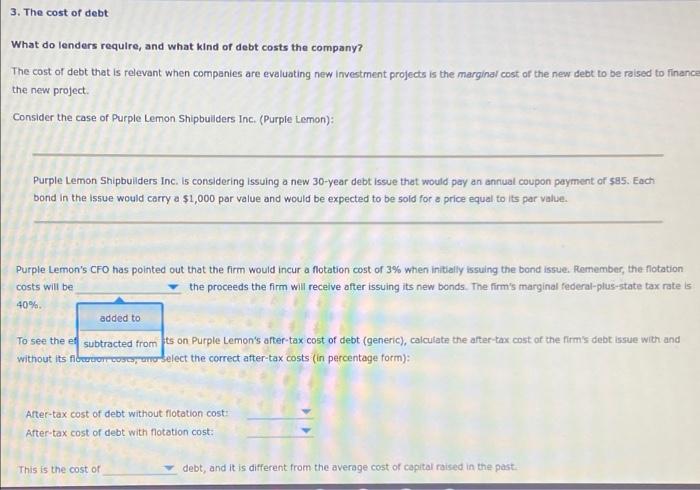

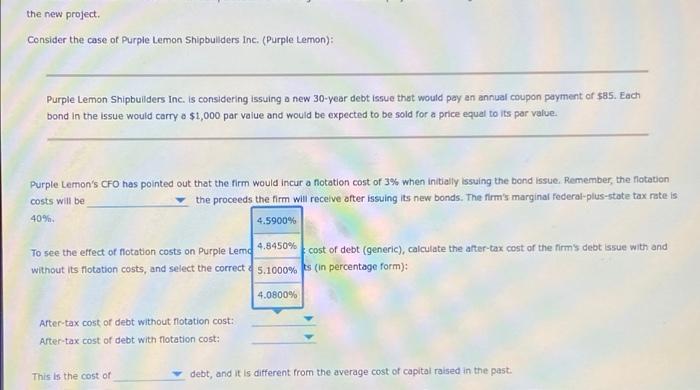

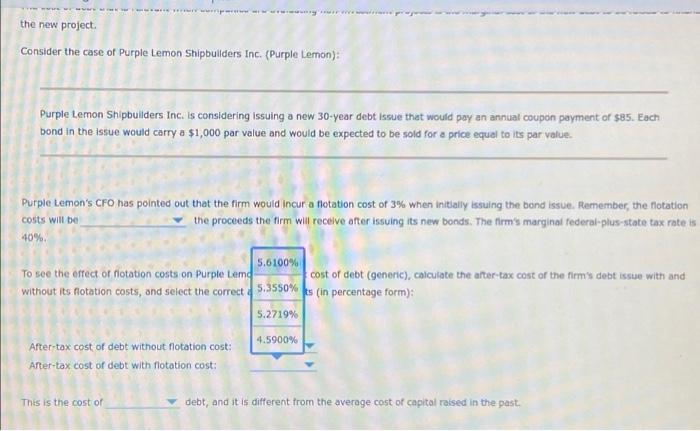

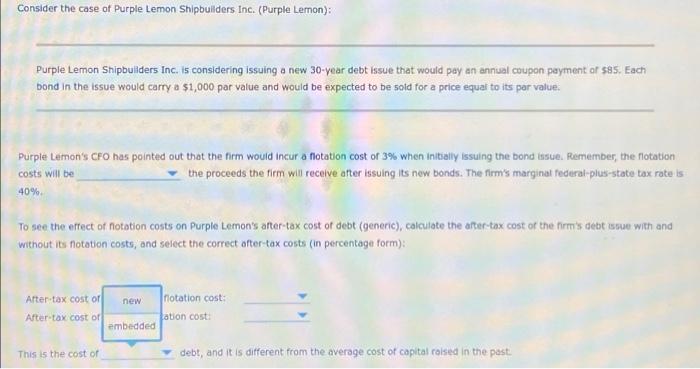

3. The cost of debt What do lenders require, and what kind of debt costs the company? The cost of debt that is relevant when companies are evaluating new investment projects is the marginal cost of the new debt to be raised to finance the new project. Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon) Purple Lemon Shipbuilders Inc. is considering issuing a new 30-year debt issue that would pay an annual coupon payment or ses. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value Purple Lemon's CFO has pointed out that the firm would incur a notation cost of 3% when initially issuing the bond issue. Remember, the flotation costs will be the proceeds the fire will rective after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 40% To see the effect of flotation costs on Purple Lemon's after-tax cost of debt (generic), calculate the after tax cost of the firm's debt issue with and without its notation costs, and select the correct after-tax costs (in percentage form); After-tax cost of debt without flotation cost: After-tax cost of debt with Hotation cost: This is the cost of debt, and it is different from the average cost of capital raised in the past 3. The cost of debt What do lenders require, and what kind of debt costs the company? The cost of debt that is relevant when companies are evaluating new investment projects is the marginal cost of the new debt to be raised to finance the new project Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon): Purple Lemon Shipbuilders Inc. is considering issuing a new 30-year debt issue that would pay an annual coupon payment or $85. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value. Purple Lemon's CFO has pointed out that the firm would incur a flotation cost of 3% when initially issuing the band issue. Remember, the flotation costs will be the proceeds the firm will receive after issuing its new bands. The firm's marginal federal-plus-state tax rate is 40% added to To see the el subtracted from ts on Purple Lemon's after-tax cost of debt (generic), calculate the alter-tax cost of the firm's debt issue with and without its fibrator coserono select the correct after-tax costs (in percentage form): After-tax cost of debt without flotation cost: After-tax cost of debt with flotation cost: This is the cost of debt, and it is different from the average cost of capital raised in the past the new project Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon): Purple Lemon Shipbuilders Inc. is considering issuing a new 30-year debt issue that would pay an annual coupon payment of $85. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value Purple Lemon's CFO has pointed out that the firm would incur a rotation cost of 3% when initially issuing the bond issue. Remember, the flotation the proceeds the firm will receive after issuing its new bonds. The firm's marginal Federal-plus-state tax rate is 40% 4.5900% costs will be To see the effect of flotation costs on Purple tem 4,8450% cost of debt (generic), calculate the after-tax cost of the firm's debt issue with and without its flotation costs, and select the correct. 5.1000%s (in percentage form) 4.0800% After-tax cost of debt without rotation cost: After-tax cost of debt with rotation cost: This is the cost of debt, and it is different from the average cost of capital raised in the past the new project. Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon) Purple Lemon Shipbuilders Inc. is considering issuing a new 30-year debt issue that would pay an annual coupon payment of $85. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value. Purple Lemon's CrO nas pointed out that the firm would Incur a flotation cost of 3% When initially issuing the bond issue. Remember, the flotation costs will be the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 40% 5.6100% To see the orfect of rotation costs on Purple Lema cost of debt (generic), calculate the after-tax cost of the fiems debt issue with and without its rotation costs, and select the correcte 5.3550% is (in percentage form) 5.2719% 4.5900% After-tax cost of debt without flotation cost: After-tax cost or debt with flotation cost: This is the cost of debt, and it is different from the average cost of capital raised in the past. Consider the case of Purple Lemon Shipbuilders Inc. (Purple Lemon): Purple Lemon Shipbuliders Inc. is considering issuing a new 30-year debt issue that would pay an annual coupon payment or $85. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a price equal to its par value: Purple Lerron's CFO has pointed out that the firm would incur a flotation cost of 3% when initially issuing the bond issue. Remember, the flotation costs will be the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 40% To see the effect of notation costs on Purple Lemon's after-tax cost of debt (generic), calculate the after-tax cost of the firm's debt issue with and without its flotation costs, and select the correct after-tax costs (in percentage form) After-tax cost or After-tax cost of new notation cost: lation cost embedded This is the cost of debt, and it is different from the average cost of capital raised in the past