Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose the KRW/USD exchange rate is currently 1400. Consider a company that imports $200M worth of wine from US to Korea. But because this

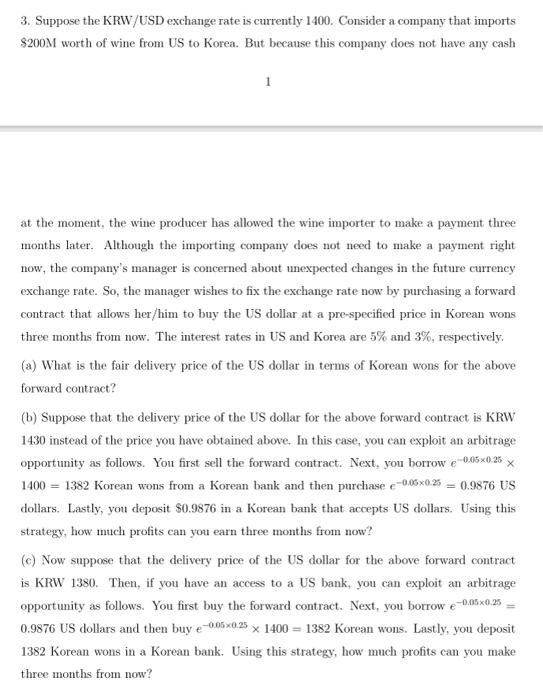

3. Suppose the KRW/USD exchange rate is currently 1400. Consider a company that imports $200M worth of wine from US to Korea. But because this company does not have any cash at the moment, the wine producer has allowed the wine importer to make a payment three months later. Although the importing company does not need to make a payment right now, the companys manager is concerned about unexpected changes in the future currency exchange rate. So, the manager wishes to fix the exchange rate now by purchasing a forward contract that allows her/him to buy the US dollar at a pre-specified price in Korean wons three months from now. The interest rates in US and Korea are 5% and 3%, respectively.

(a) What is the fair delivery price of the US dollar in terms of Korean wons for the above forward contract?

(b) Suppose that the delivery price of the US dollar for the above forward contract is KRW 1430 instead of the price you have obtained above. In this case, you can exploit an arbitrage opportunity as follows. You first sell the forward contract. Next, you borrow e0.050.25 1400 = 1382 Korean wons from a Korean bank and then purchase e0.050.25 = 0.9876 US dollars. Lastly, you deposit $0.9876 in a Korean bank that accepts US dollars. Using this strategy, how much profits can you earn three months from now?

(c) Now suppose that the delivery price of the US dollar for the above forward contract is KRW 1380. Then, if you have an access to a US bank, you can exploit an arbitrage opportunity as follows. You first buy the forward contract. Next, you borrow e0.050.25 = 0.9876 US dollars and then buy e0.050.25 1400 = 1382 Korean wons. Lastly, you deposit 1382 Korean wons in a Korean bank. Using this strategy, how much profits can you make three months from now?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started