Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose that there is one riskless asset and one risky asset. The return on the risky asset is specified as follows: 0% with probability

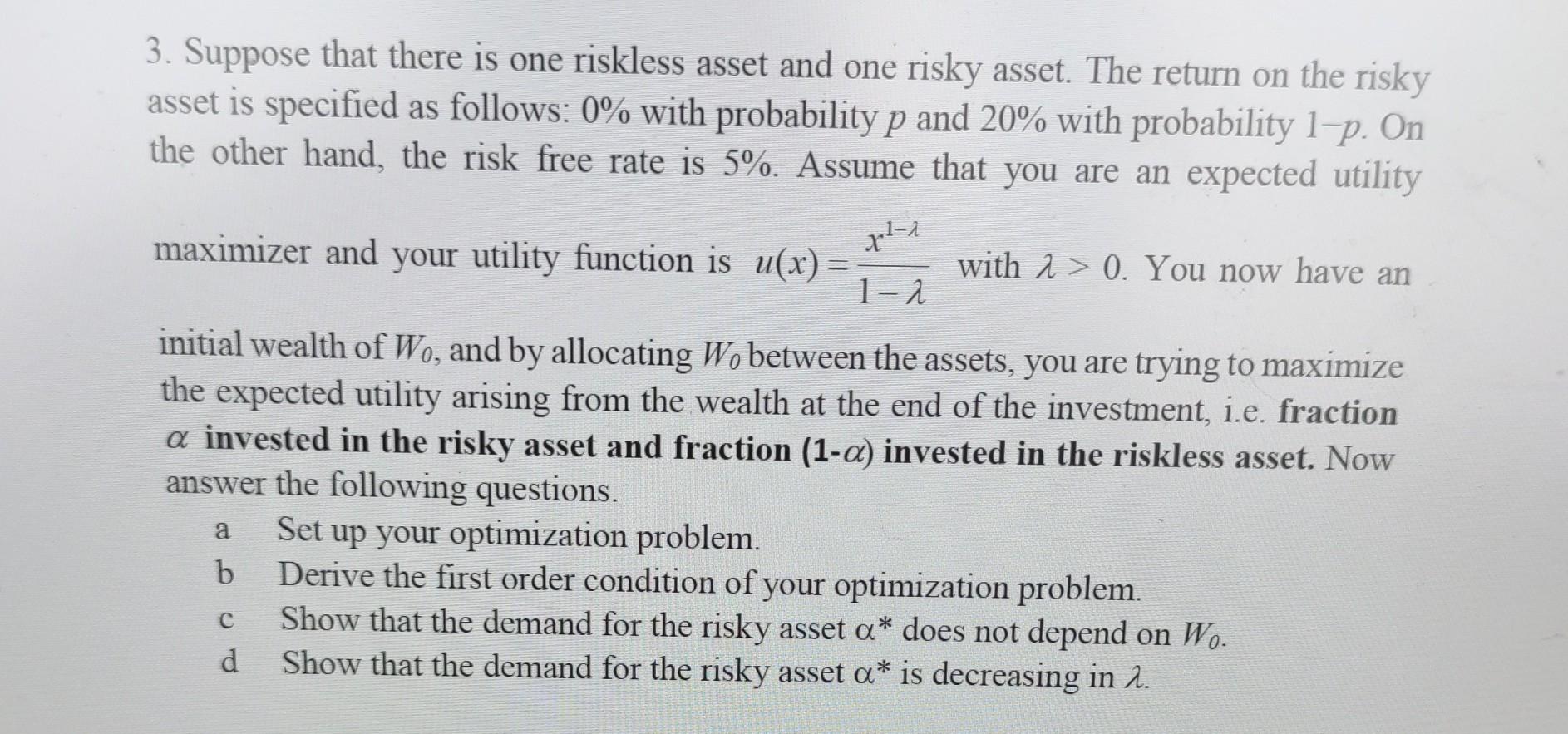

3. Suppose that there is one riskless asset and one risky asset. The return on the risky asset is specified as follows: 0% with probability p and 20% with probability 1p. On the other hand, the risk free rate is 5%. Assume that you are an expected utility maximizer and your utility function is u(x)=1x1 with >0. You now have an initial wealth of W0, and by allocating W0 between the assets, you are trying to maximize the expected utility arising from the wealth at the end of the investment, i.e. fraction invested in the risky asset and fraction (1) invested in the riskless asset. Now answer the following questions. a Set up your optimization problem. b Derive the first order condition of your optimization problem. c Show that the demand for the risky asset does not depend on W0. d Show that the demand for the risky asset is decreasing in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started