Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Silver prices have a year-over-year inflationary rate increase of 14.6 percent. A company purchased $823,683 of silver during the year just ended right

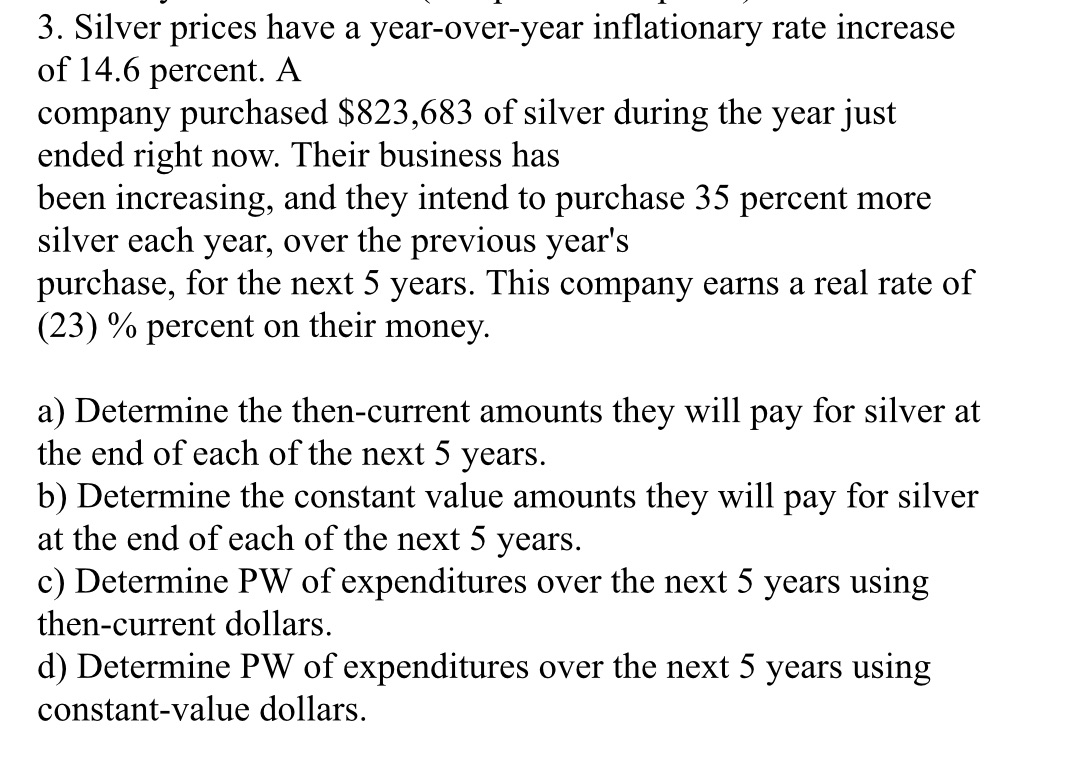

3. Silver prices have a year-over-year inflationary rate increase of 14.6 percent. A company purchased $823,683 of silver during the year just ended right now. Their business has been increasing, and they intend to purchase 35 percent more silver each year, over the previous year's purchase, for the next 5 years. This company earns a real rate of (23) % percent on their money. a) Determine the then-current amounts they will pay for silver at the end of each of the next 5 years. b) Determine the constant value amounts they will pay for silver at the end of each of the next 5 years. c) Determine PW of expenditures over the next 5 years using then-current dollars. d) Determine PW of expenditures over the next 5 years using constant-value dollars.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Determine the thencurrent amounts they will pay for silver at the end of each of the next 5 years We are given the following information Initial pur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started