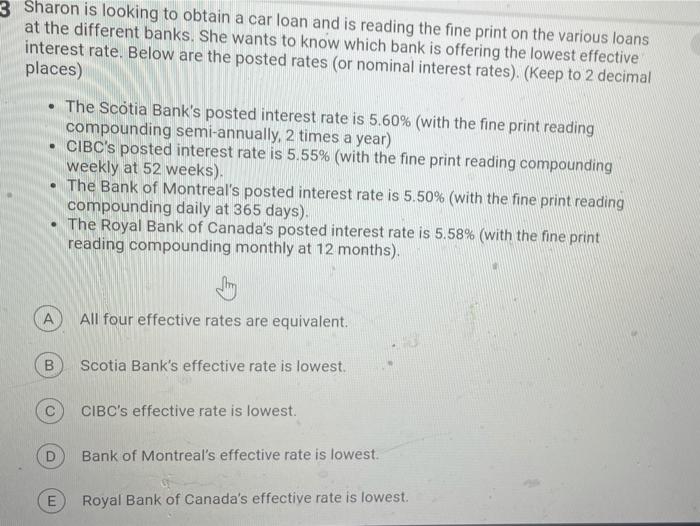

3 Sharon is looking to obtain a car loan and is reading the fine print on the various loans at the different banks. She wants

3 Sharon is looking to obtain a car loan and is reading the fine print on the various loans at the different banks. She wants to know which bank is offering the lowest effective interest rate. Below are the posted rates (or nominal interest rates) (Keep to 2 decimal places) The Scotia Bank's posted interest rate is 5.60% (with the fine print reading compounding semi-annually, 2 times a year) CIBC's posted interest rate is 5.55% (with the fine print reading compounding weekly at 52 weeks). The Bank of Montreal's posted interest rate is 5.50% (with the fine print reading compounding daily at 365 days). The Royal Bank of Canada's posted interest rate is 5.58% (with the fine print reading compounding monthly at 12 months). A All four effective rates are equivalent. Scotia Bank's effective rate is lowest. CIBC's effective rate is lowest. Bank of Montreal's effective rate is lowest E Royal Bank of Canada's effective rate is lowest

3 Sharon is looking to obtain a car loan and is reading the fine print on the various loans at the different banks. She wants to know which bank is offering the lowest effective interest rate. Below are the posted rates (or nominal interest rates) (Keep to 2 decimal places) The Scotia Bank's posted interest rate is 5.60% (with the fine print reading compounding semi-annually, 2 times a year) CIBC's posted interest rate is 5.55% (with the fine print reading compounding weekly at 52 weeks). The Bank of Montreal's posted interest rate is 5.50% (with the fine print reading compounding daily at 365 days). The Royal Bank of Canada's posted interest rate is 5.58% (with the fine print reading compounding monthly at 12 months). A All four effective rates are equivalent. Scotia Bank's effective rate is lowest. CIBC's effective rate is lowest. Bank of Montreal's effective rate is lowest E Royal Bank of Canada's effective rate is lowest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started