Answered step by step

Verified Expert Solution

Question

1 Approved Answer

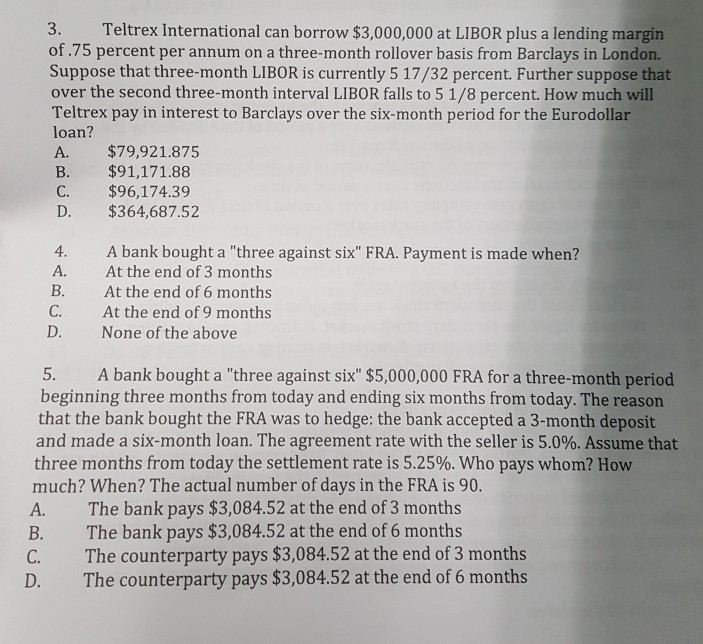

3. Teltrex International can borrow $3,000,000 at LIBOR plus a lending margin of .75 percent per annum on a three-month rollover basis from Barclays in

3. Teltrex International can borrow $3,000,000 at LIBOR plus a lending margin of .75 percent per annum on a three-month rollover basis from Barclays in London. Suppose that three-month LIBOR is currently 5 17/32 percent. Further suppose that over the second three-month interval LIBOR falls to 5 1/8 percent. How much will Teltrex pay in interest to Barclays over the six-month period for the Eurodollar loan? A. $79,921.875 B. $91,171.88 C. $96,174.39 D. $364,687.52 A bank bought a "three against six" FRA. Payment is made when? At the end of 3 months At the end of 6 months At the end of 9 months None of the above 4. A. B. C. D. 5. A bank bought a "three against six" $5,000,000 FRA for a three-month period beginning three months from today and ending six months from today. The reason that the bank bought the FRA was to hedge: the bank accepted a 3-month deposit and made a six-month loan. The agreement rate with the seller is 5.0%. Assume that three months from today the settlement rate is 5.25%. Who pays whom? How much? When? The actual number of days in the FRA is 90. A. The bank pays $3,084.52 at the end of 3 months B. The bank pays $3,084.52 at the end of 6 months C. The counterparty pays $3,084.52 at the end of 3 months D. The counterparty pays $3,084.52 at the end of 6 months

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started