Question

3. Suppose three risky assets B1, B2 and B3 have expected returns of 2%, 4% and 3% respectively, and the variance-covariance matrix = 1 3

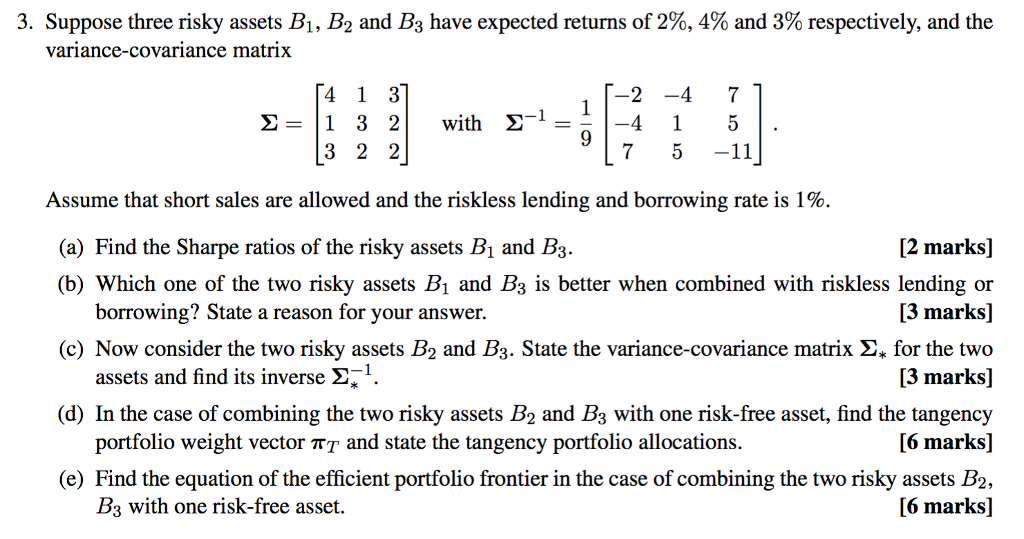

3. Suppose three risky assets B1, B2 and B3 have expected returns of 2%, 4% and 3% respectively, and the variance-covariance matrix = 1 3 2 with 1=1 4 1 5 . 4 1 3 2 4 7 9 3 2 2 7 5 11 Assume that short sales are allowed and the riskless lending and borrowing rate is 1%.

(a) Find the Sharpe ratios of the risky assets B1 and B3.

(b) Which one of the two risky assets B1 and B3 is better when combined with riskless lending or [2 marks] borrowing? State a reason for your answer. [3 marks]

(c) Now consider the two risky assets B2 and B3. State the variance-covariance matrix for the two assets and find its inverse 1. [3 marks]

(d) In the case of combining the two risky assets B2 and B3 with one risk-free asset, find the tangency portfolioweightvectorT andstatethetangencyportfolioallocations. [6marks]

(e) Find the equation of the efficient portfolio frontier in the case of combining the two risky assets B2, B3 with one risk-free asset. [6 marks]

3. Suppose three risky assets B1, B2 and B3 have expected returns of 2%, 4% and 3% respectively, and the variance-covariance matrix 2 -4 7 -4 15 2-1 3 2 ith 2- Assume that short sales are allowed and the riskless lending and borrowing rate is 1%. (a) Find the Sharpe ratios of the risky assets B1 and B3. [2 marks] (b) Which one of the two risky assets Bi and B3 is better when combined with riskless lending or [3 marks] (c) Now consider the two risky assets B2 and B3. State the variance-covariance matrix 2* for the two [3 marks] (d) In the case of combining the two risky assets B2 and B3 with one risk-free asset, find the tangency [6 marks] (e) Find the equation of the efficient portfolio frontier in the case of combining the two risky assets B2, [6 marks] borrowing? State a reason for your answer. assets and find its inverse * portfolio weight vector , and state the tangency portfolio allocations. B3 with one risk-free asset. 3. Suppose three risky assets B1, B2 and B3 have expected returns of 2%, 4% and 3% respectively, and the variance-covariance matrix 2 -4 7 -4 15 2-1 3 2 ith 2- Assume that short sales are allowed and the riskless lending and borrowing rate is 1%. (a) Find the Sharpe ratios of the risky assets B1 and B3. [2 marks] (b) Which one of the two risky assets Bi and B3 is better when combined with riskless lending or [3 marks] (c) Now consider the two risky assets B2 and B3. State the variance-covariance matrix 2* for the two [3 marks] (d) In the case of combining the two risky assets B2 and B3 with one risk-free asset, find the tangency [6 marks] (e) Find the equation of the efficient portfolio frontier in the case of combining the two risky assets B2, [6 marks] borrowing? State a reason for your answer. assets and find its inverse * portfolio weight vector , and state the tangency portfolio allocations. B3 with one risk-free assetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started