Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Shortly after the latest financial meltdown (eg., the global financial crisis (GFC), COVID pandemic, etc.), the share price of the common stock (10

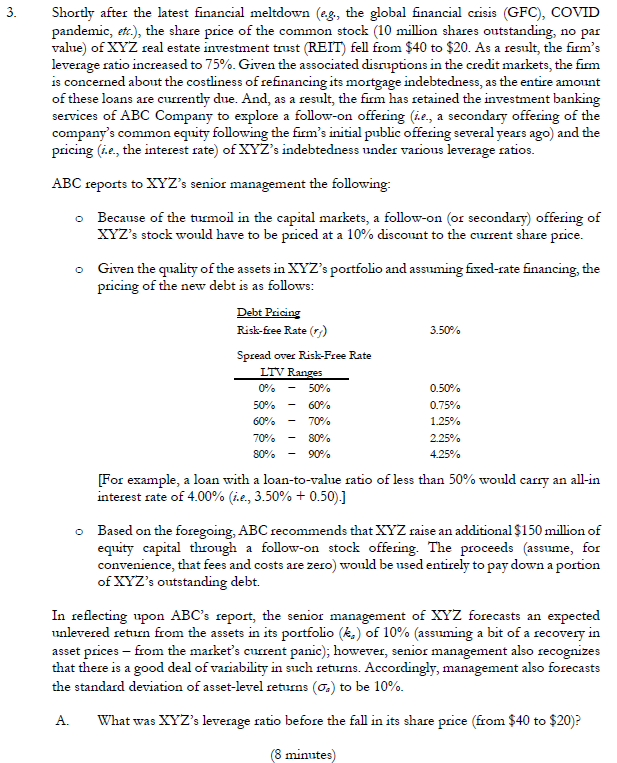

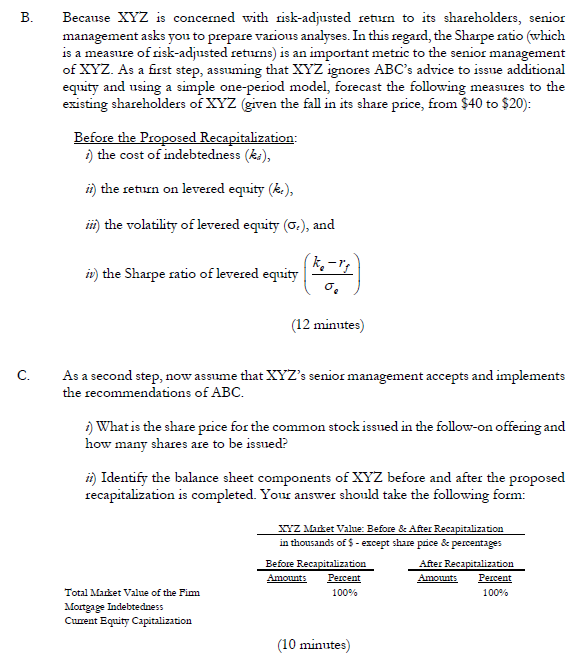

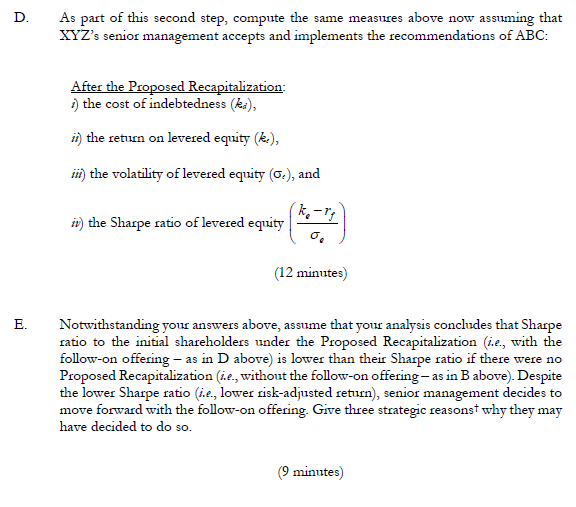

3. Shortly after the latest financial meltdown (eg., the global financial crisis (GFC), COVID pandemic, etc.), the share price of the common stock (10 million shares outstanding, no par value) of XYZ real estate investment trust (REIT) fell from $40 to $20. As a result, the firm's leverage ratio increased to 75%. Given the associated disruptions in the credit markets, the firm is concerned about the costliness of refinancing its mortgage indebtedness, as the entire amount of these loans are currently due. And, as a result, the firm has retained the investment banking services of ABC Company to explore a follow-on offering (ie., a secondary offering of the company's common equity following the firm's initial public offering several years ago) and the pricing (z.e., the interest rate) of XYZ's indebtedness under various leverage ratios. ABC reports to XYZ's senior management the following: Because of the turmoil in the capital markets, a follow-on (or secondary) offering of XYZ's stock would have to be priced at a 10% discount to the current share price. Given the quality of the assets in XYZ's portfolio and assuming fixed-rate financing, the pricing of the new debt is as follows: Debt Pricing Risk-free Rate (r) Spread over Risk-Free Rate LTV Ranges 0% 50% 50% - 60% 60% - 70% 70% - 80% 80% - 90% 3.50% 0.50% 0.75% 1.25% 2.25% 4.25% [For example, a loan with a loan-to-value ratio of less than 50% would carry an all-in interest rate of 4.00% (i.e., 3.50% +0.50).] Based on the foregoing, ABC recommends that XYZ raise an additional $150 million of equity capital through a follow-on stock offering. The proceeds (assume, for convenience, that fees and costs are zero) would be used entirely to pay down a portion of XYZ's outstanding debt. In reflecting upon ABC's report, the senior management of XYZ forecasts an expected unlevered return from the assets in its portfolio (k,) of 10% (assuming a bit of a recovery in asset prices - from the market's current panic); however, senior management also recognizes that there is a good deal of variability in such returns. Accordingly, management also forecasts the standard deviation of asset-level returns () to be 10%. A. What was XYZ's leverage ratio before the fall in its share price (from $40 to $20)? (8 minutes) B. Because XYZ is concerned with risk-adjusted return to its shareholders, senior management asks you to prepare various analyses. In this regard, the Sharpe ratio (which is a measure of risk-adjusted returns) is an important metric to the senior management of XYZ. As a first step, assuming that XYZ ignores ABC's advice to issue additional equity and using a simple one-period model, forecast the following measures to the existing shareholders of XYZ (given the fall in its share price, from $40 to $20): Before the Proposed Recapitalization: 2) the cost of indebtedness (ka), ii) the return on levered equity (k), iii) the volatility of levered equity (.), and iv) the Sharpe ratio of levered equity (12 minutes) C. As a second step, now assume that XYZ's senior management accepts and implements the recommendations of ABC. 1) What is the share price for the common stock issued in the follow-on offering and how many shares are to be issued? ii) Identify the balance sheet components of XYZ before and after the proposed recapitalization is completed. Your answer should take the following form: Total Market Value of the Firm Mortgage Indebtedness Current Equity Capitalization XYZ Market Value: Before & After Recapitalization in thousands of $ - except share price & percentages Before Recapitalization Amounts Percent 100% After Recapitalization Amounts Percent 100% (10 minutes) D. E. As part of this second step, compute the same measures above now assuming that XYZ's senior management accepts and implements the recommendations of ABC: After the Proposed Recapitalization: 1) the cost of indebtedness (ka), ii) the return on levered equity (k), iii) the volatility of levered equity (.), and i) the Sharpe ratio of levered equity k-r (12 minutes) Notwithstanding your answers above, assume that your analysis concludes that Sharpe ratio to the initial shareholders under the Proposed Recapitalization (ie., with the follow-on offering - as in D above) is lower than their Sharpe ratio if there were no Proposed Recapitalization (ie., without the follow-on offering - as in B above). Despite the lower Sharpe ratio (ie., lower risk-adjusted return), senior management decides to move forward with the follow-on offering. Give three strategic reasonst why they may have decided to do so. (9 minutes)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started