Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (Submit for grading) A venture capital company plans to invest in one of two start-up engineering firms. Investments like this are risky by

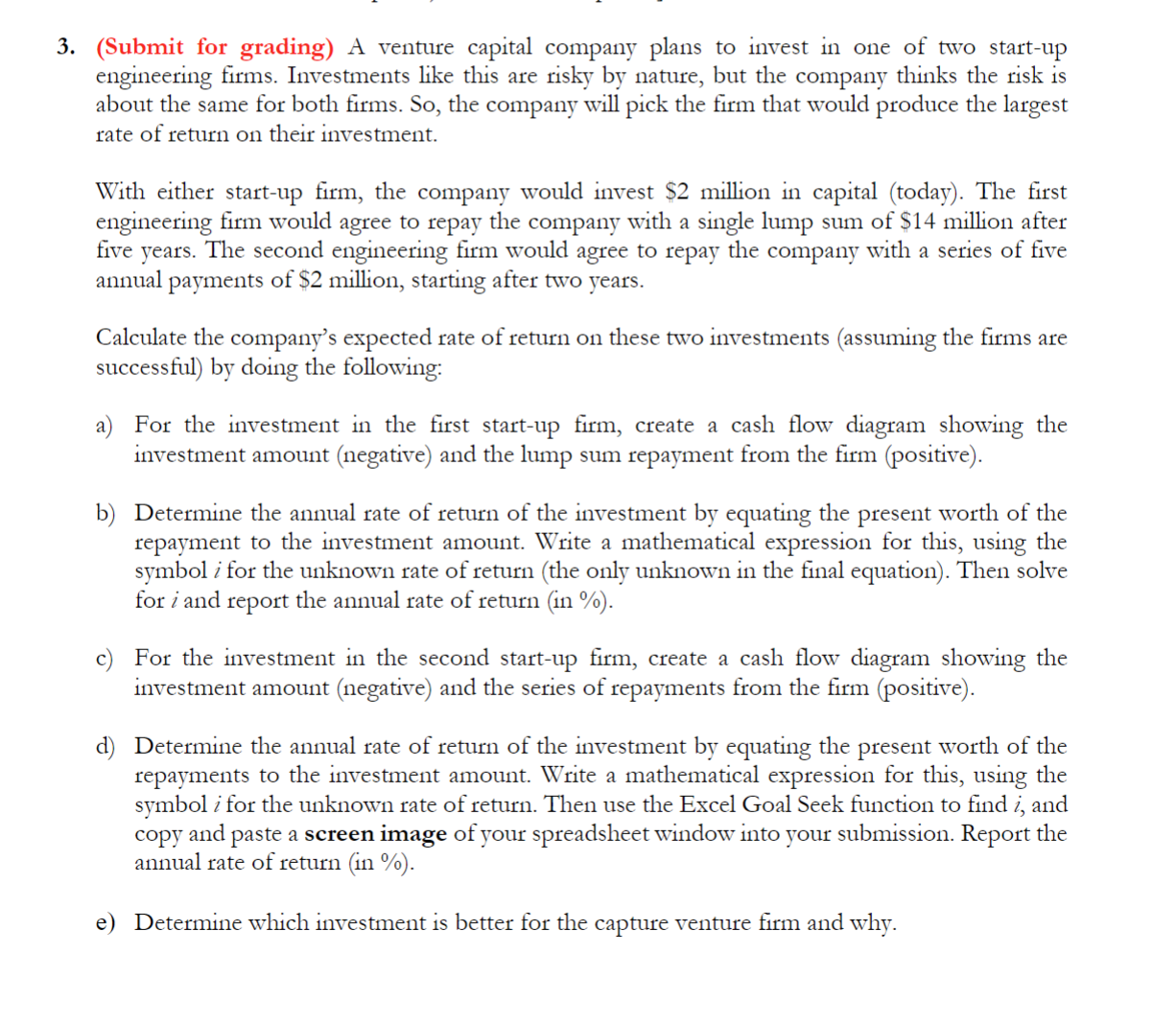

3. (Submit for grading) A venture capital company plans to invest in one of two start-up engineering firms. Investments like this are risky by nature, but the company thinks the risk is about the same for both firms. So, the company will pick the firm that would produce the largest rate of return on their investment. With either start-up firm, the company would invest $2 million in capital (today). The first engineering firm would agree to repay the company with a single lump sum of $14 million after five years. The second engineering firm would agree to repay the company with a series of five annual payments of $2 million, starting after two years. Calculate the company's expected rate of return on these two investments (assuming the firms are successful) by doing the following: a) For the investment in the first start-up firm, create a cash flow diagram showing the investment amount (negative) and the lump sum repayment from the firm (positive). b) Determine the annual rate of return of the investment by equating the present worth of the repayment to the investment amount. Write a mathematical expression for this, using the symbol i for the unknown rate of return (the only unknown in the final equation). Then solve for i and report the annual rate of return (in %). c) For the investment in the second start-up firm, create a cash flow diagram showing the investment amount (negative) and the series of repayments from the firm (positive). d) Determine the annual rate of return of the investment by equating the present worth of the repayments to the investment amount. Write a mathematical expression for this, using the symbol i for the unknown rate of return. Then use the Excel Goal Seek function to find i, and copy and paste a screen image of your spreadsheet window into your submission. Report the annual rate of return (in %). e) Determine which investment is better for the capture venture firm and why.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

d Annual Rate of Return Using the same principle as before we need to find the discount rate that makes the present value of all future repayments equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started