Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Stock prices and stand-alone risk Risk is the potential for an investment to generate more than one return. A security that will produce only

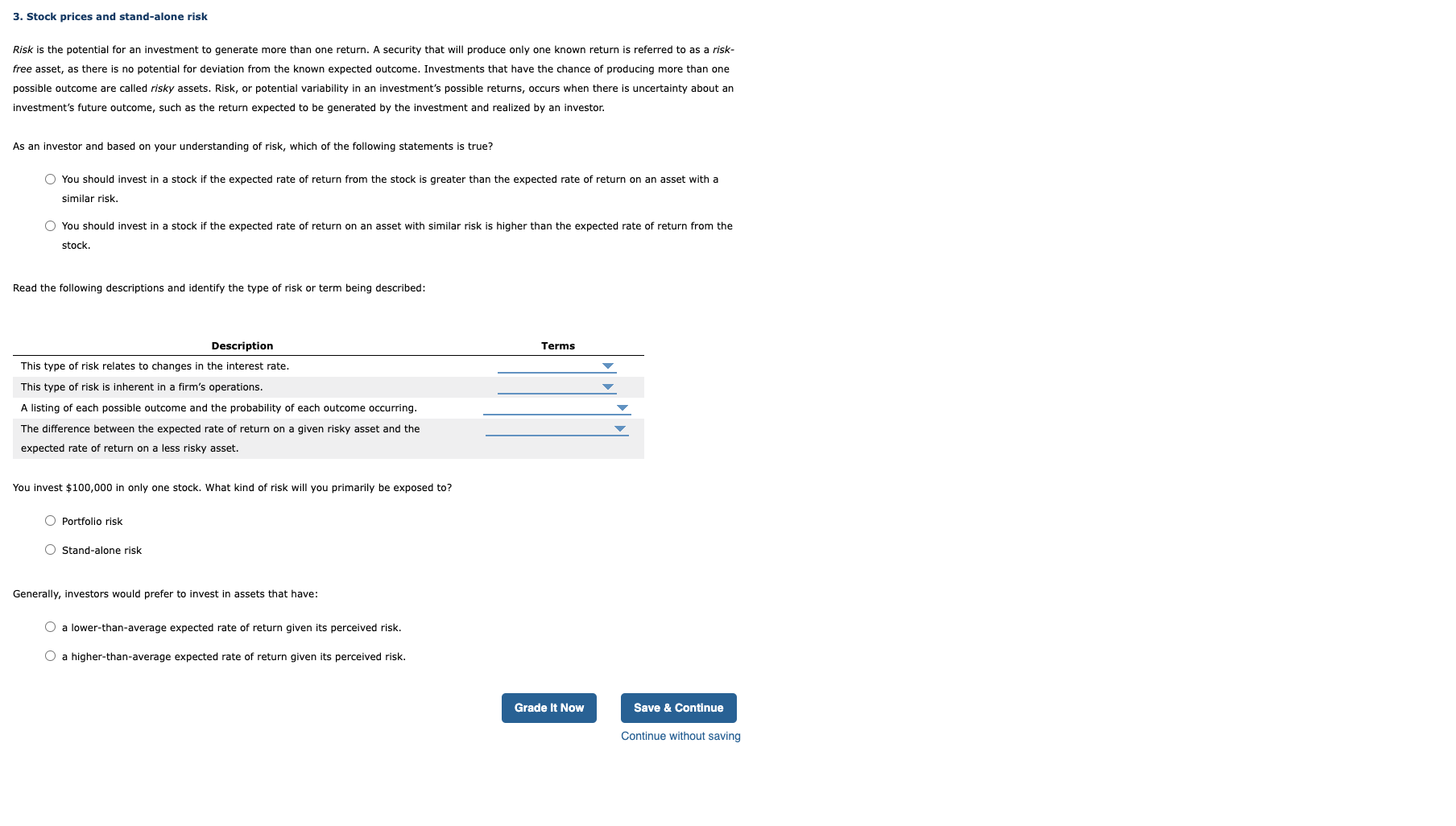

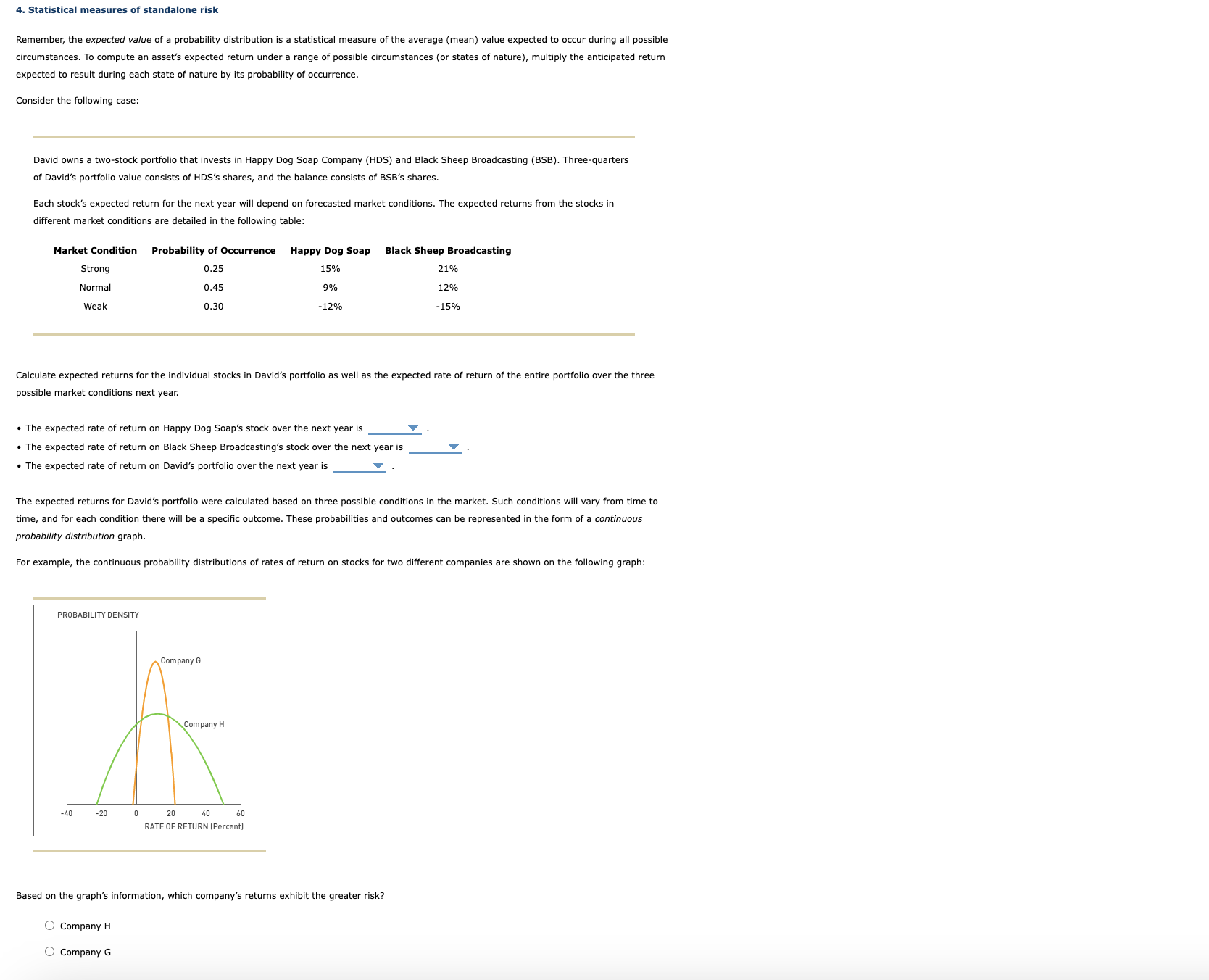

3. Stock prices and stand-alone risk Risk is the potential for an investment to generate more than one return. A security that will produce only one known return is referred to as a riskfree asset, as there is no potential for deviation from the known expected outcome. Investments that have the chance of producing more than one possible outcome are called risky assets. Risk, or potential variability in an investment's possible returns, occurs when there is uncertainty about an investment's future outcome, such as the return expected to be generated by the investment and realized by an investor. As an investor and based on your understanding of risk, which of the following statements is true? You should invest in a stock if the expected rate of return from the stock is greater than the expected rate of return on an asset with a similar risk. You should invest in a stock if the expected rate of return on an asset with similar risk is higher than the expected rate of return from the stock. Read the following descriptions and identify the type of risk or term being described: You invest $100,000 in only one stock. What kind of risk will you primarily be exposed to? Portfolio risk Stand-alone risk Generally, investors would prefer to invest in assets that have: a lower-than-average expected rate of return given its perceived risk. a higher-than-average expected rate of return given its perceived risk. 4. Statistical measures of standalone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: David owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters of David's portfolio value consists of HDS's shares, and the balance consists of BSB's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Calculate expected returns for the individual stocks in David's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. - The expected rate of return on Happy Dog Soap's stock over the next year is - The expected rate of return on Black Sheep Broadcasting's stock over the next year is - The expected rate of return on David's portfolio over the next year is The expected returns for David's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph. For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph: Based on the graph's information, which company's returns exhibit the greater risk? Company H Company G

3. Stock prices and stand-alone risk Risk is the potential for an investment to generate more than one return. A security that will produce only one known return is referred to as a riskfree asset, as there is no potential for deviation from the known expected outcome. Investments that have the chance of producing more than one possible outcome are called risky assets. Risk, or potential variability in an investment's possible returns, occurs when there is uncertainty about an investment's future outcome, such as the return expected to be generated by the investment and realized by an investor. As an investor and based on your understanding of risk, which of the following statements is true? You should invest in a stock if the expected rate of return from the stock is greater than the expected rate of return on an asset with a similar risk. You should invest in a stock if the expected rate of return on an asset with similar risk is higher than the expected rate of return from the stock. Read the following descriptions and identify the type of risk or term being described: You invest $100,000 in only one stock. What kind of risk will you primarily be exposed to? Portfolio risk Stand-alone risk Generally, investors would prefer to invest in assets that have: a lower-than-average expected rate of return given its perceived risk. a higher-than-average expected rate of return given its perceived risk. 4. Statistical measures of standalone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: David owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters of David's portfolio value consists of HDS's shares, and the balance consists of BSB's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Calculate expected returns for the individual stocks in David's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. - The expected rate of return on Happy Dog Soap's stock over the next year is - The expected rate of return on Black Sheep Broadcasting's stock over the next year is - The expected rate of return on David's portfolio over the next year is The expected returns for David's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph. For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph: Based on the graph's information, which company's returns exhibit the greater risk? Company H Company G Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started