Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose that the US market and the Japanese market are segmented, but the CAPM holds within each market. A US company (ZYX) wishes to

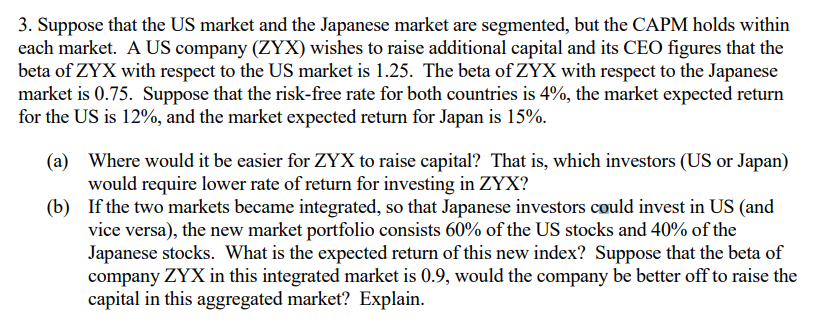

3. Suppose that the US market and the Japanese market are segmented, but the CAPM holds within each market. A US company (ZYX) wishes to raise additional capital and its CEO figures that the beta of ZYX with respect to the US market is 1.25 . The beta of ZYX with respect to the Japanese market is 0.75 . Suppose that the risk-free rate for both countries is 4%, the market expected return for the US is 12%, and the market expected return for Japan is 15%. (a) Where would it be easier for ZYX to raise capital? That is, which investors (US or Japan) would require lower rate of return for investing in ZYX? (b) If the two markets became integrated, so that Japanese investors could invest in US (and vice versa), the new market portfolio consists 60% of the US stocks and 40% of the Japanese stocks. What is the expected return of this new index? Suppose that the beta of company ZYX in this integrated market is 0.9 , would the company be better off to raise the capital in this aggregated market? Explain

3. Suppose that the US market and the Japanese market are segmented, but the CAPM holds within each market. A US company (ZYX) wishes to raise additional capital and its CEO figures that the beta of ZYX with respect to the US market is 1.25 . The beta of ZYX with respect to the Japanese market is 0.75 . Suppose that the risk-free rate for both countries is 4%, the market expected return for the US is 12%, and the market expected return for Japan is 15%. (a) Where would it be easier for ZYX to raise capital? That is, which investors (US or Japan) would require lower rate of return for investing in ZYX? (b) If the two markets became integrated, so that Japanese investors could invest in US (and vice versa), the new market portfolio consists 60% of the US stocks and 40% of the Japanese stocks. What is the expected return of this new index? Suppose that the beta of company ZYX in this integrated market is 0.9 , would the company be better off to raise the capital in this aggregated market? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started