Answered step by step

Verified Expert Solution

Question

1 Approved Answer

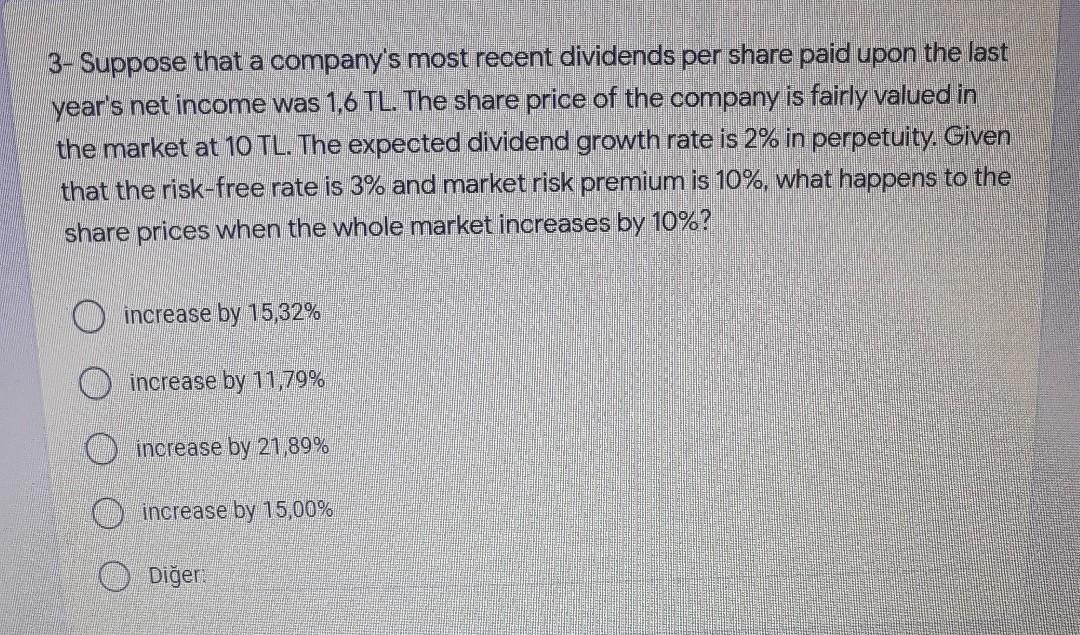

3- Suppose that a company's most recent dividends per share paid upon the last year's net income was 1,6 TL. The share price of the

3- Suppose that a company's most recent dividends per share paid upon the last year's net income was 1,6 TL. The share price of the company is fairly valued in the market at 10 TL. The expected dividend growth rate is 2% in perpetuity. Given that the risk-free rate is 3% and market risk premium is 10%, what happens to the share prices when the whole market increases by 10%? increase by 15,32% o increase by 11,79% increase by 21,89% increase by 15,00% O Dier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started