Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 - Statement Modeling Qualified Assessment Support ( Blank ) . xlsx 0 . 0 5 Mb Forecasting Revenues down to EBITDA EBIT and EBITDA

Statement Modeling Qualified Assessment Support Blankxlsx

Mb

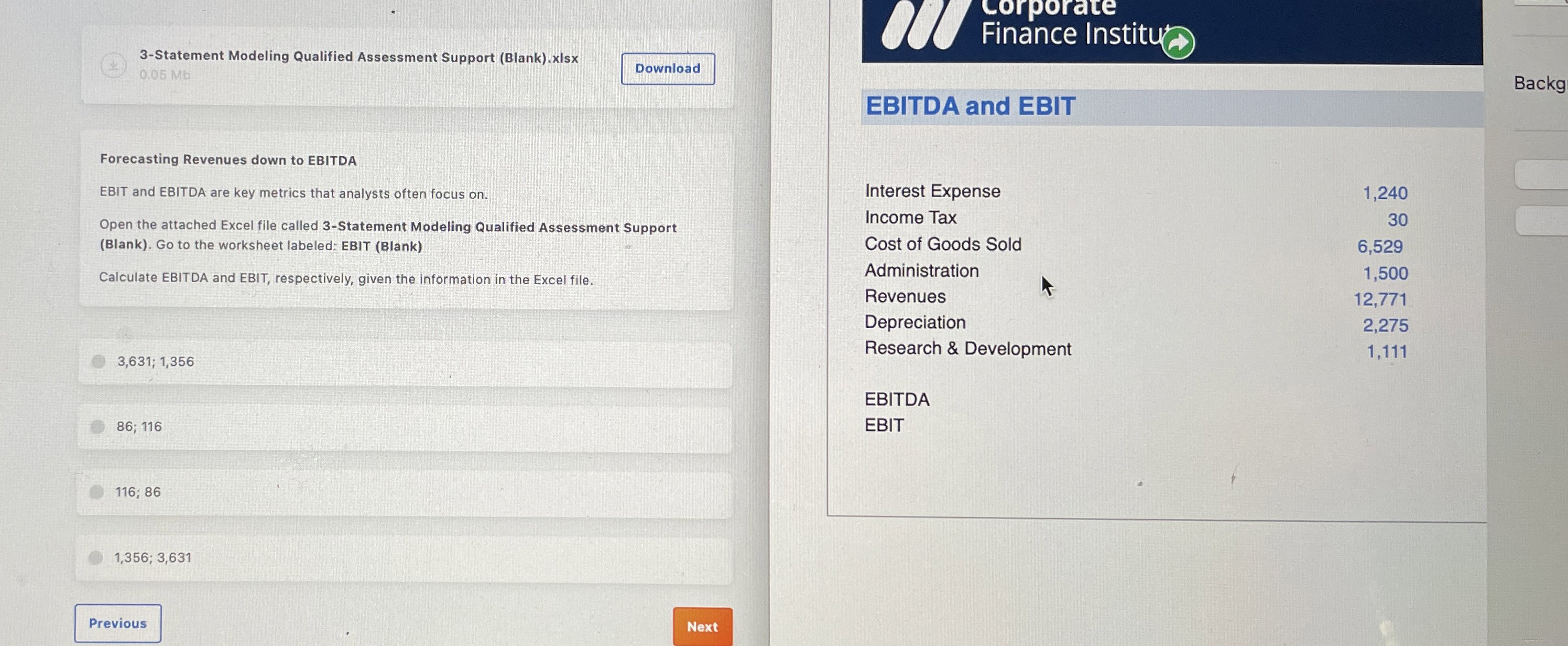

Forecasting Revenues down to EBITDA

EBIT and EBITDA are key metrics that analysts often focus on

Open the attached Excel file called Statement Modeling Qualified Assessment Support Blank Go to the worksheet labeled: EBIT Blank

Calculate EBITDA and EBIT, respectively, given the information in the Excel file.

;

;

;

;

Finance Instity

EBITDA and EBIT

tableInterest Expense,Income Tax,Cost of Goods Sold,AdministrationRevenuesDepreciationResearch & Development,

EBITDA

EBIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started