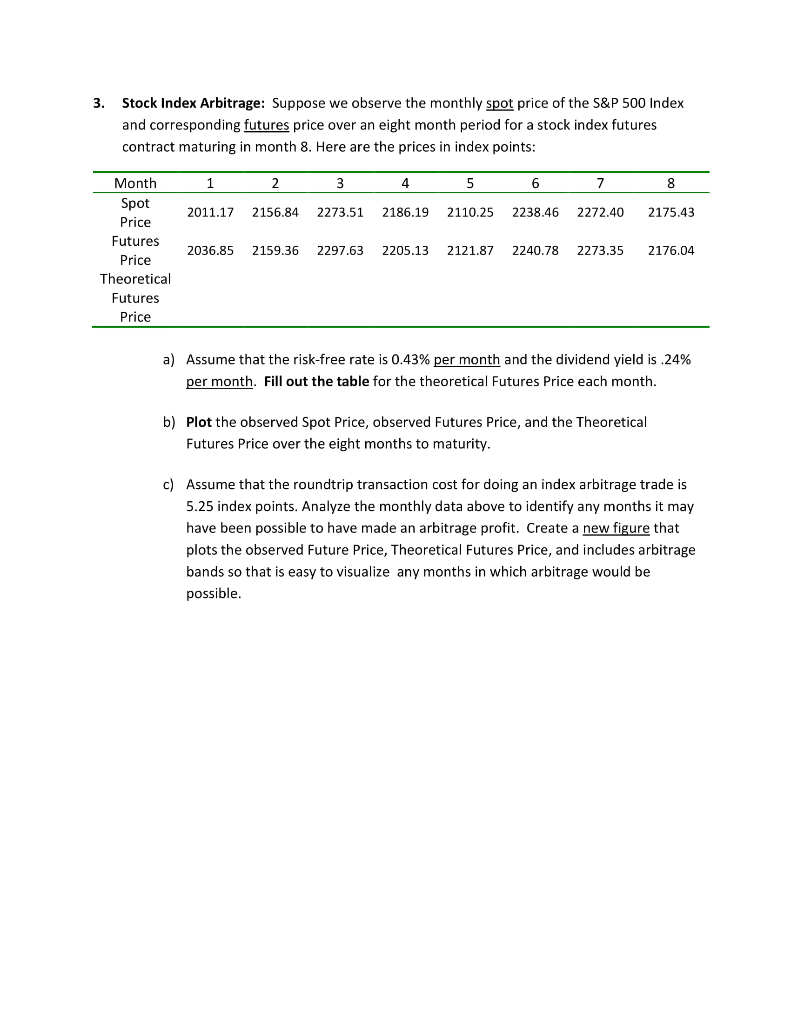

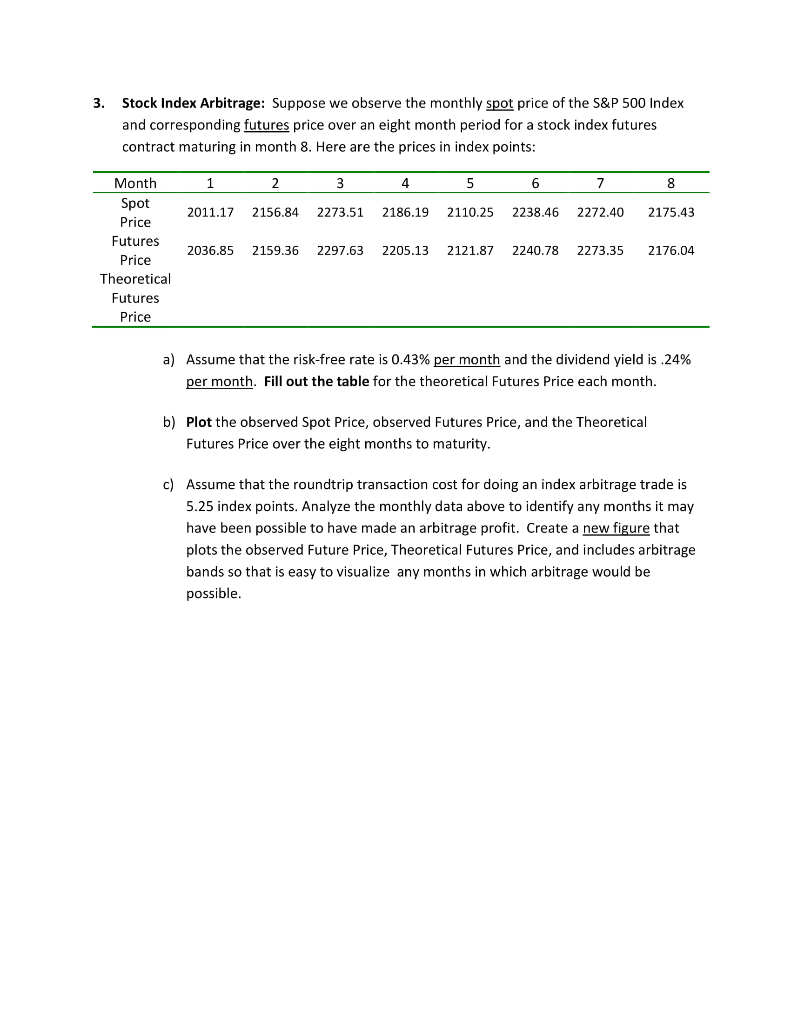

3. Stock Index Arbitrage: Suppose we observe the monthly spot price of the S&P 500 Index and corresponding futures price over an eight month period for a stock index futures contract maturing in month 8. Here are the prices in index points Month Spot Price 4 6 7 2011.17 2156.84 2273.51 2186.19 2110.25 2238.46 2272.40 2175.43 2036.85 2159.36 2297.63 2205.13 2121.87 2240.78 2273.35 2176.04 Price Theoretical Futures Price a) Assume that the risk-free rate is 0.43% per month and the dividend yield is .24% per month. Fill out the table for the theoretical Futures Price each month b) Plot the observed Spot Price, observed Futures Price, and the Theoretical Futures Price over the eight months to maturity c) Assume that the roundtrip transaction cost for doing an index arbitrage trade is 5.25 index points. Analyze the monthly data above to identify any months it may have been possible to have made an arbitrage profit. Create a new figure that plots the observed Future Price, Theoretical Futures Price, and includes arbitrage bands so that is easy to visualize any months in which arbitrage would be possible 3. Stock Index Arbitrage: Suppose we observe the monthly spot price of the S&P 500 Index and corresponding futures price over an eight month period for a stock index futures contract maturing in month 8. Here are the prices in index points Month Spot Price 4 6 7 2011.17 2156.84 2273.51 2186.19 2110.25 2238.46 2272.40 2175.43 2036.85 2159.36 2297.63 2205.13 2121.87 2240.78 2273.35 2176.04 Price Theoretical Futures Price a) Assume that the risk-free rate is 0.43% per month and the dividend yield is .24% per month. Fill out the table for the theoretical Futures Price each month b) Plot the observed Spot Price, observed Futures Price, and the Theoretical Futures Price over the eight months to maturity c) Assume that the roundtrip transaction cost for doing an index arbitrage trade is 5.25 index points. Analyze the monthly data above to identify any months it may have been possible to have made an arbitrage profit. Create a new figure that plots the observed Future Price, Theoretical Futures Price, and includes arbitrage bands so that is easy to visualize any months in which arbitrage would be possible