Answered step by step

Verified Expert Solution

Question

1 Approved Answer

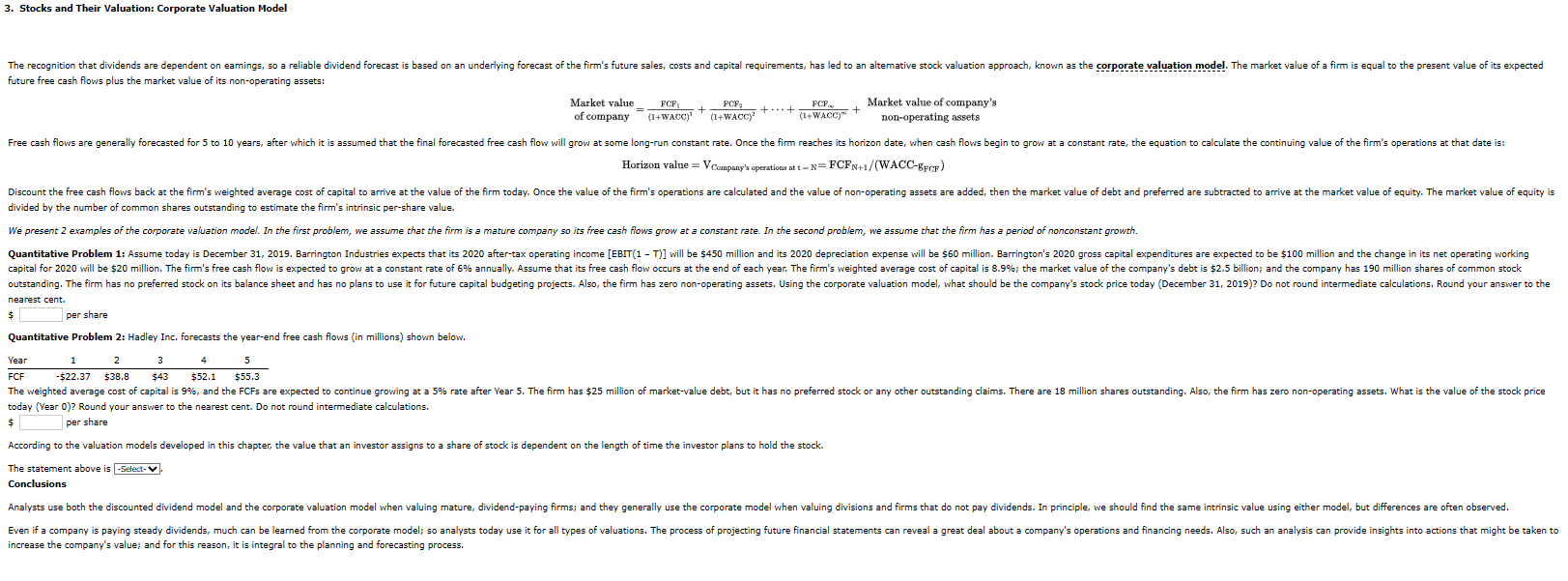

3. Stocks and Their Valuation: Corporate Valuation Model future free cash flows plus the market value of its non-operating assets: Horizon value =VCompanysoperstioesattN=FCFN+1/( WACC-g FCF)

3. Stocks and Their Valuation: Corporate Valuation Model future free cash flows plus the market value of its non-operating assets: Horizon value =VCompanysoperstioesattN=FCFN+1/( WACC-g FCF) divided by the number of common shares outstanding to estimate the firm's intrinsic per-share value. nearest cent. $ per share Quantitative Problem 2: Hadley Inc, forecasts the year-end free cash flows (in millions) shown below. \begin{tabular}{lccccc} Year & 1 & 2 & 3 & 4 & 5 \\ \hline FCF & $22.37 & $38.8 & $43 & $52.1 & $55.3 \end{tabular} today (Year 0) ? Round your answer to the nearest cent. Do not round intermediate calculations. $ per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is - Select- V. Conclusions increase the company's value; and for this reason, it is integral to the planning and forecasting process

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started