Answered step by step

Verified Expert Solution

Question

1 Approved Answer

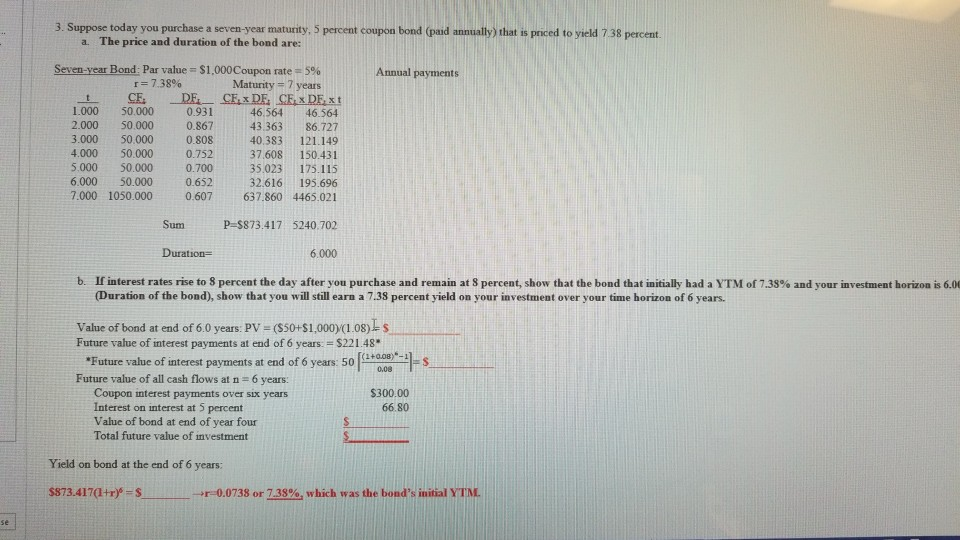

3. Suppose today you purchase a seven-year maturity, 5 percent coupon bond (paid annually) that is priced to yield 738 percent The price and duration

3. Suppose today you purchase a seven-year maturity, 5 percent coupon bond (paid annually) that is priced to yield 738 percent The price and duration of the bond are: a. Seven-year Bond: Par value $1,000Coupon rate 596 Maturity 7 years Annual payments r 738% 1.000 50.000 2.000 50.000 3.000 50.000 0.808 4.000 50.000 0.75 0.931 0.867 46,564 46.564 43.36386.727 40.383 121.149 37.608 150.431 5.000 50.000 0.700 35.023 175.115 32.616 195.696 7.000 1050.000 0.607 637.860 4465.021 2 6.00050.000 0.652 SumP-$873.417 5240.702 Duration- 6.000 b. If interest rates rise to 8 percent the day after you purchase and remain at 8 percent, show that the bond that mitally had a YTM of 735% and your investment hora a s 6.00 (Duration of the bond), show that you will still earn a 7.38 percent yield on your investment over your time horizon of 6 years. Value of bond at end of 6.0 years: PV- (S50+$1,000 (1.08)-s Future value of interest payments at end of 6 years $221.48 6 years 50i+008 - $300.00 66.80 "Future value of interest payments at end of 6 years: 50-ost-1 Future value of all cash flows at n 6 years: Coupon interest payments over six years Interest on interest at 5 percent Value of bond at end of year four Total future value of investment Yield on bond at the end of 6 years: $873.4171tr)-S -r-00738 or 738%, which was the band's initial YTN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started